Diversifying our state revenue is critical for equitably funding our future

- Download this policy brief (Updated Oct. 2022; 12 pages; pdf)

- Download the previous version of this policy brief (Oct. 2021; 8 pages; pdf)

By Paige Knight, MPP

In order to provide the opportunities necessary for our children to thrive both now and into the future, New Mexico needs to ensure that investments in services like education and public safety are adequately, sustainably, and equitably funded.

That funding comes primarily from tax revenue, but because of past tax cuts that favored the wealthy and well-connected, combined with our overdependence on volatile oil and gas revenues, our funding is neither adequate or sustainable nor is it equitable. This puts our ability to consistently invest in the programs and services that help families and businesses build a brighter future – like quality public education, child care assistance for working parents, economic development initiatives, and behavioral health services – at risk.

While current revenue projections are rosy, our state’s history has taught us that this is unreliable and underlines one of our state’s long-term problems: our revenue goes up and down like a roller coaster. With equitable and sustainable state revenues, we can build a stronger, more prosperous New Mexico. What follows are the top five reasons New Mexico needs to focus on diversifying our revenue streams now, and recommendations on where we can begin.

1. We are dangerously dependent on the boom-and-bust oil and gas industry

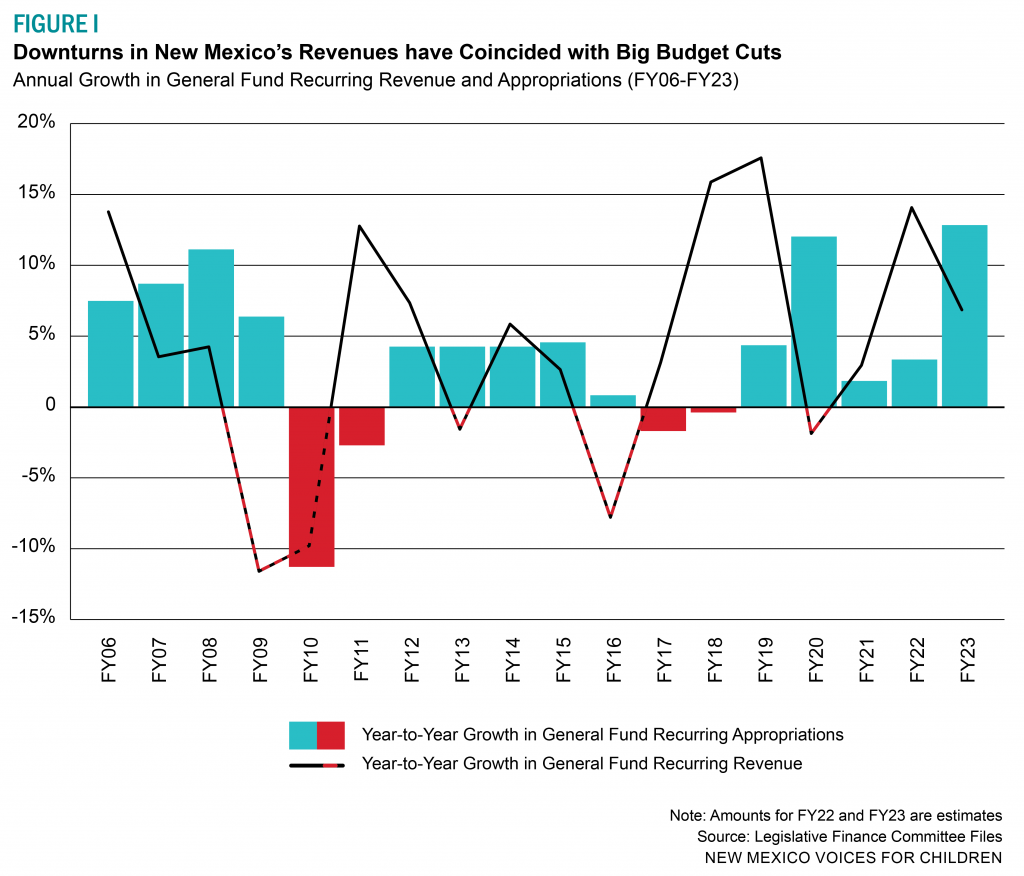

Our state budget remains overly reliant on revenues from the oil and gas industry. About one-third of our state revenues are attributable to oil and gas activity.[1] The industry’s inherent volatility makes it difficult for New Mexico to meet the budget needs of our schools, hospitals, courts, and more on a consistent basis. When market cycles that are out of our control result in a drop in oil and gas prices and production – and therefore a drop in state revenue – lawmakers often choose to make cuts to our state budget and the programs and services that families and businesses rely on rather than raise revenue elsewhere (see Figure I).

