Download this fact sheet (updated Feb. 2023; 2 pages; pdf)

Download a previous version of this fact sheet (Feb. 2021; 2 pages; pdf)

Support SB 189

New Mexico should raise corporate tax rates and close loopholes so big, profitable corporations are contributing their fair share towards the goods and services that benefit us all.

The Problem

Cutting corporate taxes is an ineffective economic development and job-creation strategy. That’s because corporations base location decisions mostly on whether a state offers a growing market for their goods, a well-trained workforce, robust infrastructure, and a quality of life that assures they will be able to hire their workforce.

After corporate taxes were slashed in 2013, New Mexico started losing tens of millions of dollars each year. That was revenue New Mexico could have invested in preparing workers for 21st century jobs, improving public safety, and modernizing our infrastructure.

These tax cuts made our tax system less fair, and hardworking New Mexicans have had to bear more of the responsibility for paying for the resources and services that businesses and people both use – like roads and bridges, police and fire protection, clean water, and more.

Corporate income taxes (CIT) provided around 5% of the money to fund our state budget in the decade before the big corporate tax cut of 2013. But now, CIT averages about 2% of the budget.[1]

Fairer tax rates can help ensure that corporations are paying their fair share and contributing to the health and success of our economy.

The Solution

Increase the corporate income tax rate. The tax cuts that benefited big corporations in 2013 did not lead to increased economic activity, as promised, but they did substantially reduce the revenues needed for the public investments – like education, health, and public safety – that do create jobs and build a strong economy. New Mexico should increase the corporate income tax rate to ensure that corporations – especially those that have profited immensely from the pandemic – are paying their fair share.

The Bottom Line

New Mexico has a lot to offer, and everyone – corporations and individuals – should be responsible for paying their fair share for educating our workforce and using New Mexico’s land and water, roads and bridges, and public services. It’s time to raise corporate tax rates and close loopholes, so big, profitable corporations are contributing towards the goods and services that benefit us all.

Equity Impact Statement

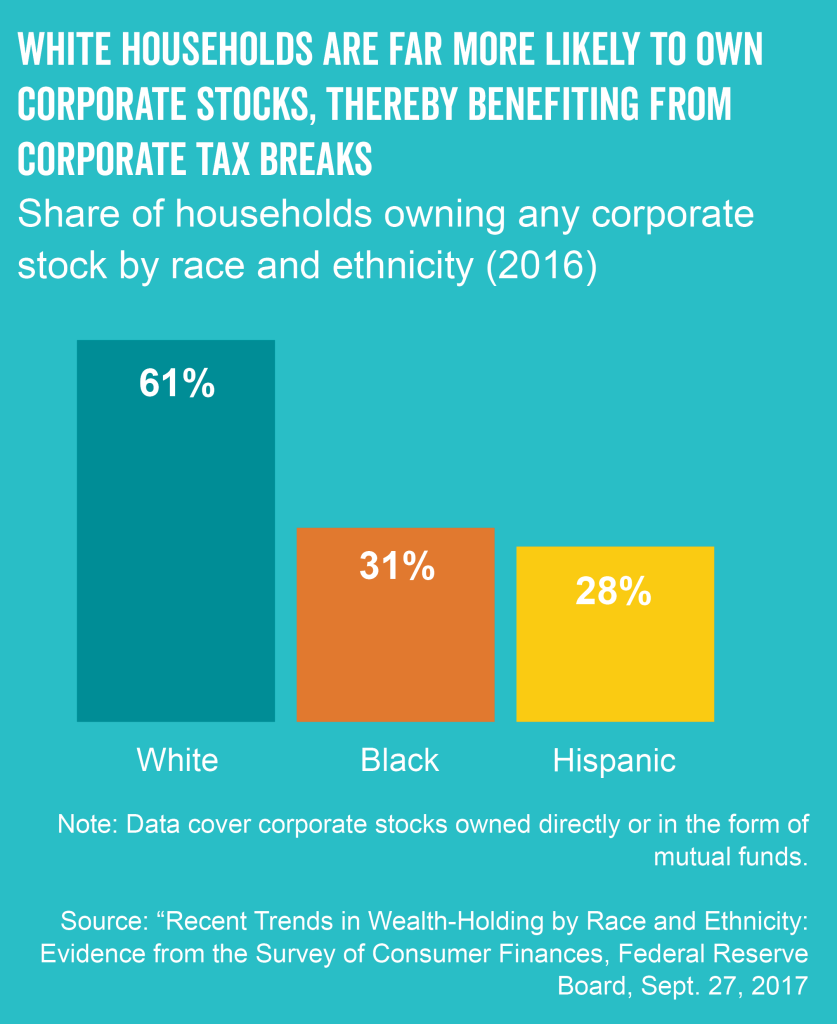

When corporations get big income tax breaks – like those New Mexico enacted in 2013 – racial and ethnic inequity is made worse. That’s because the benefits go largely to the corporation’s stockholders, who are twice as likely to be white households than Black and Hispanic households. When corporations are allowed to shirk their tax responsibility by not paying a fair rate, it overwhelmingly benefits white stakeholders, further widening the existing income and wealth divide.

[1] While the CIT tax cuts are a significant reason for the declining share of CIT revenues, the film tax credit contributes to that declining percentage of overall revenues and – as noted – will further reduce that share in the future. The 2013 change to single sales factor for manufacturers, the narrowing of the base through tax incentives, tax avoidance strategies, and the growth of pass-through entities (which are taxed through the personal income tax) are additional reasons the share has declined.