An analysis of the taxation of grocery purchases and its impacts on the health of the state’s children, families, and communities

Download this executive summary (Nov. 2015; 12 pages; pdf)

Download the full report and appendix (updated Jan. 2016; 94 pages; pdf)

Link to the press release

Executive Summary

This document summarizes findings from a health impact assessment (HIA) that was conducted in 2014 and 2015 on the potential health impacts of a reinstatement of a tax on grocery purchases in New Mexico. This HIA report is intended to be an accessible and informative resource for New Mexico residents and policy makers (at both the state and local level) interested in the issue of taxing food in New Mexico. The report is intended to inform the decision-making process by describing the potential positive and negative health impacts that could result from a tax on food.

The New Mexico Voices for Children HIA team also recognizes that other state and local governments have considered or may in the future address food taxes, and it is hoped that this HIA may be of value to decision makers and stakeholders in those areas as well. In a broader sense, the framework of this HIA—examining how tax policy can affect health—should be a relevant basis on which to consider “health in all” policies and the health impacts of other tax and economic policy decisions, both in and outside of New Mexico.

Acknowledgements

This project was supported by a grant from the Health Impact Project, a collaboration of the Robert Wood Johnson Foundation and The Pew Charitable Trusts. Over the course of the project, the New Mexico Voices for Children’s (NMVC) health impact assessment team received valuable input and participation from a variety of stakeholders, including community members, nonprofit and faith leaders, food bank and food pantry employees, researchers, academics, government officials, and public health experts. We thank them for their willingness to share their valuable time and significant experiences for the benefit of the project.

We extend special thanks and deep gratitude to the stakeholders who served on the HIA Advisory Council (see Appendix A in the full HIA report for a complete list of Advisory Council members). These experts brought an incredible body of knowledge, passion, and expertise to the project, and they were crucial to its execution. We also wish to thank Kari Bachman, M.A., with Doña Ana Place Matters, Jordon Johnson, Ph.D. with McKinley Community Place Matters, Rodrigo Rodriguez with the SouthWest Organizing Project, and Janet Page-Reeves, Ph.D., with the Department of Family and Community Medicine at the University of New Mexico Health Sciences Center. Their input and expertise was critical to conducting focus group research and gathering community feedback on the possible health impacts of a tax on food.

This HIA would not have been possible without the guidance and support of Amber Lenhart, M.P.H., of the Health Impact Project; Tia Henderson, Ph.D. and M.S.T., and Heidi Guenin, M.U.R.P. and M.P.H. of Upstream Public Health; and Mandy Green, M.P.H. of Green Health Consulting.

Disclaimer

The authors of this report are responsible for the facts and accuracy of the information presented. The views expressed are those of the authors and do not necessarily reflect the views of the Food Tax HIA Advisory Council, the Health Impact Project, The Pew Charitable Trusts or the Robert Wood Johnson Foundation.

