And how New Mexico can continue to remedy that

Download this fact sheet (Mar. 2023; 4 pages; pdf)

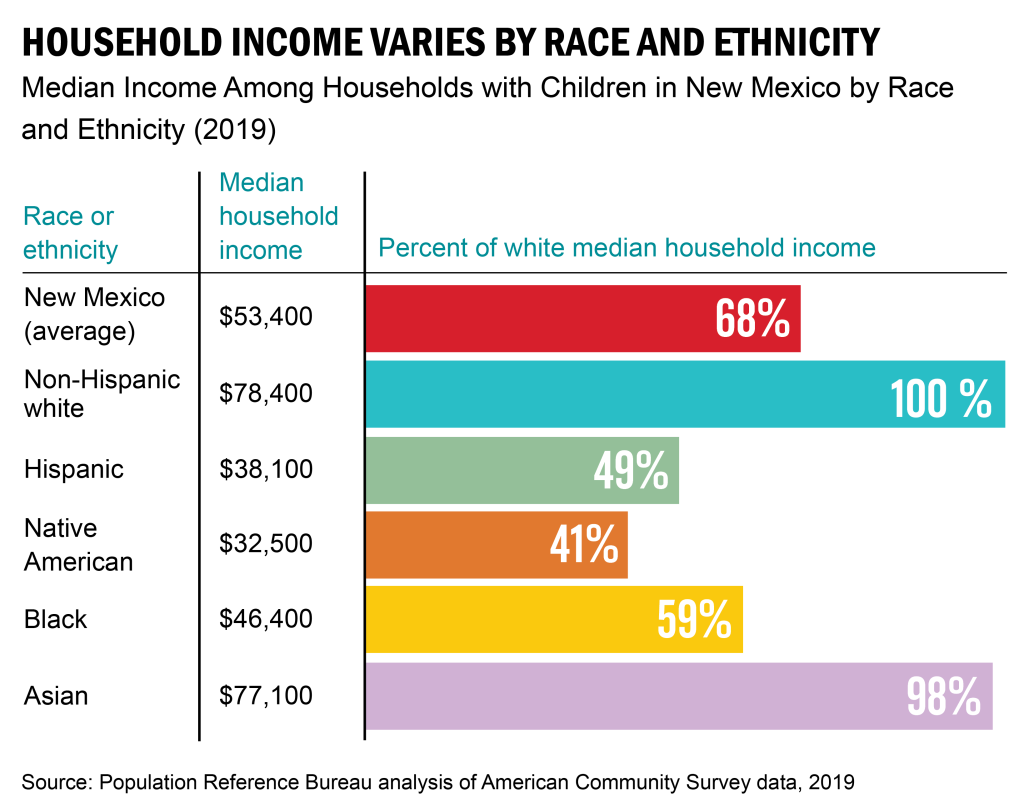

Decades of structural racism – in everything from education to voting rights, home ownership, and even drug sentencing laws – have advantaged whites while disadvantaging people of color. This has led to huge gaps in income – even in New Mexico where people of color make up the majority of the population.