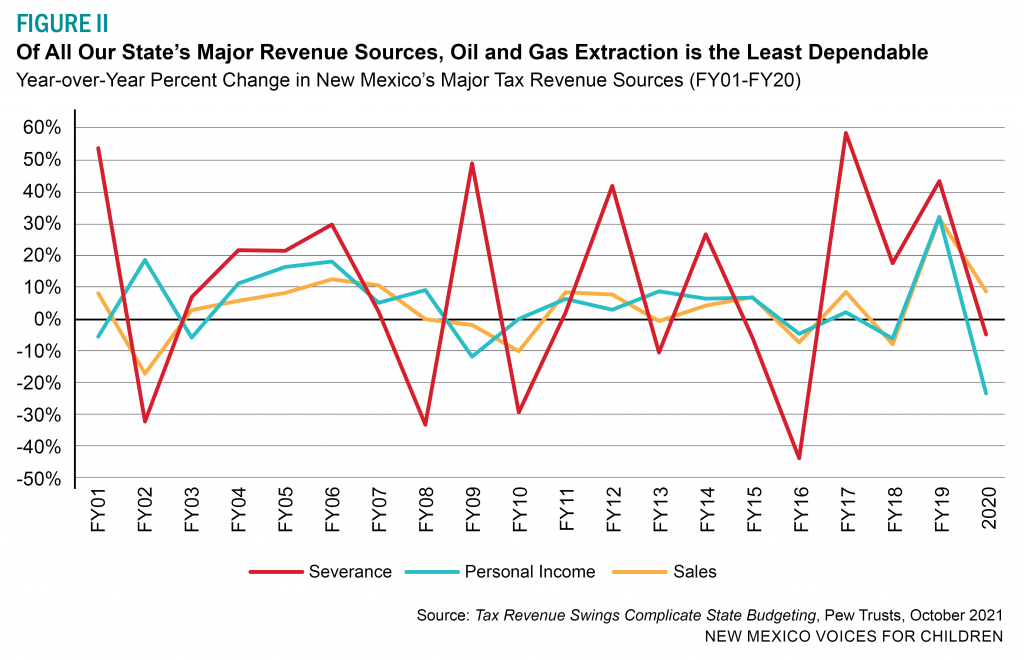

New Mexico’s revenues are ranked the fourth most volatile in the nation by Pew Trusts, with Figure II clearly demonstrating in red the ups and downs of our oil and gas revenues, known as severance taxes, in comparison to the other, much more stable sources (the blue and gold lines).[2]

We cannot continue oscillating between revenue booms and busts. New Mexico needs more stable and fair revenues to make sure we can provide the necessary programs and services that help New Mexico’s families thrive, regardless of the global price of oil.

2. A number of indicators show the oil and gas industry is in a long-term decline

New Mexico’s over-reliance on one industry’s revenues is a threat to our fiscal health because research shows that the oil and gas industry is in a long-term decline – a decline that began even before the pandemic. The steady growth of renewables and changes in energy consumption patterns mean we cannot continue to rely on this industry as an ongoing source of revenue.

As the energy landscape changes to one that accounts for the growing threat of climate change, “the combined effects of high infrastructure costs, over-production and substantial shifts in the energy market have permanently weakened the oil and gas industry’s revenues and profitability,” according to a recent report.[3]

The industry has certainly contributed significantly to our revenues over the years, but our children, our classrooms, and our communities deserve more sustainable funding. Lawmakers cannot wait for these revenues to dissipate, and instead need to be forward-thinking in replacing these revenues with fair and stable sources now.

3. For the health and well-being of our children, New Mexico needs to transition away from fossil fuels

In 2018, the oil and gas sector was responsible for 53% of greenhouse gas emissions in New Mexico, according to New Mexico’s climate report. The sector with the next-largest emissions, transportation, was only responsible for 14%.[4]

These emissions are a threat to public health and pollute our air, which can cause respiratory illness and other acute and chronic health problems, especially among children and the elderly. Oil and gas production can also leak toxic substances into the soil and our drinking water, negatively impacting the health of our communities and wildlife.