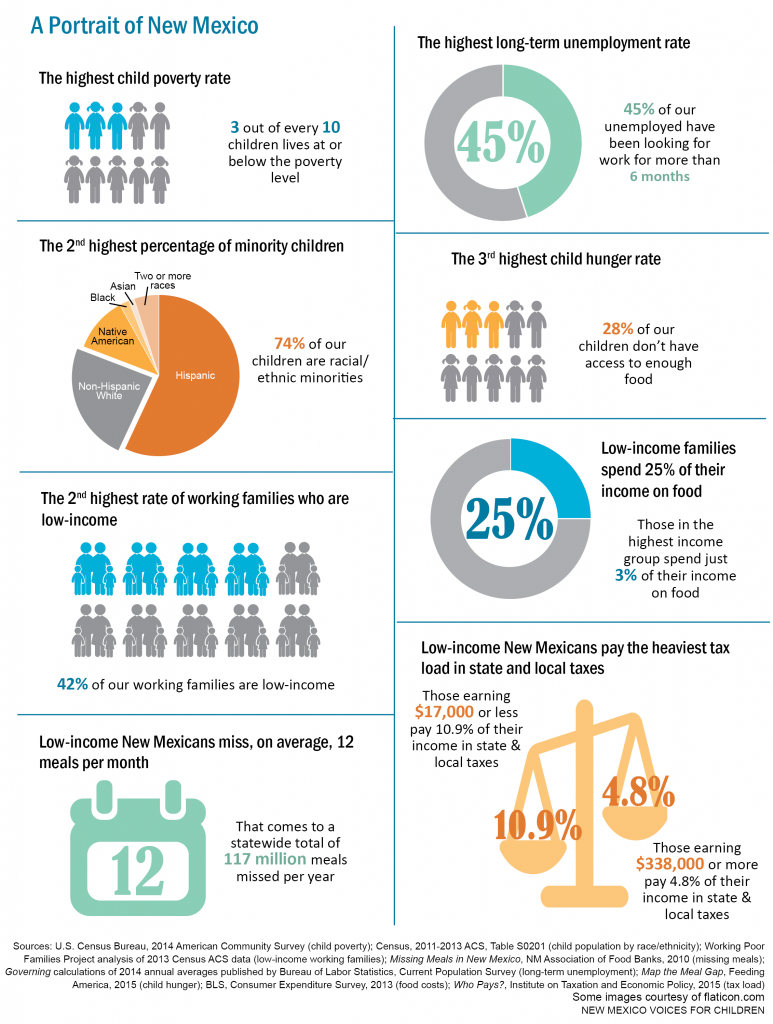

Project Background

In October of 2014, New Mexico Voices for Children (NMVC) received funding from the Health Impact Project—a collaboration of the Robert Wood Johnson Foundation and The Pew Charitable Trusts—to conduct a health impact assessment (HIA) on the possible reinstatement of a tax on food purchased for consumption at home in New Mexico. A health impact assessment is defined as “a systematic process that uses an array of data sources and analytic methods and considers input from stakeholders to determine the potential effects of a proposed policy, plan, program or project on the health of a population and the distribution of those effects within the population. HIA provides recommendations on monitoring and managing those effects.”1

In considering the value of an HIA on a food tax, the NMVC HIA team first noted that public health—or the consideration of how community health is supported, or at risk, before anyone feels sick and needs to visit the doctor—was not part of the discussion on the issue. While NMVC had previously engaged in policy work and research on the food tax, the staff had not examined how it could potentially impact health. The NMVC HIA team then considered and gathered stakeholder and expert input on the existing health conditions in New Mexico as well as how these health conditions might be impacted by a tax on food.

After consulting with stakeholders and considering the decision to be made and the current debate around the issue, the NMVC staff determined that the possible health impacts of a reinstatement of a tax on food might not be considered unless an HIA on the topic was done. The decision to conduct an HIA was also strongly influenced by the likely timeline of the introduction and discussion of a bill to tax food, its potential impacts on family economic security and health outcomes, the intersection of health and tax policy, and the background and policy expertise among NMVC staff and partners in these areas.

Food Tax HIA Goals

- 1. Inform public opinion and government decisions on the potential health impacts of food tax policy;

- 2. Ensure that any potential health impacts of a food tax are rigorously evaluated and considered when decisions related to food taxation are being made;

- 3. Demonstrate the policy’s health impacts on particularly vulnerable groups, as well as to engage these groups and help build advocacy resources for them;

- 4. Demonstrate how tax, economic, and budgetary policies can impact health outcomes;

- 5. Create new and/or strengthen ongoing partnerships between health and non-health groups; and

- 6. Increase organizational, partner, government, and community capacity to conduct and use HIAs.

The development of the scope of the HIA, as well as the HIA process, were driven by the accepted values of democracy, equity, ethical use of evidence, and a comprehensive approach to health that underpin HIA.2

HIA Methodology

HIA is defined as “a systematic process that uses an array of data sources and analytic methods and considers input from stakeholders to determine the potential effects of a proposed policy, plan, program or project on the health of a population and the distribution of those effects within the population. HIA provides recommendations on monitoring and managing those effects.”3

