By Paige Knight, MPP

By Paige Knight, MPP

Download this report (Dec. 2024; 10 pgs; pdf)

Download the first report in this series, “Understanding the Impact of Income Supports in the Data” (Nov. 2024; 16 pgs; pdf)

Note: This is the second in a series of reports on how public benefits programs and tax credits improve poverty outcomes in New Mexico. The first part, “Understanding the Impact of Income Supports in the Data,” looks at how poverty is measured by the U.S. Census Bureau and which measurements take into account anti-poverty programs like tax credits.

Background on Tax Credits

Tax credits – both at the state and federal level – for families earning low incomes are instrumental to improving economic well-being by helping New Mexicans meet their basic needs, like housing, food, and utilities. A “tax credit” refers to an amount of money that taxpayers can subtract directly – dollar for dollar – from the income taxes they owe.

When households earning low incomes have little to no tax liability, and therefore don’t owe much or anything in federal or state income taxes, refundable tax credits provide critical financial relief by sending any remaining amount back into their pockets (see the box for definitions).This not only reduces tax liability but also boosts household income, helping families cover basic needs or save for the future. Research indicates that this additional income is associated with reduced poverty, improved child and maternal health, improved educational achievement, and it can boost local and state economies.

Three Types of Tax Credits:[i]

- Nonrefundable tax credits directly reduce your tax liability until it is $0. Any remaining amount of the credit is in effect lost.

- Refundable tax credits are the most beneficial because they are paid in full, so if the credit reduces your tax liability to below $0, you are due a refund for any amount left beyond that.

- Partially refundable tax credits let you take only a portion of the credit as a refund if your tax liability is $0.

Tax credits also play an important, non-stigmatizing role in providing assistance to families most in need of support. Examples at the federal level include the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC). At the state level, New Mexico has made incredible progress creating and increasing or expanding targeted tax credits like the Low-Income Comprehensive Tax Rebate (LICTR), the Working Families Tax Credit (WFTC), and the Child Tax Credit (state CTC).

This brief gives information on the important role tax credits play in reducing poverty and improving equity, as well as the many additional, well-researched benefits they provide to families and children. In addition, tax policy recommendations are provided to build upon and amplify the positive impacts tax credits provide for families, communities, and businesses in New Mexico.

Measuring Poverty

There are two primary ways poverty is measured. When policymakers and researchers want to better understand the impact income support programs and tax credits have on the resources a family has, the supplemental poverty measure (SPM) is used. For a more in-depth discussion on measuring poverty, please reference the first part of the From Poverty to Prosperity series, “Understanding the Impact of Income Supports in the Data.”

Impact of Tax Credits on Poverty

Refundable tax credits help provide families with more of the resources needed to help ease financial stress, afford safe housing, purchase nutritious food, or simply sign their child up for their neighborhood soccer team. In addition, they are extremely effective anti-poverty policy tools that help improve the lives of millions of children across the country.

Federally, the two most generous and commonly claimed tax credits for working families earning low incomes are the EITC and the CTC. Together, these credits helped lift 6.4 million people out of poverty nationwide in 2023, the second largest impact of any income support program following Social Security – making them the second most effective income support programs in the U.S., after Social Security, according to the Supplemental Poverty Measure (SPM) (see Figure I). Refundable tax credits (shown in dark blue) have been the most effective program for reducing childhood poverty, lifting more children out of poverty than any other intervention.

This reduction in poverty is especially noteworthy because it occurred during the temporary expansion of the federal CTC in 2021, when the national poverty rate decreased by nearly half as measured by the SPM – the largest single-year decline in poverty ever recorded. Remarkably, this happened during a pandemic, when work and other economic activity was severely disrupted. This dramatic decline in poverty was driven by key changes to the CTC. First, the credit amount was increased, allowing for a larger credit for young children. Second, it was made fully refundable, which fixed a flaw in the tax code that had kept families with very low incomes – those in most need of support – from receiving the full CTC. In New Mexico, more than 450,000 kids – or 95% of the child population – benefited from the federal expansion, which lifted an additional 32,000 children out of poverty.

