Executive Summary

Download this executive summary (updated July 2023; 4 pages; pdf)

Link to the full Guide to New Mexico’s Tax System

Link to the Guide to New Mexico’s State Budget executive summary

Link to the full Guide to New Mexico’s State Budget

Link to An Advocate’s Guide to New Mexico’s Budget

Link to A Guide to Legislative Advocacy in New Mexico

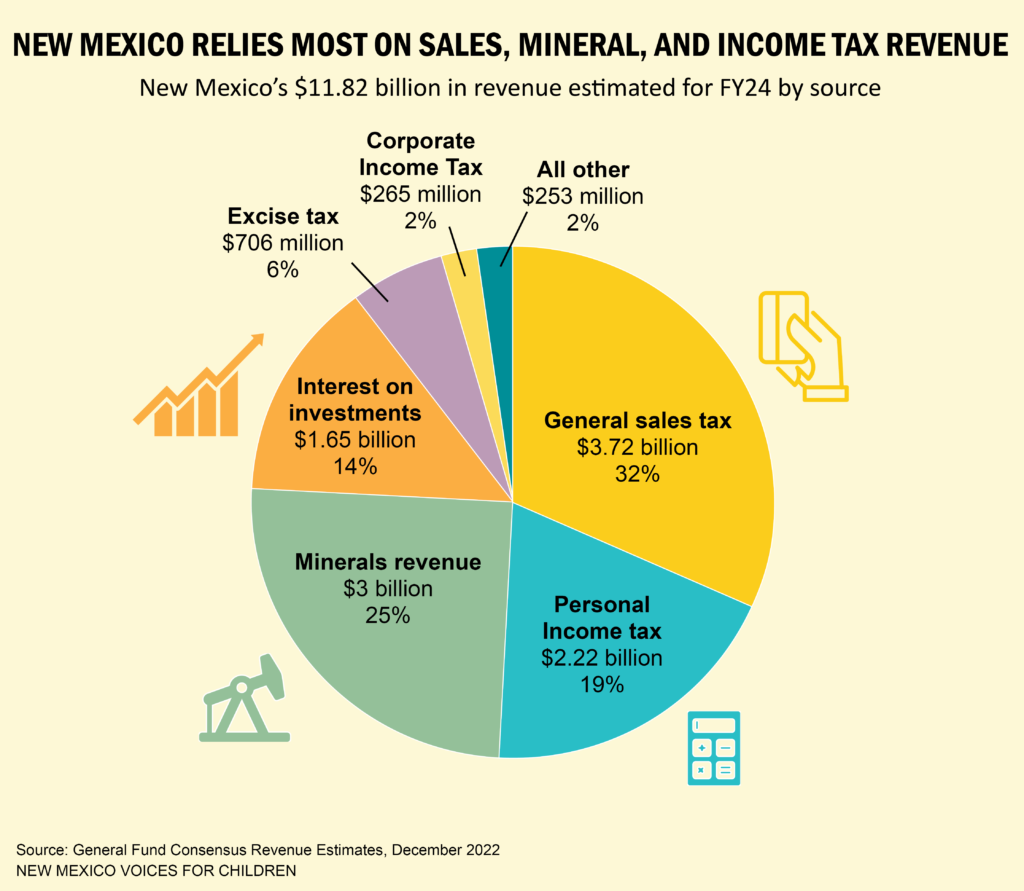

General sales taxes include gross receipts taxes (GRT) and compensating taxes. GRT is levied on most goods and services and is often passed along to the consumer.

Excise taxes are also sales taxes, but they are reserved for things like tobacco, liquor, motor vehicles, and telecommunications services.

Income taxes include personal income taxes (PIT) and corporate income taxes (CIT). Corporate income taxes are levied on a corporation’s net profits.

Mineral revenues are collected on crude oil, natural gas, coal, copper, and other hard minerals that are extracted from the ground, as well as rents and royalties from the sale or lease of mineral-producing land.

Interest on investments is primarily income derived from investing permanent fund revenue in the stock and bond markets.

All other includes gaming revenue from tribal casinos as well as the fees paid on things like registering your car or visiting a state park or museum.

How the State Collects Money

The taxes we all pay are how we fund the state’s programs and public services that benefit us collectively. They are how we build our roads, bridges, waterlines, electrical grids, and how we educate our children, advance public health, and uphold our laws. These programs and services form the foundation of our economy, enhance our quality of life, and pay dividends far into the future.