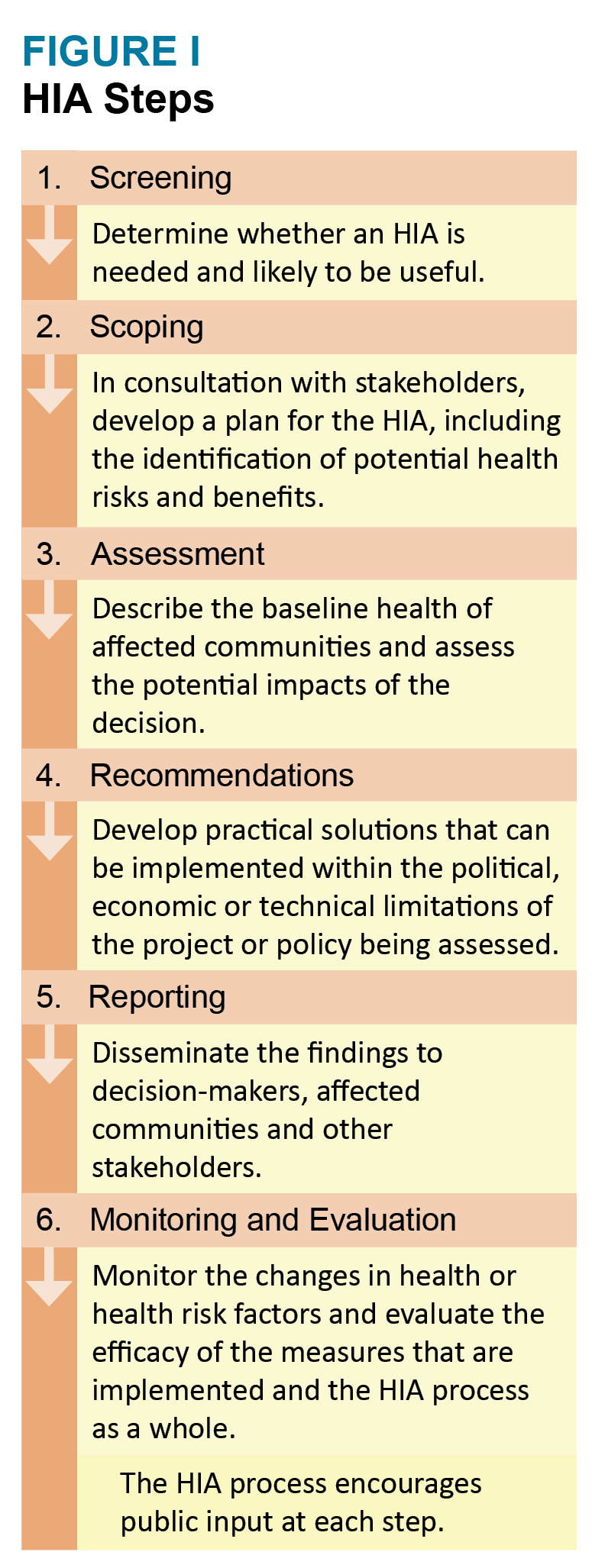

An HIA is conducted in six primary stages: screening, scoping, assessment, recommendations, reporting, and monitoring/evaluation. Stakeholder engagement is essential to and happens in every stage of the HIA process. The steps of an HIA4 are outlined in Figure I.

Food Tax HIA Research Methods

Food Tax HIA Research Methods

This health impact assessment relied on five primary research methods to identify and evaluate the potential health impacts of reinstating a tax on food: 1) literature review, 2) evaluation of existing conditions, 3) quantitative data analysis, 4) key stakeholder interviews, and 5) focus groups. A full discussion of the findings, methods, and data sources can be found in the full HIA report.

