Link to our capital gains fact sheet (Jan. 2024; 2 pages)

Support HB 37

A large share of New Mexico’s wealth is concentrated in the hands of a few – thanks in part to a special tax preference that favors wealth over wages – limiting opportunities for all New Mexicans.

The Legislature can build more broadly shared prosperity, improve equity in our tax system, and raise reliable revenue for our state by reigning in the unnecessary and ineffective capital gains deduction.

Capital gains is the income you get when you sell an asset – such as shares of stock, mutual funds, artwork, or real estate – at a profit. New Mexico is one of only nine states that gives a big tax break to those with this type of “unearned income” (a term used by the IRS for any income not acquired through work).

Right now, investors are allowed to deduct – and therefore not pay any tax on – 40% of their capital gains income. That means this unearned income is taxed at a lower rate than wages earned by hard-working New Mexicans.

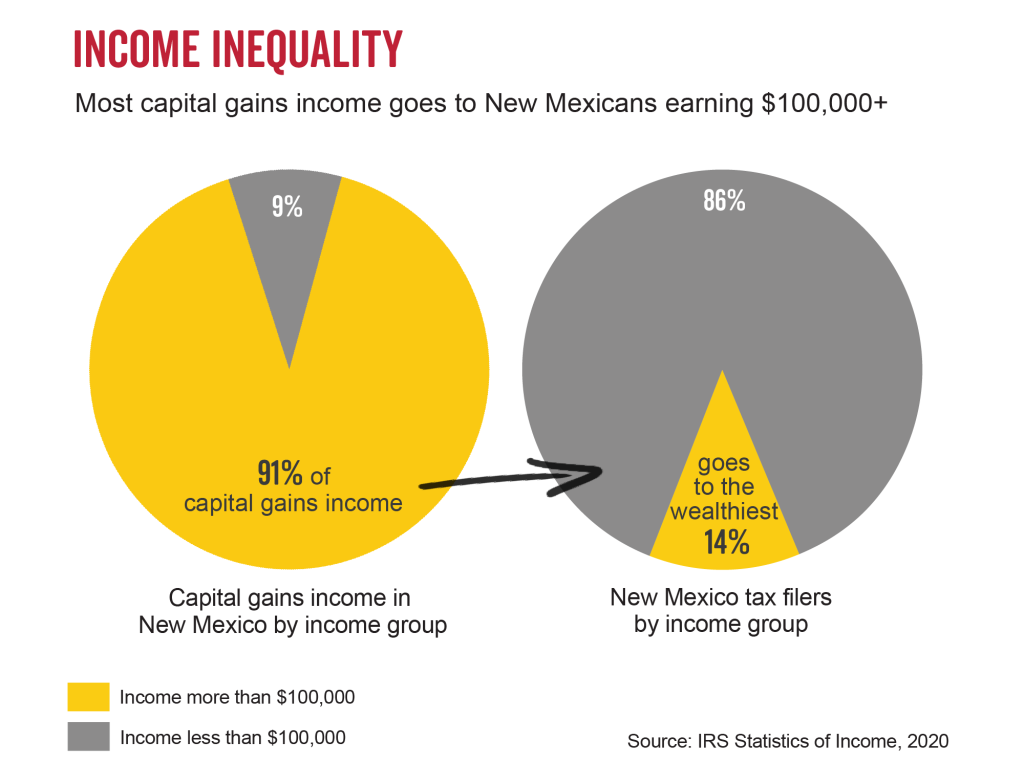

This deduction overwhelmingly goes to the highest-income earners – the people who are already paying the smallest share of their incomes in state and local taxes. In fact, 91% of the value of the capital gains deduction goes to just 14% of New Mexicans – those who earn more than $100,000.

There is also no evidence that the capital gains deduction promotes economic growth or fosters investment in our state, especially given that there is no requirement that investments are made in New Mexico’s communities or businesses. The bonds or assets generating capital gains can be located anywhere in the country or world.

Eliminating or limiting the capital gains deduction would advance racial equity in New Mexico because capital gains income is generated by wealth – the vast majority of which is held by white households due to decades of discriminatory policies and practices that have denied families of color the same wealth-building opportunities as white families.

Limiting the capital gains deduction will make our tax system more fair and raise sustainable revenue that can be invested in the public goods and services that help build thriving communities – like libraries, parks, quality schools, and public health services.

Our legislators need to act now. The hard-earned wages of everyday working New Mexicans should not be taxed at a higher rate than the profits that the state’s wealthiest few make from selling stocks and bonds.