Most of the taxes we pay are deposited into the general fund, which is the state’s main pot of money for programs and services laid out in our state budget (see our budget guide for more on that). Not all of the money in the state general fund comes from taxes. The state also collects rents and royalties from the sale or lease of state lands for oil and gas production, and it earns income on the investments it makes in the stock market. Other common revenue sources for the state include fuel taxes, some fees, federal funds, and a share of property taxes, but those do not go into the state general fund.

Who Pays?

Besides deciding how to spend this money, the lawmakers we elect and send to Santa Fe are charged with determining how our tax money is collected for important investments like education, infrastructure, public safety, and more. In other words, they have to decide who pays taxes and how much, in order to advance our collective priorities.

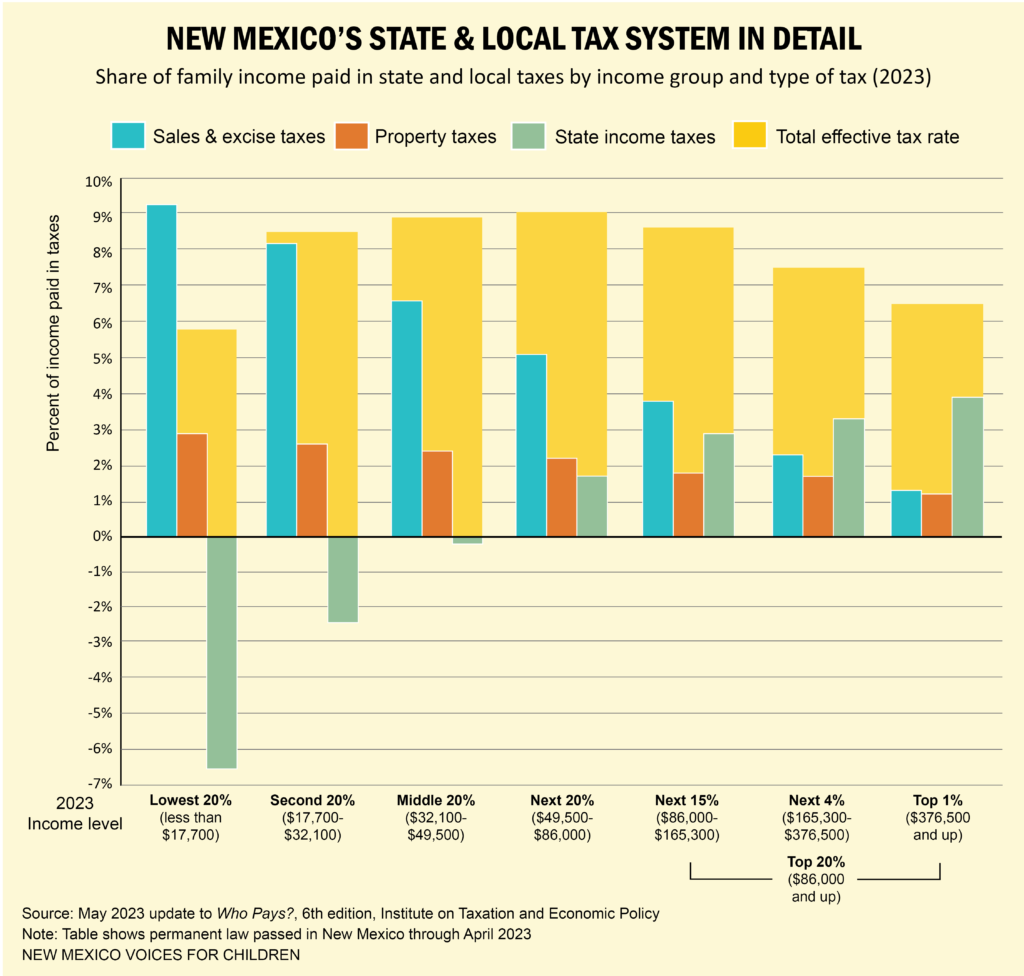

Most tax systems are either regressive or progressive. A regressive tax system is one in which those with the lowest incomes pay the highest share of their income in taxes. Sales and excise taxes tend to be regressive. In contrast, a progressive tax system is one in which those who earn the least pay the lowest rates, with rates increasing as income increases. The federal income tax is progressive, and was designed as such to help make up for the fact that state and local taxes tend to be regressive.