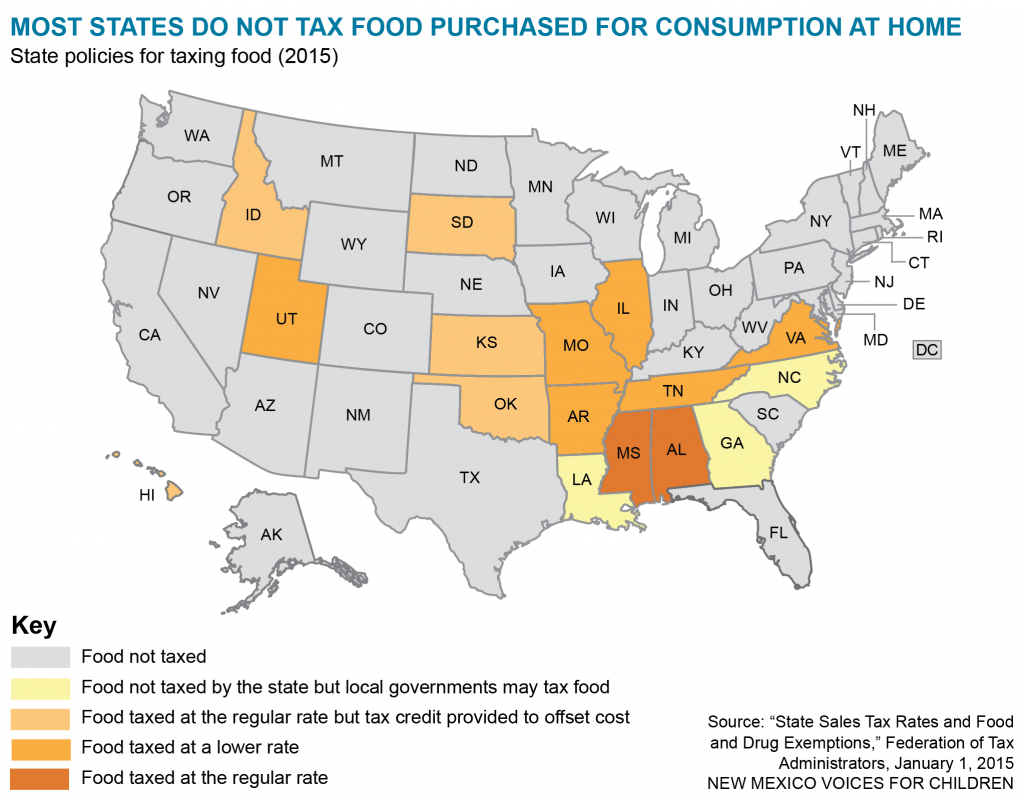

History of the Food Tax in New Mexico

Prior to 2004, New Mexico taxed food that was purchased for consumption at home under the state’s gross receipts tax (GRT), the state’s version of a sales tax. In 2004, the state Legislature exempted food groceries from the GRT. (Food purchased from restaurants is still taxed, as are non-food groceries such as paper products.) The legislation contained a “hold-harmless” provision whereby the state would compensate cities and counties for their portion of the revenue lost from this new exemption. Over time the value of the exemption grew to be approximately $250 million per year—much more than was originally estimated.

In 2013, a new law was enacted that phased out the hold-harmless payments over a 15-year period. This was done to offset the cost of a major corporate income tax cut. This new law also allowed cities and counties to recoup the loss of the hold-harmless revenue by imposing small increments of the local GRT. However, many local governments are faced with declining revenues, and many local officials have resisted raising their GRT rates. In 2014, some local government officials called for legislation to allow local governments the option to tax food. Since then, multiple bill versions have been discussed that include a reinstatement of a tax on food.

Policy Alternatives

State legislators—under pressure from the local governments faced with declining revenues as well as lawmakers wishing to overhaul the state’s entire tax system—are now considering reinstating a tax on food. New Mexico policy makers have drafted, proposed, and/or discussed multiple bills that would reinstate the GRT on food. Recently proposed legislation has included two options. The tax overhaul proposal would add food to the tax base and eliminate many other deductions and exemptions in order to reduce the total GRT rate on all goods and services. A second proposal would allow cities and counties to tax food but would not apply state-level taxes. Some cities and counties have also advocated for a referendum that would allow voters in each constituency to decide whether to tax food.

While conducting the HIA, the HIA team focused only on the food tax component of proposed legislation and the health impacts that could result from any new tax on food. The non-food-tax components of the bills seeking to overhaul the tax system differ from tax package to tax package to the extent that it is not possible under current time and resource restraints to thoroughly evaluate the health impacts of each different tax package comprehensively. These components were considered, however, but only generally for contextual purposes and specifically for the Secondary Policy Recommendations section of this report.

Timeline for the Decision-Making Process and the HIA

A bill to reinstate the food tax could be introduced and passed by state legislators—and either signed or vetoed by the Governor—as early as the 2016 legislative session. The bill could be written so that food could be taxed by the state as soon as mid-2016. If a bill to give local governments the option to reinstate a food tax is enacted, local governments could begin formally considering the tax under a timeline determined by state law and by each local government, though those laws would not likely go into effect until 2017 at the earliest.

Health Determinants Related to a Tax on Food

Health determinants are any factors that contribute to a person’s state of health and can include income, access to transportation and healthy food, neighborhood safety, etc. According to the World Health Organization, social determinants of health are “the complex, integrated, and overlapping social structures and economic systems that are responsible for most health inequities. Social determinants of health are shaped by the distribution of money, power, and resources throughout local communities, nations, and the world.”5 Health determinants shape the places in which people are born, learn, grow, work, and live, and are key influences on peoples’ health throughout their lives.