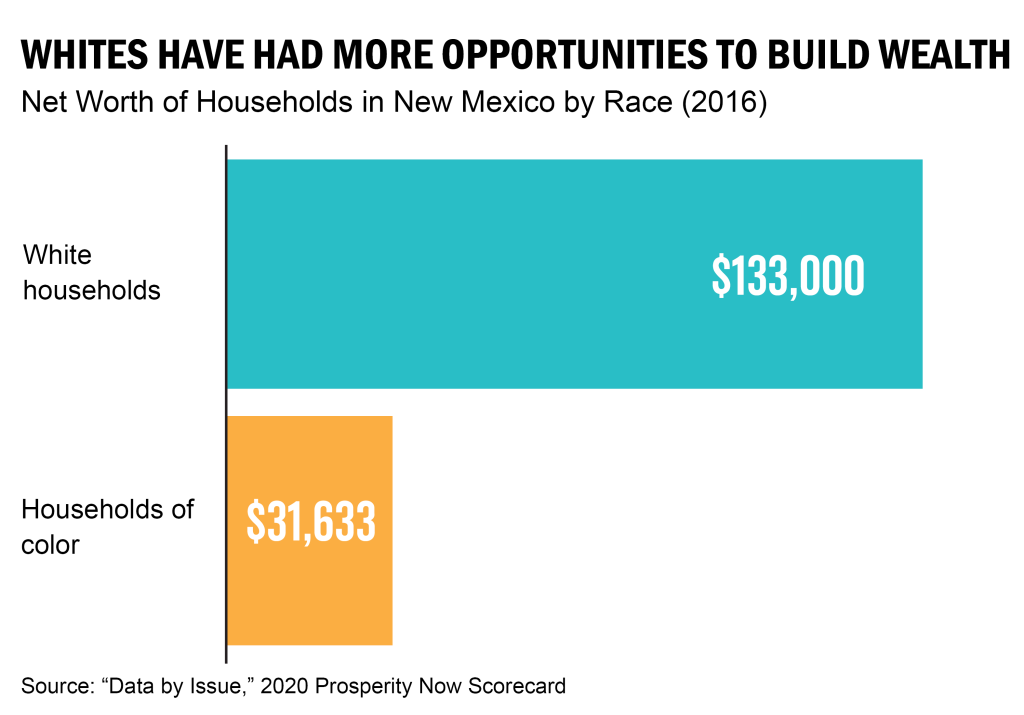

Income inequality leads to wealth inequality.

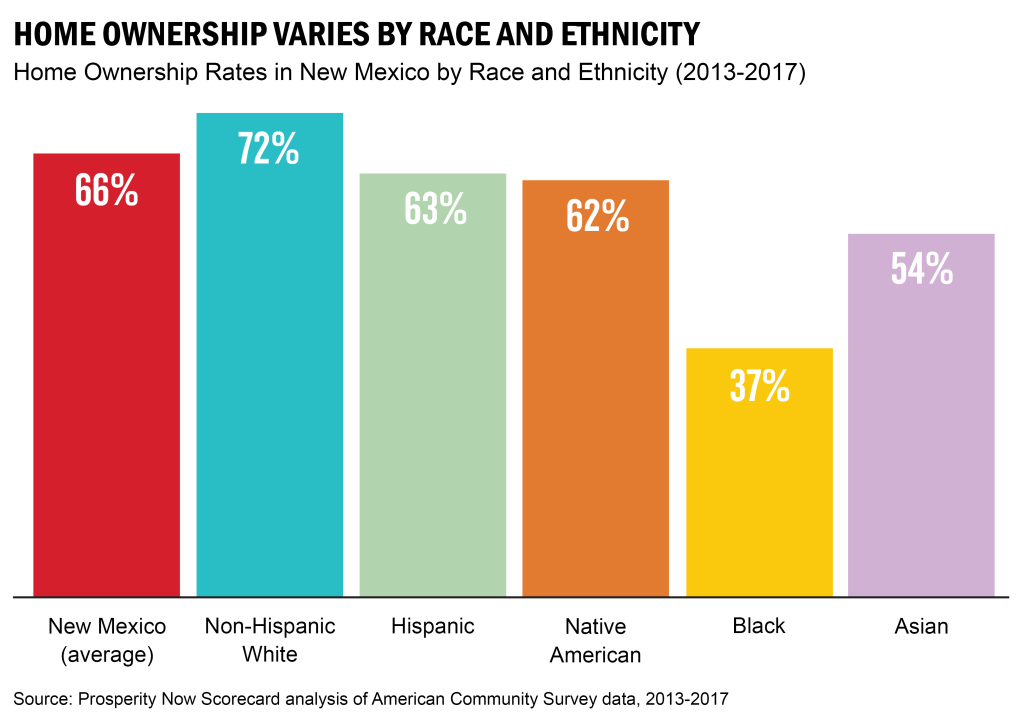

Income inequality leads to wealth inequality.  Americans hold the majority of their wealth in their homes. Not only does home ownership stabilize a family and give them a financial cushion to fall back on, it is the primary way wealth is passed down through generations.

Americans hold the majority of their wealth in their homes. Not only does home ownership stabilize a family and give them a financial cushion to fall back on, it is the primary way wealth is passed down through generations.

Income inequality and red lining – which continues to this day in the form of disparate lending practices – have made it far more difficult for families of color to build wealth.

