Executive Summary

Download this executive summary (updated Aug. 2012; 1 page; pdf)

Download the full report (updated Aug. 2012; 8 pages; pdf)

Download the companion report The Economic Benefits of Health Care Reform in New Mexico (updated July 2012; 8 pages; pdf)

The Affordable Care Act (ACA) of 2010 will have an enormous positive impact on New Mexico. Billions in federal funding will flow into New Mexico as part of an expansion of Medicaid and as tax credits and subsidies that will help people with their insurance premiums, co-pays, and deductibles. Our companion paper, The Economic Benefits of Health Care Reform in New Mexico, estimates that this influx of money will create billions in economic activity and thousands of jobs.

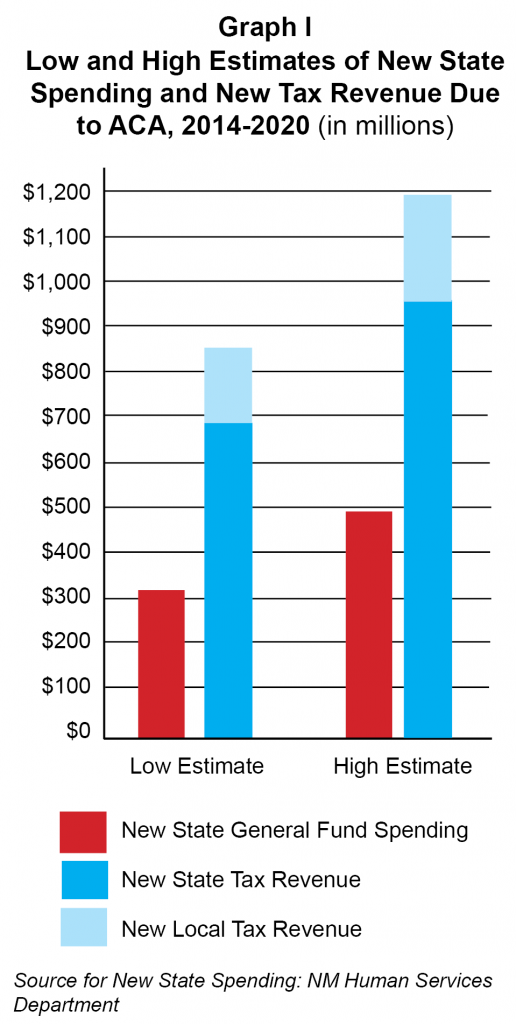

The Medicaid expansion will require some new state General Fund spending—estimated by the Human Services Department at between $320 and $496 million in the seven years from 2014 to 2020. However, that investment will be more than offset by new state tax revenues—estimated at between $693 and $953 million—from the economic activity that the federal funding will stimulate. The additional revenue—between $373 and $457 million over seven years—will go into the state General Fund. In addition, local governments will get between $165 and $229 million in new tax revenues over the same period.

Insurance Premiums Tax

New Mexico currently exempts health insurance premiums from the gross receipts tax (GRT) and imposes a separate 4.003 percent Insurance Premiums Tax (IPT) on them instead. Premium subsidies provided under ACA are paid directly to the insurer who applies them to the health insurance premiums of the qualified enrollee. Because they are part of a premium payment, they will likely be subject to the IPT.

Other Tax Revenue

The ultimate tax treatment of other funds—such as those used for cost-sharing subsidies for insurers, Medicaid Fee-for-Service, and business tax credits—remains less certain. A general methodology that compares general fund tax revenue from non-extractive sources to personal income was used to estimate the general fund revenue impact of these new federal inflows. In this paper, cost-sharing subsidies and Medicaid Fee-for-Service are assumed to be taxed at a statewide average effective tax rate of 5.23 percent and a local average effective gross GRT rate of 1.09 percent.

In addition to these benefits to the state, ACA will also reduce the net federal deficit over the next two decades.

Download this executive summary (updated Aug. 2012; 1 page; pdf)

Download the full report (updated Aug. 2012; 8 pages; pdf)

Download the companion report The Economic Benefits of Health Care Reform in New Mexico (updated July 2012; 8 pages; pdf)

This summary and the full report were generously funded by First Focus, Voices for America’s Children, and the David and Lucile Packard Foundation.