Current and proposed climate change mitigation strategies will help reduce the state’s overall emissions profile, but reaching the state’s long-term targets will require ambitious action and increased regulations to limit the oil and gas industry’s ability to pollute our air, land, and water. Diversifying our revenues away from oil and gas will help the state make a smoother, quicker transition away from fossil fuels to greener sources of energy, while still maintaining the ability to fund the programs and services that help New Mexicans thrive.

4. The state has many unmet revenue needs, and they’re only expected to grow

Our state not only needs stable revenue to reliably invest in our future, but also to meet the outstanding financial needs we have at the moment, many of which impact the health and well-being of our children and families.

These include: massive infrastructure needs like fixing our roads, bridges, and water systems, and mitigating and adapting to climate change; bold, equitable, and long-term investments in our education system to address the ruling in the Yazzie-Martinez lawsuit; addressing challenges with state employee vacancies, compensation, and retention rates; outstanding cases protesting income tax amounts owed to the Taxation and Revenue Department; public retirement fund needs; and film credit payments, which are anticipated to grow.

In addition, the state’s budget must grow by at least 3% each year to account for inflation and population growth in order for the state to offer the same level of services.[5]

5. Raising adequate and sustainable revenue can help promote equity in our communities

The pandemic and corresponding economic downturn illuminated the long-standing health and economic inequities that exist for our communities of color. These inequities ultimately stem from racism’s harmful legacy and the ongoing inequality of opportunity that plagues our state and nation.

Disparities are created and furthered by government policies and practices – from slavery and the confiscation of tribal land and resources, to Jim Crow laws, the segregation of Black families in lower-value neighborhoods, lending discrimination to make purchasing homes or starting businesses difficult if not impossible, and tax cuts that favor wealth over wages.

Tax policy is an important equity tool to help remedy these disparities because it is how the state determines who pays their fair share of taxes, who doesn’t, and who benefits most from the way the system is structured. Fortunately, New Mexico’s lawmakers can help provide more opportunities for communities of color by enacting tax and budget policies that advance equity. They can also prioritize our communities of color instead of the wealthy and well-connected, who are disproportionately white, when considering tax cuts and changes to deductions, credits, and rates. They’ve made tremendous progress in improving the equity of our tax code in recent years,[6] and now is the perfect time to build on that progress.

By asking those with the most resources to contribute a little more, we can use this increase in reliable revenue to budget with our values and invest in education, health care, public safety, and economic development, all of which benefit our communities and classrooms, while building a stronger, more prosperous New Mexico for all. To learn more on this topic, see our report Tax Policy: A Powerful Tool to Advance Racial Equity in New Mexico.

Recommendations for raising fair, sustainable, and adequate revenue our state can rely upon

There are many common-sense, forward-looking ways to raise reliable, sustainable revenue that can be used to better support child well-being and environmental health, educate our workforce, create jobs, and bolster our economy. Income, wealth, property, sales, and excise taxes can all be reformed in a way that asks more from those with the means to pay their fair share.

Personal Income Tax

Raise income tax rates for the state’s wealthiest earners

In 2003, New Mexico cut the top three personal income tax brackets, benefiting only the highest-income earners in the state. This failed to create the promised jobs and made our income tax system essentially flat. In 2019, legislators restored some progressivity by introducing a new bracket, but only for the highest 3% of earners. We can continue to fix our upside-down tax code and ensure the wealthiest pay their fair share by introducing additional brackets at the high end of the income scale.

Reform or repeal itemized deductions

Itemized deductions are costly and provide little-to-no benefit to most people earning low and middle incomes. The 2017 federal income tax law – by significantly increasing the standard deduction – curtailed the number of taxpayers who itemize, and now it’s mostly affluent households that still itemize.[7] New Mexico should consider reforming the itemized deductions it allows, like for home mortgage interest.

Require high-income earners to pay the top rate on all their income

New Mexico’s income tax code allows high-income earners to pay the top tax rate only on the portion of their income that falls in the highest tax bracket. (This is called a ‘standard graduated-rate income tax.’) This means, the lower tax rates that are intended to benefit lower- and middle-income New Mexicans benefit the wealthy as well. Enacting so-called “tax benefit recapture” would require high-income earners to pay the top rate on all of their income.

