The capital gains deduction reduces New Mexico’s ability to plan for an equitable future

- Download this fact sheet (Updated Jan. 2024; 2 pages; pdf)

- Link to our capital gains gif-splainer (Updated Jan. 2024)

- Download a previous version of this fact sheet (Updated Jan. 2023; 2 pages; pdf)

Support HB 37

Repealing – or significantly limiting – the capital gains tax deduction will help build a more equitable tax system – one that doesn’t favor wealth over work – all while generating sustainable revenue for the state.

The Problem

- New Mexico is one of only nine states that gives a big, unnecessary tax break to those with capital gains income, which is the income an investor gets when selling an asset – such as shares of stock, real estate, or artwork – at a profit.

- This tax break allows people to deduct up to 40% of their capital gains income from their state taxes, meaning this unearned income is taxed at a lower rate than the hard-earned wages and tips of ordinary New Mexicans.

- This deduction overwhelmingly goes to the highest-income earners – the people who are already paying the smallest share of their income in state and local taxes.

- This tax giveaway costs the state nearly $70 million every year – money that could go to schools or health care, or to provide economic relief to families struggling financially.

- There is no evidence that the capital gains deduction promotes economic growth or fosters investment in our state, especially given that there is no requirement that investments are made in New Mexico’s communities or businesses. The bonds or assets generating capital gains can be located anywhere in the country or world. It is an ineffective tax give-away and should be repealed or significantly limited.

Why now?

- As a state that consistently has one of the highest rates of poverty, New Mexico should structure its tax code to help hard-working families, especially when the pandemic disproportionately devastated families earning low incomes. We’ve made great progress, but more can be done to advance equity through our tax code.

- This deduction is one of the many tax breaks that has made New Mexico too reliant on revenue from the oil and gas industry, which keeps us in a boom-or-bust cycle. It’s impossible to plan for future needs when our revenue outlook is so uncertain.

- Limiting the 40% capital gains tax deduction will create a fairer tax system while generating sustainable, diverse revenue that can be invested in proven job creators such as a cradle-to-career education system that produces a highly qualified workforce.

Who gets this tax break?

Who gets this tax break?

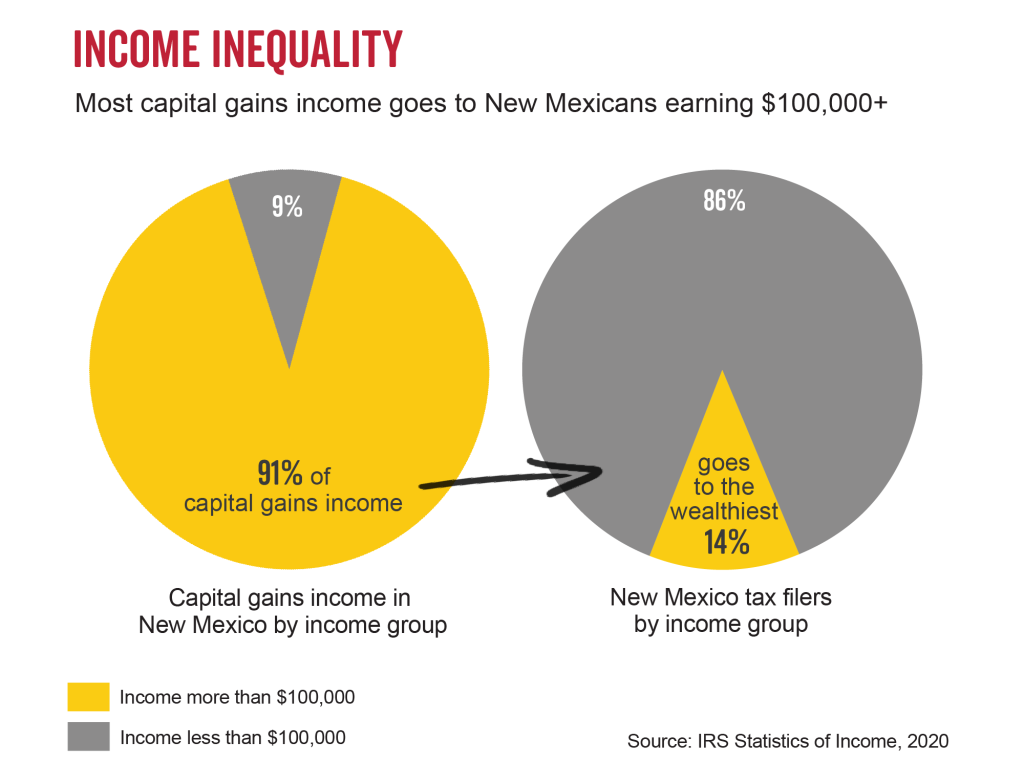

- 91% of the value of the capital gains deduction goes to just 14% of New Mexicans – those who earn more than $100,000.

- Even more alarming, over half (54%) of the value goes to the tiny share of New Mexicans (0.1%) who make more than $1 million.

- Capital gains income is generated by wealth, and because 87% of the wealth in this nation is held by white households, this deduction is part of the system that furthers income and wealth disparities along racial and ethnic lines.

The Bottom Line

The hard-earned wages of everyday working New Mexicans should not be taxed at a higher rate than the profits that the state’s wealthiest make from selling stocks, bonds, and other assets.

How this Impacts Racial Equity

Eliminating or limiting the capital gains deduction would advance racial equity in New Mexico because capital gains income is generated by wealth – the vast majority of which is held by white households. By disproportionately benefiting white households, this tax policy is a brick in the wall of structural racism that has unfairly disadvantaged too many New Mexicans. This structural racism – whether intentional or not – has prevented many families of color from having the same wealth- and income-building opportunities that white families have had.[1]

[1] “Tax Policy: A Powerful Tool to Advance Racial Equity in New Mexico,” NM Voices, December 2020