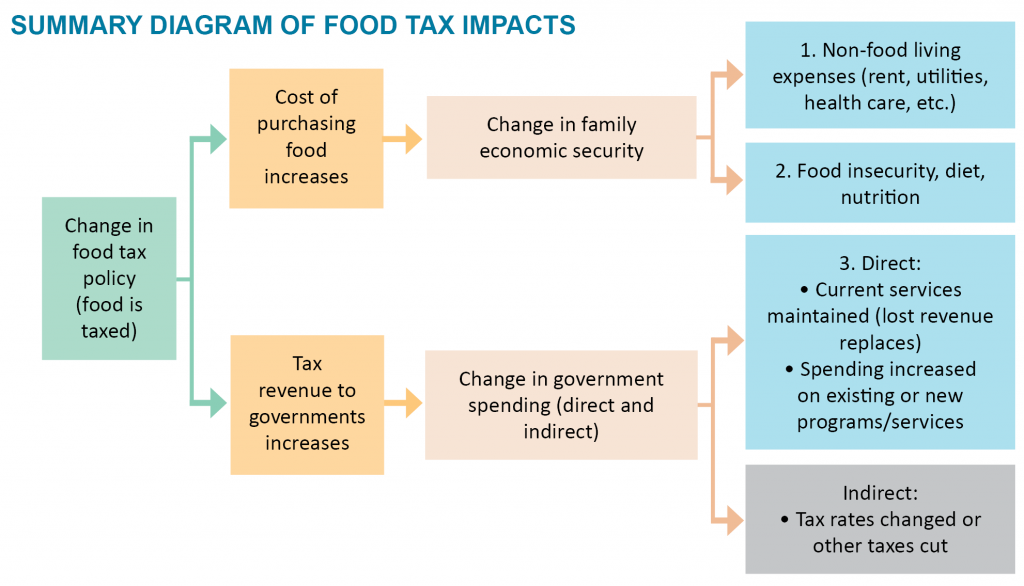

If a tax on food is reinstated, three things could happen that could have a strong influence on health determinants that impact health in New Mexico. The cost of purchasing food would increase for most grocery purchases, changing the economic security of families, particularly those with low incomes. Households have a limited amount of money in their budget; if a food tax emerges, households have to decide where that extra money to pay a tax would come from. Households would either:

- 1. Maintain their current food purchasing patterns, which would mean increasing the amount of money they spend on food and decreasing spending in other budget areas, or

- 2. Maintain their current food budget, which would require them to change their spending habits on food by buying less food or buying lower-cost food.

At the same time, a food tax would cause government revenues to increase, which would change government spending (either directly or indirectly through other changes to the tax code). This means governments could:

- 3. Be able to maintain current service levels (in the case of municipalities that are facing budgetary shortfalls), or could increase spending for current programs, create new programs, cut other taxes, or reduce tax rates (the latter being the case with a state-level tax system overhaul).

From these outcomes and the logic outlined above, and based on community, Advisory Council, and key stakeholder input, as well as on a preliminary review of existing literature, NMVC selected the following three health determinant logical pathways for further study:

- Family Economic Security: Non-Food Living Expenses

- Family Economic Security: Food Insecurity, Diet, and Nutrition

- Direct Government Spending: Maintaining Current Services

Potentially Vulnerable Populations

A core tenet of HIA is to consider health equity, highlight health disparities, and systematically evaluate health impacts of a potential project, program, or policy (in this case, a tax on food) on particularly vulnerable populations that may be disproportionately affected by a policy or face harmful health effects at greater rates or more detrimental levels.6 When available, data were disaggregated by population characteristics including, but not limited to age, gender, income, place of residence, and race or ethnicity whenever data or research was available in order to best understand the health impacts that a change in food tax policy would have on the following populations that were identified by the HIA project team and Advisory Council as particularly vulnerable:

- Children

- People of color

- Low- and lower middle-income families and individuals

The potential health effects on elderly New Mexicans (adults ages 65 and older), residents of rural areas, and residents of food deserts (places without reliable access to affordable sources of healthy food) were also analyzed when possible.