Decouple from federal “Opportunity Zone” tax breaks

The 2017 federal tax law created tax breaks for investments in designated “Opportunity Zones” (OZs). There is already considerable evidence that the program is merely a tax windfall for rich investors rather than for the intended beneficiaries of the policy: low-income residents in these identified zones. There’s also no requirement that New Mexicans who receive these tax breaks make these investments here in our state. If New Mexico doesn’t disallow these breaks, we will continue to lose revenue to subsidize OZ investments in other states.[8]

Wealth Taxes

Enact an estate or inheritance tax

A large share of the nation’s wealth is concentrated in the hands of very few, and taxes on inherited wealth – estate or inheritance taxes – can help build more broadly shared prosperity. An estate tax is a tax on property (like cash, real estate, or stocks) before it is transferred to the heirs of someone who has passed away, while an inheritance tax is levied on the recipients rather than the estate itself. Most states, including New Mexico, used to have such taxes, but due to federal tax changes in 2001, only 17 states and D.C. now have an estate or inheritance tax.

Fully repeal the capital gains preference

Most of the nation’s capital gains income, which is the profits from the sale of assets like stocks and real estate, goes to a very small share of people – those who have money to invest. New Mexico is one of only nine states to tax income from capital gains at a lower rate than the wages of hard-working people. Currently, New Mexico allows 40% of this unearned income to be deducted from income taxes, making this an unnecessary and unfair tax break that overwhelmingly helps the wealthiest while taking revenue away from much-needed public investment.

Enact a “mansion tax” on high-value homes

New Mexico can also adopt a tax on high-value housing, often called a ‘mansion tax,’ to help fund crucial services. We can do this in one of two ways, either by levying a tax or fee at the time of sale (like a real estate transfer tax; see below), or on an ongoing basis through existing property tax systems. No state has a graduated property tax rate for mansions, but seven states levy a surcharge on the highest-value homes or have a progressive bracket structure through their real estate transfer tax system.[9]

Corporate Income Tax

Increase the corporate income tax

In 2013, lawmakers significantly cut corporate income taxes. This failed to increase economic activity, and substantially reduced revenues needed for the public investments that do create jobs and build a strong economy. Because of these cuts to the corporate income tax, hardworking New Mexicans have had to bear more of the responsibility in paying for the resources and services that both businesses and people use.

Establish a corporate minimum tax of $500 or more

Corporations benefit from New Mexico’s land and water, roads and bridges, and public services, yet many do not pay their fair share for these public goods. In fact, many states have no minimum corporate income tax, meaning large corporations can exploit the many loopholes that exist or claim numerous tax breaks and end up paying no income tax at all. New Mexico, at the very least, should have a flat dollar minimum tax of at least $500.

Establish a minimum tax on large S-corps and LLCs

S-corporations, partnerships, and limited liability companies (LLCs) – or “passthrough entities” – are not subject to corporate income taxes even though they receive almost all the benefits that taxable corporations do. A minimum tax helps ensure they pay some taxes for those benefits. Any minimum taxes imposed should match those imposed on taxable corporations and could be limited to passthrough entities earning profits above a certain amount, to protect small businesses and start-ups.[10]

Include foreign tax havens in mandatory combined reporting

New Mexico closed a corporate tax loophole in 2019 by passing a mandatory combined reporting law. However, corporations only have to report the combined profits from parent and subsidiary companies formed in the U.S. This means corporations can – and do – form subsidiaries in tax-haven countries to hide their profits from taxation. Six states have closed this loophole and required corporations to also report profits from subsidiaries formed in tax havens abroad.[11]

Sales Tax

Repeal wasteful and ineffective tax breaks

Hundreds of tax breaks have been carved out of the gross receipts tax (GRT) base over the years, many of which merely qualify as handouts to special interest groups. What’s more, few of these carve-outs have ever been evaluated for effectiveness. Repealing wasteful and ineffective tax breaks will allow lawmakers to put that money to work in our schools and communities where it will benefit everyone. Additionally, broadening the base will allow for a meaningful reduction in the overall GRT rate, benefitting lower- and middle-income families.

Excise Taxes

Raise the motor vehicle excise tax

Despite an increase to the motor vehicle excise tax in 2019, the tax on motor vehicles is still lower than the general sales tax on most other goods purchased in the state. It’s also lower than in surrounding states.