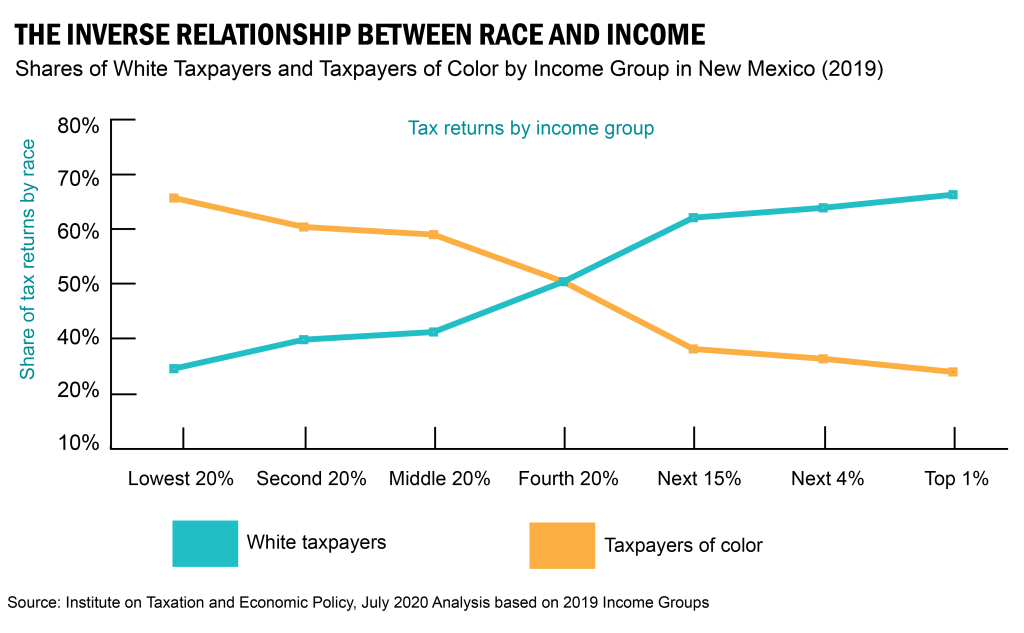

New Mexico’s tax system exacerbates this inequality, which was made worse when tax cuts were enacted in 2003 and 2013. Though these changes were based on trickle-down theory, they utterly failed at creating economic activity or jobs.

The tax cuts enacted in 2003 conferred preferential treatment on capital gains income, which is money earned from wealth. This preference helps those who already have wealth gain even more, which furthers the racial and ethnic wealth gap.