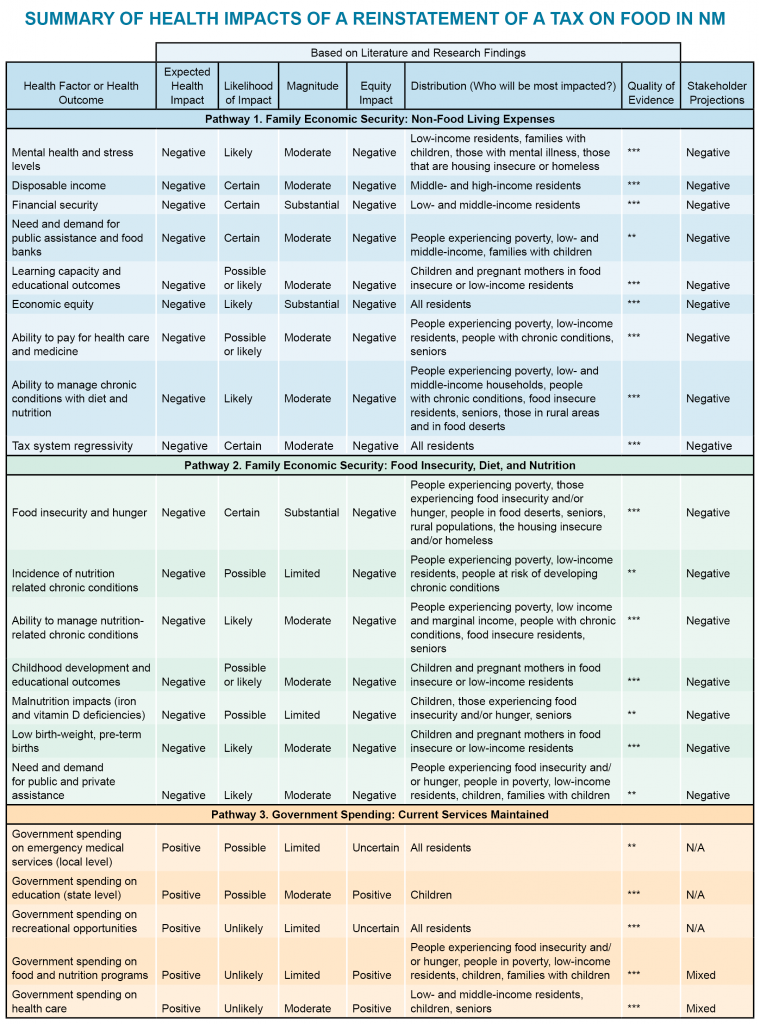

Overall Assessment Findings

Reinstating a tax on food in New Mexico may affect several health factors. The analysis conducted as part of this HIA through a literature review and both quantitative and qualitative research suggests that implementing a food tax is likely to have an overall negative impact on health through multiple health factors; while there are some potentially positive health impacts that could result, these are less likely. A full discussion of the findings, methods, and data sources can be found in the full HIA report.

Health Impacts of a Food Tax on Family Economic Security: Taxing food would cost each New Mexico household around $350 per year, or $29 per month, on average. Highest-income earners in New Mexico would spend about one-half of 1 percent of their income on a food tax, while the lower half of New Mexico earners would spend around 1 percent of their income on the food tax alone—double the rate that high earners would pay. Research and calculations show that a food tax would exacerbate the tax system’s regressivity—that is, it would hit low-income earners harder than it would hit high- income earners—and could harm family economic security, which could have negative impacts on mental health and stress levels, income available for other necessary purchases besides food, need and demand for public assistance, childhood development, ability to pay for health services and medicine, economic equity, and the ability to manage chronic conditions through diet.

Health Impacts of a Food Tax on Food Security, Diet, and Nutrition: Taxing food could also have an adverse impact on food security, diet, and nutrition by prompting purchases of less food or cheaper, less nutritious food. This could have important and harmful implications for health, particularly nutrition-related chronic conditions, the ability to manage chronic conditions through diet, childhood development and learning capacity, malnutrition issues, the incidence of low birth-weight and/or preterm babies, and the need and demand for food assistance from public, private, and nonprofit sources.