Raise tobacco, e-cigarette, and alcohol taxes

These taxes could increase revenue for public health services and promote greater wellness, particularly when they act as an effective disincentive for young people to take up smoking.

Property Taxes

Enact a real estate transfer tax on second or high-value homes

New Mexico has yet to join the 37 other states that have a real-estate transfer tax, which is a one-time tax that is collected after a home is sold and is typically a percentage of the sales price. New Mexico could levy a real estate transfer tax to be paid at the time of sale of a second or high-value home, ensuring that a large percentage of the revenue raised comes from higher-income households.

Adopt different property tax rates for different kinds of property

Different types of property (residential, commercial, agricultural) should be taxed at different rates (this is called a ‘split roll property tax’). There could be a higher set value for commercial properties, or an assessed value could be used for all types of non-residential property with a lower rate for residential property. This would help with the fact that commercial property turns over less frequently than residential property, which shifts more of the property tax responsibility onto homeowners.

Other Taxes and Revenue Options

Tax the full rental rate of hotels booked online

New Mexico and its local governments lose significant revenues in annual lodging tax by failing to ensure that online travel companies collect and pay the full amount of tax on hotel rooms booked online. This loophole can be closed by redrafting state sales and hotel tax laws to make clear that the applicable taxes be based on the “retail” room rate charged to consumers rather than the “wholesale” room rate the online companies pay to the hotels.[12]

Increase severance taxes on natural resource extraction (royalty payments)

New Mexico should consider increases to the severance taxes we collect, like the oil and gas school tax, as well as increasing the royalty rate for production on state trust lands. This would help ensure New Mexicans are getting a fair return on the public resources that belong to all of us. We also need to ensure that the industry is adequately regulated, as natural gas wasted through venting and flaring harms the air we breathe and cheats New Mexico students out of millions of dollars of lost education revenue.

Enact a new tax on diesel fuel

A large portion of this tax would be paid by out-of-state entities like interstate trucking companies, which rely on our highways to move their goods to other states.

Enact a heavy trucks permit fee

A fee assessed on heavy vehicles operating on highways in New Mexico makes sense, as heavier vehicles do more damage to our roads than do passenger cars. Increasing this fee can result in significant revenues.

Conclusion

Diversifying our economy and revenue streams cannot happen overnight nor can it happen quickly, but it must begin to happen soon if we want to have a stable, sustainable way to truly invest in the programs that matter most to our families now and into the future.

We cannot afford to be so reliant on oil and gas revenues. Instead, we need to evaluate our tax code and ensure that it is working for all New Mexicans and that we have enough revenue to build the best possible future for our state – one that robustly supports the programs that are most important to our children’s and our families’ well-being and support opportunities for them to thrive and reach their full potential.

[1] Legislative Finance Committee analysis based on August 2022 Consensus Revenue Estimate

[2] “Tax Revenue Swings Complicate State Budgeting,” Pew Charitable Trusts, Oct. 14, 2021

[3] New Mexico’s Risky Reliance on Oil Revenue Must Change: Industry Fundamentals Point to Long-Term Decline, Institute for Energy Economics and Financial Analysis, pg. 3, October 2020

[4] “Closing New Mexico’s Emissions Gap” presentation to the Water and Natural Resources Committee by Rama Zakaria, November 2020

[5] “Post-Session Fiscal Report” presented to the Revenue Stabilization and Tax Policy Committee by the Legislative Finance Committee, June 9, 2021

[6] “New Mexico is Putting Families First in Tax Policy,” NM Voices for Children, June 2022

[7] “State Itemized Deductions: Surveying the Landscape, Exploring Reforms,” Institute on Taxation and Economic Policy (ITEP), February 2020

[8] “States Should Decouple Their Income Taxes from Federal ‘Opportunity Zone’ Tax Breaks ASAP,” Center on Budget and Policy Priorities (CBPP), April 2019

[9] “State ’Mansion Taxes’ on Very Expensive Homes,” CBPP, October 2019

[10] “Reforming the Tax Treatment of S-Corporations and Limited Liability Companies Can Help States Finance Public Services,” CBPP, April 2009

[11] “A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens,” ITEP, January 2019

[12] “State and Local Governments Should Close Online Hotel Tax Loophole and Collect Taxes Owed,” CBPP, April 2011