Download this fact sheet (June 2022; 2 pages; pdf)

Our state’s policy makers made a number of improvements to the tax code since 2019 that will help low- and middle-income New Mexicans, improve equity, and increase economic opportunity for our working families.

Changes to the tax code improve equity for families earning low wages:

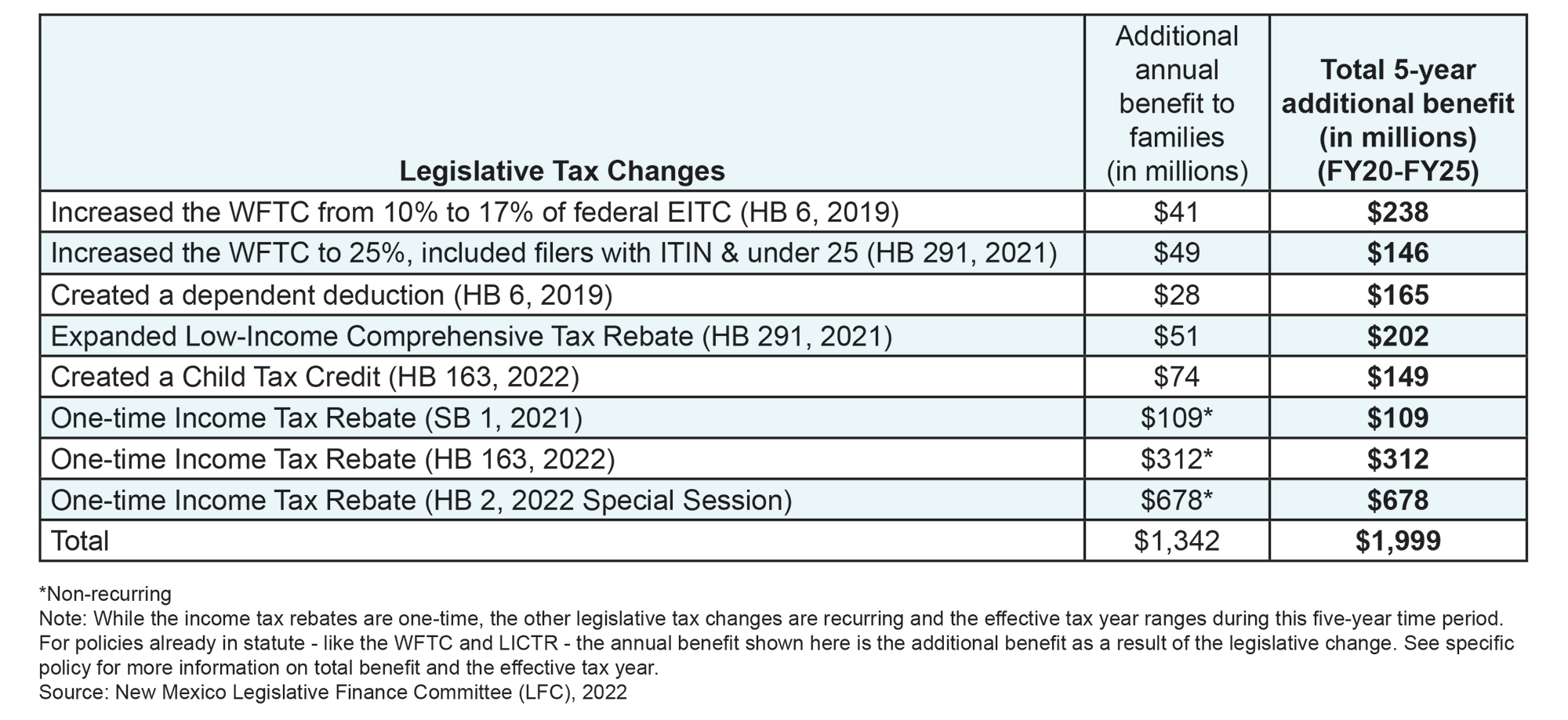

Recent policy changes will return $2 billion to New Mexico families.

Working Families Tax Credit (WFTC)

The WFTC is a tax credit proven to improve outcomes for working families with children:

- Increased twice; by 70% in 2019 and a further 47% in 2021[1]

- Expanded to include 41,000 young workers without children and 10,000+ immigrant workers

- Will return an additional $90 million annually to 250,000 hard-working New Mexicans, for a total benefit of nearly $130 million once these improvements are completely phased in

Low-Income Comprehensive Tax Rebate (LICTR)

LICTR benefits those facing the biggest financial challenges in the state:

- Increased both the amount and income eligibility, nearly tripling its value for families

- Indexed to inflation so it will hold its value over time

- Returns an additional $50 million annually to those who need it the most, for a total benefit of $70 million to 380,000 residents[2]

Created a Child Tax Credit (CTC)

The CTC will help reduce childhood poverty and reach every single child in New Mexico:

- The newly-enacted, refundable credit ranges from $25-$175/child

- It is progressive, so families with lower-incomes will receive larger credits

- Will return $75 million annually to families in New Mexico, benefiting 475,000 children[3]

Economic Relief for Families

Tax rebates helped provide economic relief for many families impacted by the pandemic:

- Targeted tax rebates will return over $400 million to low- and middle-income families in 2021 and 2022

- An additional $680 million will be returned to all New Mexicans to help with the costs of inflation and rising gas prices

Additional Tax Benefits for Families with Children

In response to federal tax changes, New Mexico allows for a tax deduction for children:

- Federal tax changes in 2017 resulted in many New Mexicans with children having to pay more in state taxes

- To offset this, in 2019 the state created a new $4,000 deduction for each dependent beyond the first, returning $30 million annually to New Mexico families

[1] The credit amount of the state WFTC is a percentage of the federal Earned Income Tax Credit (EITC). The WFTC was increased in the 2019 session from 10% to 17% of the federal EITC, and from 17% to 25% in the 2021 session. The increase passed in the 2021 session is phased in: the WFTC increased to 20% for tax years 2021 and 2022, and will increase to 25% in tax year 2023 and beyond.

[2] LICTR increased in tax year 2021, and will be indexed to inflation moving forward

[3] The CTC may be claimed starting tax year 2023 and sunsets after tax year 2031