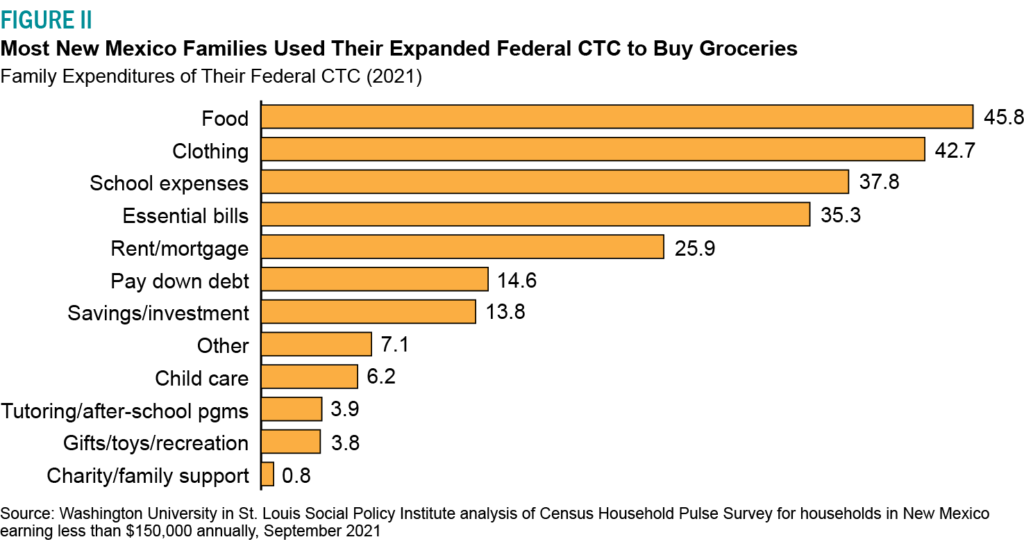

Another component that was beneficial for families was the option to receive their CTC in monthly payments. Families who took this path reported lower rates of food insecurity, and most used the CTC to pay for essential and routine household expenses (see Figure II). Other families improved their financial well-being by saving the CTC and using it to pay off debt.

Unfortunately, federal policymakers let the expansion expire, and the data the following year showed an inverse from the prior year’s improvements with millions of children falling back into poverty. Now that the federal CTC was reverted back to pre-pandemic law, and the credit is no longer fully refundable, families earning the lowest incomes are unable to access the full federal credit, meaning 36.5% of children in New Mexico are left out of the benefit. At the same time, a married couple making up to $400,000 receives the full amount of the tax credit.

Fully refundable tax credits for low-income families are key to advancing racial and gender equity because systemic barriers have led to lower incomes and lower wealth for people of color, women, and immigrants. But even among white people, those from low-income backgrounds experience significant disparities. These tax credits help reduce economic inequality, supporting marginalized groups while benefiting all low-income families and promoting broader economic opportunity.[ii]

Another important tax credit for reducing poverty is the federal Earned Income Tax Credit (EITC), which boosts low-paid workers’ incomes, helping lower-income families achieve greater economic security while keeping millions of Americans out of poverty since its enactment in the mid-1970s. The EITC was also expanded during the pandemic for one year, but with a focus on younger workers and seniors in the workforce. Together, the expanded EITC and CTC lifted an estimated 9.6 million people out of poverty nationwide in 2021, compared to 6.4 million in 2023.

At the state level, robust, refundable tax credits also play an important role in reducing poverty across New Mexico. While smaller in scale than the credits available at the federal level, they still improve the economic and overall well-being of thousands of children and families, and return hundreds of millions dollars into the pockets of New Mexicans who benefit most from the extra financial assistance (see Figure III).

Additional Benefits

Tax credits have been extensively researched for decades and shown to have many economic and health benefits beyond reducing poverty. Increasing families’ income, especially during the early years of a child’s life improves a child’s immediate well-being and leads to positive long-term impacts such as better health and higher earnings in adulthood. Moreover, studies have demonstrated that programs like the Earned Income Tax Credit (EITC) improve school performance and increase college attendance rates, further contributing to greater economic mobility and success.[iii]

Recent Improvements to State Credits

Recognizing the incredible positive impact of tax credits on families and children, New Mexico’s policymakers have recently created, increased, and expanded several of the state’s tax credits to enhance their effectiveness and provide additional support and resources to New Mexicans. In just the past few years, New Mexico has:

- Increased the WFTC twice and expanded it to include 41,000 young workers without children and 10,000 immigrant workers, ensuring it returns an additional $90 million annually to nearly 200,000 New Mexico households, for a total annual benefit of $123 million.

- Increased the amount and income eligibility limits of LICTR, nearly tripling its value for families, and indexing the rebate amount to inflation so it will hold its value over time, for a total benefit of $44 million to 305,000 New Mexico households.

- Created, then increased, a refundable state CTC that is progressively structured, so families with lower incomes receive a larger credit. The CTC returns $132 million annually to 239,000 families in New Mexico. It is structured to benefit 475,000 children in New Mexico.

While some states, like New Mexico, use tax policy as a tool to uplift families and advance equity, others use their tax systems to push families earning low incomes into deeper poverty. Texas, for example, has no personal income tax – the only part of the tax system that could be made progressive to avoid placing the heaviest burden on those at the bottom of the income scale. Without an income tax, Texas cannot implement tax credits to help those families who need it most. Because of that, those Texans who earn the lowest incomes pay the highest share of their incomes on other state and local taxes, such as property and sales taxes.[iv] New Mexico, on the other hand, has made its tax system more progressive by enacting, increasing and expanding refundable tax credits. These tax credit improvements are part of a whole host of tax policy improvements that have made our overall tax code more fair and equitable for those who are earning low incomes. New Mexico is the most improved state in the nation when it comes to making our tax code more fair or progressive. That’s according to the Institute on Taxation and Economic Policy’s (ITEP) Who Pays? report, a distributional analysis of who pays what share of taxes in each of the states.