Health Impacts of a Food Tax on Government Spending: It is also possible that the negative health impacts of taxing food could be mitigated by how that revenue is spent. If food tax revenues lead to overall increased government spending on direct health services, food assistance and nutrition programs, programs that provide recreational opportunities, and education, then the food tax could have positive implications for health, or at the very least have no net negative implications. However, it is more likely that food tax revenue would be used to make up for decreasing revenue and so be used to maintain current service levels. Though it is possible that any increases could be spent on the programs noted above, for most program areas, it is unlikely, particularly at the municipal level.

The findings of this report are presented on the next page and discussed in detail in the full HIA report (download here).

Policy Recommendations

The following recommendations were drawn from findings based on literature, data, and stakeholder feedback and are intended to improve population health in New Mexico, maximize health benefits, and minimize health risks. One key finding of this project is that the tax code is an important health determinant and can play a significant role in child and family health and well-being. The policy recommendations that follow are driven by that finding and the idea that changes to tax code should improve and not exacerbate the health and well-being challenges of New Mexico families. More detail on each of the recommendations can be found in the full HIA report.

Primary Policy Recommendations

Do not tax food. The HIA team strongly recommends that the food tax deduction is not repealed and food is not taxed due to the potentially harmful health impacts, regressivity, and increased health disparities that could result.

Generate revenue in other ways. If it is determined that new revenue is needed, instead of a food tax, New Mexico should consider other taxes that would likely have a less harmful effect on the health of vulnerable populations in New Mexico and potentially address some of the existing regressivity in the tax code. These include repealing the capital gains deductions; increasing corporate income taxes or fees collected from large and/or multi-state corporations; mandating combined reporting; enacting higher personal income tax rates for very high-income earners; and raising taxes that are associated with curbing unhealthy behavior.

Secondary Policy Recommendations

Given that New Mexico has high rates of poverty and food insecurity, several other policy recommendations should be considered to help improve the health determinants and outcomes that many New Mexicans are facing now, even without a tax on food.

Note: These recommendations are targeted towards improving families’ day-to-day economic security, food security, diet, and nutrition and do not in any way serve as an endorsement of a tax on food. While they could mitigate some of the harmful effects of a food tax, they would not likely address all or even most of those effects. Rather, these policy recommendations should be considered not just in addition to, but also apart from, any decision about taxing food.

Increase current state tax credits and create new credits for low-income families with children. Increasing tax credits for low-income families with children is one way to combat the regressivity of the state’s tax system and lift working families out of poverty. Changes could include increasing the Low-Income Comprehensive Tax Rebate and the Working Families Tax Credit (based directly on the federal Earned Income Tax Credit). The state could also implement a state Child Tax Credit based on the federal credit. Making payments of anticipated refundable credits available on a monthly basis would also help low-income families provide basics like healthy food on a more consistent basis throughout the year than is reasonable with one yearly payment.

It is important to note that though tax credits make the tax system more progressive, they do not address the underlying causes of poverty and food insecurity—they simply help to mitigate them. And while tax credit participation is higher in New Mexico than nationwide, many eligible participants do not receive the credits. To be most effective, tax credits must be paired with public awareness campaigns and free tax preparation assistance for low-income filers.

Increase and/or maximize programs that help to improve the diet- and nutrition-related health outcomes of vulnerable populations. To make improvements in this area, policy-makers could increase appropriations for services directly related to food insecurity and hunger, particularly in rural and frontier areas; increase SNAP enrollment by maximizing available program benefits and streamlining enrollment and recertification; increase utilization of USDA at-risk meal program funds; take full advantage of community eligibility for free and reduced-price school lunches; improve data sharing under the New Mexico Health Information Act; increase coordination and administrative resource sharing for administering food programs; and increase the statewide minimum wage and index it to inflation.

Endnotes

1 National Research Council of the National Academies, 2011

2 World Health Organization, 1999

3 National Research Council of the National Academies, 2011

4 HIA Process, The Pew Charitable Trusts, August 2014

5 “Closing the gap in a generation: health equity through action on the social determinants of health,” final report of the Commission on Social Determinants of Health (CSDH), World Health Organization: Geneva, 2008

6 North American HIA Practice Standards Working Group, 2014

Suggested Citation: Wallin, A., Casau, A., Jimenez, J., Bradley, G., Kayne, S. (2015). A Health Impact Assessment of a Food Tax in New Mexico: An analysis of the taxation of grocery purchases and its impacts on the health of the state’s children, families, and communities, New Mexico Voices for Children.