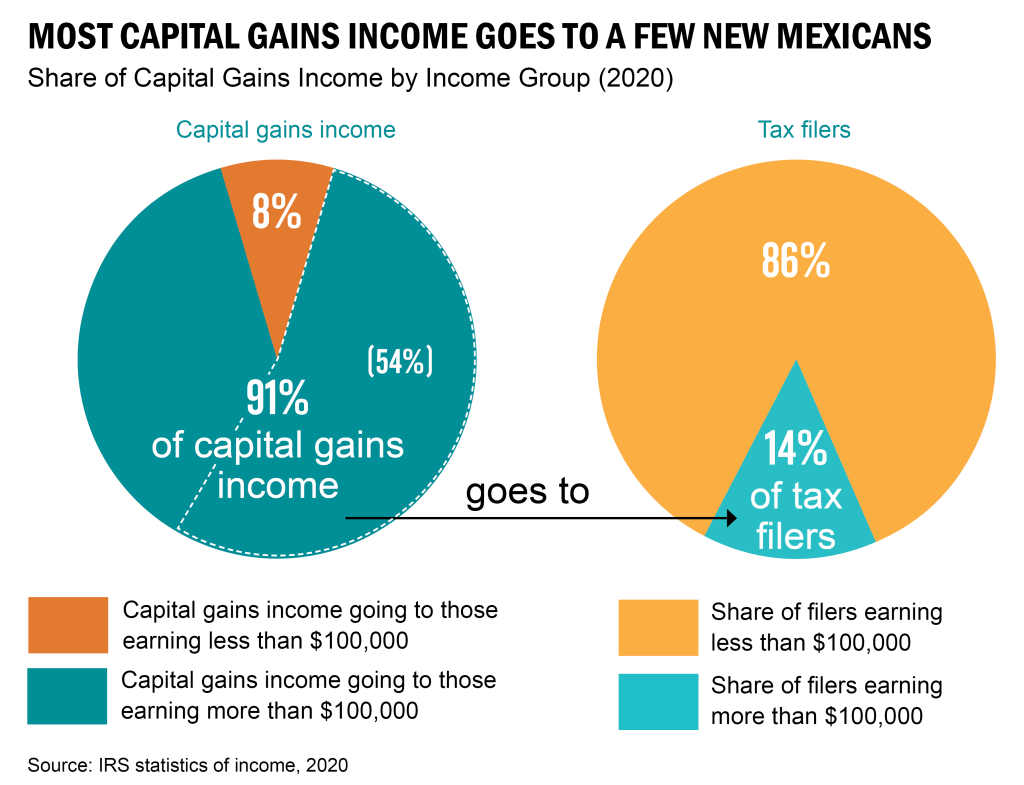

The vast majority of capital gains income in New Mexico – 91% (the whole dark blue pie slice below at left) – goes to just 14% of New Mexico tax filers (the light blue slice below at right). These filers have incomes twice the state median household income.

Even more alarming, 54% of capital gains income (the part of the dark blue slice that’s outlined in white) goes to just 0.1% of filers – a slice too small to show up on the chart! Their incomes are more than $1 million.

This preferential treatment of capital gains means that wages earned from labor are taxed at a higher rate than profits from investments and other assets.

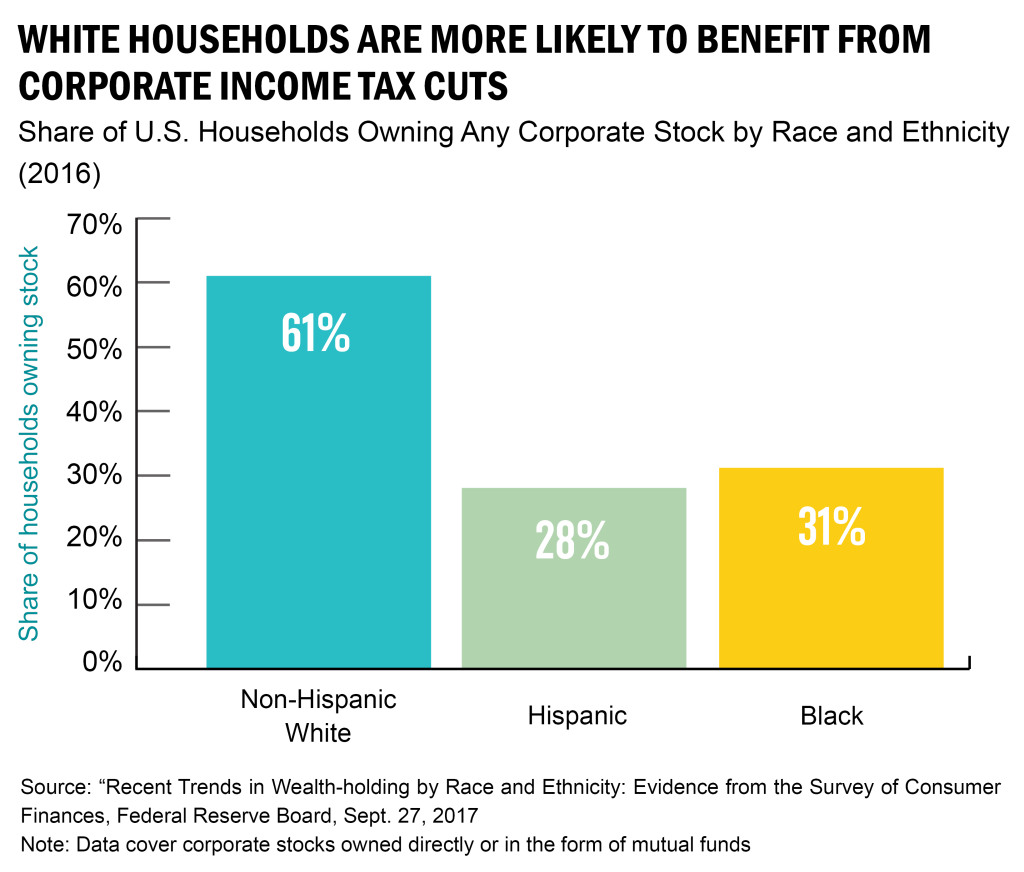

Similarly, corporate tax breaks – enacted in 2013 – provide more benefits to white households because they are more likely than households of color to own corporate stocks. New Mexico’s corporate tax breaks, which are generally passed along to share holders in the form of higher dividends, are not only more likely to benefit white households, but these stockholders may not even live in New Mexico.

