Executive Summary

Download this executive summary (updated Aug. 2012; 1 page; pdf)

Download the full report (updated Aug. 2012; 8 pages; pdf)

Download the companion report (updated Aug. 2012; 8 pages; pdf)

Federal health care reform, known officially as the Affordable Care Act (ACA), will have an enormous positive economic impact on New Mexico. The benefits have already begun as provisions have gone into effect, but they will accelerate dramatically in 2014 when implementation of the law is complete and the major influx of new federal funding begins.

Tax Credits

Under the ACA the state will have a health care insurance exchange where individuals and small businesses can compare insurance rates and benefits across a variety of plans. Starting in 2014, new federal funds will subsidize the purchase of private insurance on this exchange for New Mexicans who cannot afford the full cost of the premiums. Small employers in New Mexico are already eligible for tax credits to help them purchase health insurance for their employees. These tax credits and subsidies for individuals and employers will result in a significant inflow of federal funds into New Mexico—with the individual credits estimated at between $4.2 billion and $4.6 billion between 2014 and 2020.

Medicaid Expansion

In 2014, a big expansion of Medicaid—to be paid for almost entirely out of federal funds—will pump billions more into New Mexico. New federal Medicaid spending for 2014 through 2020 is projected to be between $4.5 billion and $6.2 billion.

Medicaid and private insurance payments to doctors and other providers translate into more jobs for all health care workers. This spending will also have outward reverberations, increasing employment in those industries that supply goods and services to health care providers, such as janitorial services and medical equipment manufacturers. Even more jobs are created when the new employees of these businesses spend their money locally.

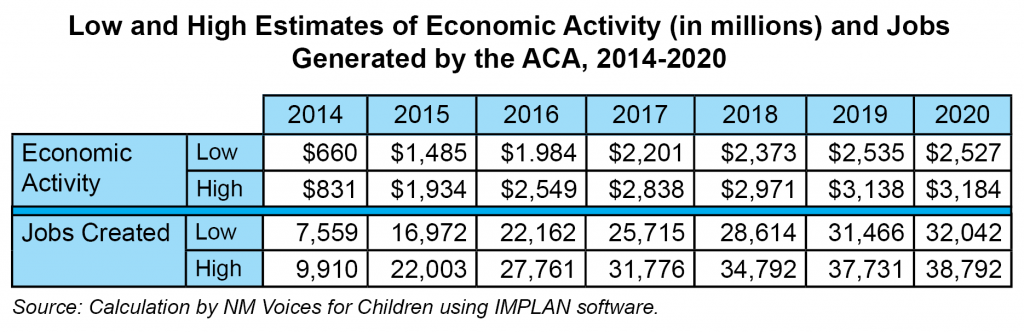

We estimate that the ACA will ultimately generate between $13 billion and $17 billion in new economic activity, and between 32,000 and 38,000 new jobs in New Mexico. Much of this economic activity will be subject to state and local taxes. Our companion paper, The Tax Revenue Benefits of Health Care Reform in New Mexico, estimates that the new tax revenue will far exceed the new spending required by the state for the Medicaid expansion.

Other Benefits

By 2020, the majority of New Mexicans who currently do not have insurance will be covered, which should also benefit the state economically in terms of improved worker productivity. The costs of uncompensated care, which are currently borne by the state and counties, as well as those who already have private insurance, will greatly decrease. This will help not only slow the increase in premiums, but any disadvantage we might have in economic development because of our high premiums could disappear.

Download this executive summary (updated Aug. 2012; 1 page; pdf)

Download the full report (updated Aug. 2012; 8 pages; pdf)

Download the companion report (updated Aug. 2012; 8 pages; pdf)

This summary and the full report were generously funded by First Focus, Voices for America’s Children, and the David and Lucile Packard Foundation.