According to ITEP’s Tax Inequality Index, New Mexico now has the 9th most progressive tax code in the nation, compared to what would have been 27th in the nation without all of these important improvements.

Figure IV shows a visual representation of that progress, detailing the share of family income paid in state and local taxes by income quintile. The light yellow, dotted bars show the effective tax rate for households back in 2018, and the darker yellow, solid bars show the current effective tax rate for families in 2024.

In 2018, New Mexicans with the lowest incomes (on the far left) were paying a much higher share of their income – more than 12% – in state and local taxes than the very rich (on the far right). Thanks to these recent policy changes and tax credits, they now pay a lower share, closer to 7% of their income in state and local taxes.

This chart also shows that, on a whole, more than 95% of New Mexicans are paying a lower effective rate of taxes now than in 2018, with only the wealthiest 1% or 2% paying slightly more.

Policymakers have made incredible progress these past several years in passing family-focused tax policy that helps support families with more of the resources they need to provide opportunities for their children.

Recommendations to Provide Further Support

New Mexico can build upon the considerable progress policymakers have made in creating a more equitable tax code in a number of ways. First, to increase the positive impact of the state CTC on children and families, New Mexico should boost the credit amount for children younger than 6. Of the 14 states that have state CTCs, half currently have them focused on, or boosted for, these early years.

This is important to consider because families with very young children tend to have lower incomes and experience higher poverty rates than households without children, as they are earlier on in their careers and can find difficulty balancing caregiving needs and the need to earn income. Ensuring young families have greater financial security is also important because evidence shows that a child’s early years are crucial to brain growth and their development, including long-term socioemotional and health outcomes. Additional research has found links between poor nutrition and severe stress in early childhood and worse health outcomes later in life. An increased CTC for families with young children can therefore boost family incomes when they most need the support.

New Mexico can also consider monthly or quarterly payments for refundable tax credits so that families have the option for more regular financial assistance throughout the year, versus a one-time payout at tax time. Minnesota became the first state to implement advance periodic payments in 2024,[v] and more states are looking to implement similar policies after the successful expansion of the federal CTC in 2021 allowed families to opt in for advance monthly payments, which demonstrated many financial benefits.

Third, New Mexico can further amplify the many benefits of the state Working Families Tax Credit by increasing our matching percentage, which is currently 25% of the federal EITC. This would help more working families put food on the table, pay their bills, and be better positioned to secure economic stability. Of the 31 states that offer state level EITCs, 11 amount to a matching percentage greater than 25%. In addition to the improved education, economic, and health outcomes that have been studied for decades, EITCs (and similarly state versions), have been shown to increase earnings and workforce participation given the way it’s designed and structured. The gradual phase out of the EITC amount as income rises also helps mitigate cliff effects,[vi] which are the loss of certain public benefits, such as SNAP or WIC, due to increased income.

Finally, in order to ensure that tax credits on both the federal and state level reach families who would benefit most, New Mexico needs to support new and existing initiatives that make tax filing simple, free, and accessible. Unfortunately, many families who would benefit from refundable tax credits face systemic barriers to accessing them, such as the high cost of for-profit tax preparation services and how time-consuming the filing process can be.

Fortunately, New Mexico’s Tax and Revenue Department is partnering with the Internal Revenue Service to implement the new, federal Direct File program in New Mexico that will make tax filing free and simple for many New Mexicans, following a successful pilot program in 12 other states this past filing season.[vii] Participation in Direct File will help more families claim federal and state credits for which they qualify, including both the EITC and WFTC – which one in five eligible New Mexican households do not receive[viii] – and the CTC.

By both increasing the impact of and expanding access to these important poverty-reducing federal and state credits, more families will be able to benefit from them, improving a parent’s ability to provide their children with stable housing, food, and other critical resources as they grow, learn, and thrive.

Endnotes

[i] “Tax Credit: What It Is, How It Works, What Qualifies, 3 Types,” investopedia.com, July 28, 2024

[ii] “States Should Prioritize Struggling Families With Targeted Tax Credits, Avoid Broad-Based Tax Cuts,” Center on Budget and Policy Priorities, Mar. 11, 2022

[iii] “Policy Basics: The Earned Income Tax Credit,” Center on Budget and Policy Priorities, April 28, 2023

[iv] “Texas: Who Pays? 7th Edition,” Institute on Taxation and Economic Policy, Jan. 9, 2024

[v] “Advance periodic payments would make the Minnesota Child Tax Credit fit even better into family budgets,” Minnesota Budget Project, May 7, 2024

[vi] “Moving on Up: Helping Families Climb the Economic Ladder by Addressing Benefits Cliffs,” National Conference of State Legislatures, July 2019

[vii] “New Mexico to join IRS Direct File program for federal taxes,” press release, NM Taxation and Revenue Department, Aug. 1, 2024

[viii] “EITC Participation Rate by States Tax Years 2014 through 2021,” Internal Revenue Service, Aug. 9, 2024