The preferential treatment of capital gains income was enacted at the same time that personal income tax (PIT) rates for those with the highest incomes were cut almost in half.

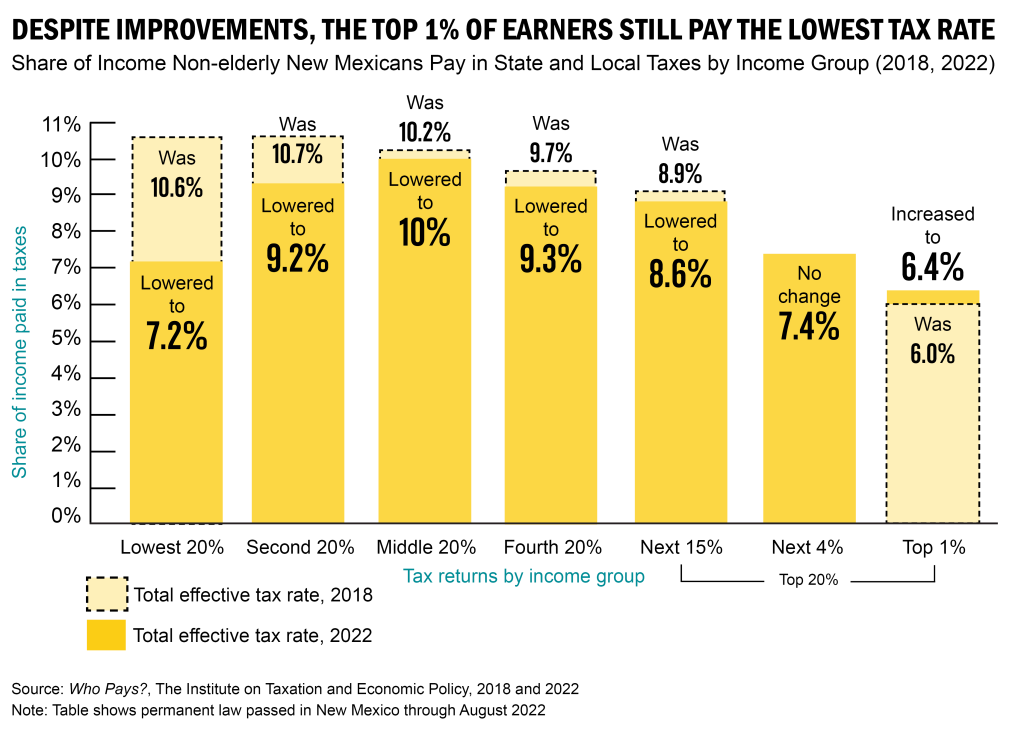

These changes made our tax system very regressive – meaning those who earned the lowest incomes paid the largest share of their incomes in state and local taxes. These effective rates are shown (as they were in 2018) in the light yellow bars outlined in black, below.

Fortunately, our Legislature has made some improvements in our tax code – making it more fair and equitable for people of color and women. The current effective rates are shown below in the dark yellow boxes. These changes include the creation and then expansion of several tax credits for those earning the lowest incomes, as well as families with children, and included the Working Families Tax Credit, the Low-Income Comprehensive Tax Rebate, and the Child Tax Credit (CTC).

These changes made our tax system progressive – but only for those earning the very lowest incomes. Those in the middle of the income scale – earning between $32,200 and $49,800 – now pay the highest effective tax rate.

Aside from inequity, the 2003 and 2013 tax breaks also made our state overly reliant on oil and gas revenue, which is inherently volatile. That has set us on a budgetary roller coaster over the past two decades. So, when revenue was low, big cuts were made to services that we all rely upon like education, health care, and public safety.

The 2003 personal income tax cuts, along with other regressive aspects of our tax system, still mean that those in New Mexico who earn the very highest incomes – more than $380,000 – pay the very lowest effective tax rate. And those who earn as much as $165,000 – three times the median income – pay a lower rate than most other New Mexicans.

Our overall tax system still needs some work. Lawmakers should:

- increase the CTC for families earning low and middle incomes;

- limit the capital gains deduction; and

- increase PIT rates for those earning the most.