Our tax system used to be very regressive, with those earning the lowest incomes paying the highest share of their incomes in state and local taxes. Meanwhile, those at the very top of the income scale paid the lowest effective tax rate. But as the bar chart below shows, thanks to tax credits and rebates (the green bars, which indicate personal income taxes), those with the very lowest incomes now pay the lowest effective tax rate. While this is a big improvement, those at the very top of the income scale still pay the next lowest effective tax rate. This needs to change in order for our overall tax system to be more fair and stable.

Principles of a Good Tax System

Besides the issue of fairness there are several other characteristics that should be built in to a state’s tax code.

Accountable: Tax credits, exemptions and deductions are easy to monitor and evaluate.

Adequate: Collects enough revenue to meet all of the state’s needs.

Consistent: Tax revenues grow at the same rate as state personal income.

Efficient: Has a broad enough base to avoid dependence on any one tax.

Equitable: Has everyone pay taxes according to their ability to pay.

Simple: Is easily understood and collection efforts are minimal.

Stable: Has more revenue sources that are predictable than sources that fluctuate.

Transparent: Information about the tax system is clear and readily available.

Not All Tax Codes are Created Equal

In general, when viewed through the lens of these principles, New Mexico’s tax system needs improvement. Given the myriad of tax credits, exemptions and deductions to the state’s tax code, it would be hard to argue that it is accountable. Hundreds of exceptions have been made to the gross receipts tax (GRT) in particular.

These exceptions to the GRT, along with corporate and personal income tax cuts enacted within the past 15 years, have reduced important streams of revenue. Due to these giveaways, which mostly benefitted the biggest corporations and wealthiest earners, the state was left without adequate funding for crucial programs and services when revenues plummeted during the Great Recession. Over the past decade, many programs that support the health, education, and well-being of New Mexico’s children were cut or severely underfunded as a result. The post-recession boom in oil and gas production changed that, but only until prices dropped again due to a global price war and the pandemic. Placing too much reliance on these industries is problematic for other reasons (see stability).

Sales and personal income taxes are the most consistent types of taxes and these make up the two largest shares of the state’s revenue pie. However, the state’s over-reliance on revenues from the oil and gas industry, which are volatile and susceptible to external economic shocks, keeps the tax system from being efficient.

As we have seen, despite recent improvements, equity is still a concern. This is largely because of income tax cuts made many years ago for corporations and those New Mexicans earning the highest incomes. These cuts included an enormous deduction for capital gains income, which is the profits made on the sale of stocks, bonds, and other assets. The vast majority of this deduction goes to those at the high end of the income scale. The deduction has been narrowed in recent years, but it is still a massive give-away to those who least need a tax break. Besides making the tax system less equitable, every time a tax cut is enacted the tax code becomes less simple to understand and implement.

Although mineral revenue makes up 25% of the state revenue pie, oil and gas extraction also brings in significant GRT, making the industry’s contribution worth about a third of the whole. When oil and gas prices fall, the state takes a big hit. This unpredictability makes the tax code less stable. To make the tax system more stable and efficient, New Mexico must diversify its revenue sources. Stabilizing revenue streams would also help improve adequacy.

A tax expenditure budget (TEB) helps keep a tax system transparent. This annual accounting looks at all the money the state has chosen to forego by way of tax breaks and should determine if those tax cuts netted the expected benefits — whether those benefits be new jobs or increased tax revenue from other sources. New Mexico did not require a TEB in statue until very recently, and while it is a valuable tool, it still lacks a robust evaluation of past tax cuts. Spending on the budget side is analyzed every year and lawmakers expect to be given information on how the money was spent and whether the spending produced the desired outcomes. But once an expenditure is written into the tax code it is almost never revisited and we rarely learn if it worked as intended.

While our tax code determines how much revenue the state will bring in every year, our budget determines how that money will be spent. Much in the same way that our tax decisions reflect our values and priorities, so too do the decisions we make when crafting the budget. Our state budget is about more than addressing our current needs. It also mirrors our hopes for the future. For more information on how the state budget it crafted, see A Guide to New Mexico’s State Budget.