By Amber Wallin, MPA

By Amber Wallin, MPA

April 19, 2023

Another Tax Day has come and gone, which makes it a great time to mention some of the improvements our state leaders have made to our tax system over the last several years. The big news is the creation and expansion of our Child Tax Credit (CTC), which we know is one of the best and most effective ways to help our families and their growing children.

Parents will be able to claim their CTC when they file their 2023 tax returns next year. The CTC will benefit every child in the state, including those who are being raised by the 27,000 grandparents who are financially responsible for their grandchildren.

When it was enacted in 2022, the CTC was set to return $74 million to families. But the credit was increased during the just-finished legislative session, meaning it will send another $105 million to families earning low and moderate incomes, with $12 million of that going to Native American families. The amount of the credit will depend on the family’s income and be worth as much as $600 per child.

Two other changes in recent years were increases in and expansions of the Working Families Tax Credit (WFTC) and Low-income Comprehensive Tax Rebate (LICTR). These two credits benefit more than 500,000 New Mexico tax filers who earn low wages – most of them families with children and seniors – and return some $100 million more to them every year either in the form of lower taxes or larger rebates. The WFTC alone benefits more than 250,000 children. Because much of this money is spent quickly and locally, the state as a whole benefits, as well.

Aside from helping those New Mexicans who need help the most, these changes also make our tax system fairer and more equitable. As with most state tax systems, ours still benefits the rich the most. Due to centuries of systemic racism – namely policies that placed barriers to success in the way of people of color – most of the people who have great wealth are white. And families raising children – who in New Mexico are overwhelmingly families of color – weren’t a high priority in the tax system until recently. But improvements over the past four years have changed that, and New Mexico is now a leader in making communities, families, and kids a top priority when making tax policy.

To understand how a tax system can be racially equitable – or not – we must look at the whole tax picture. In New Mexico that picture includes gross receipts taxes on the sale of many goods and services, excise taxes on the sale of specific products, and property taxes, which go into the cost of your housing whether you rent or own. All of the taxes we pay make it possible for the state to provide vital services like education, health care, and public safety, as well as public infrastructure like roads and bridges. But taxes that are based on consumption hit those in the lowest income levels the hardest. Fortunately, the state can help make up for that with the personal income tax, which is the only tax where the rates can be adjusted for different income groups, so it’s based on each groups’ ability to pay.

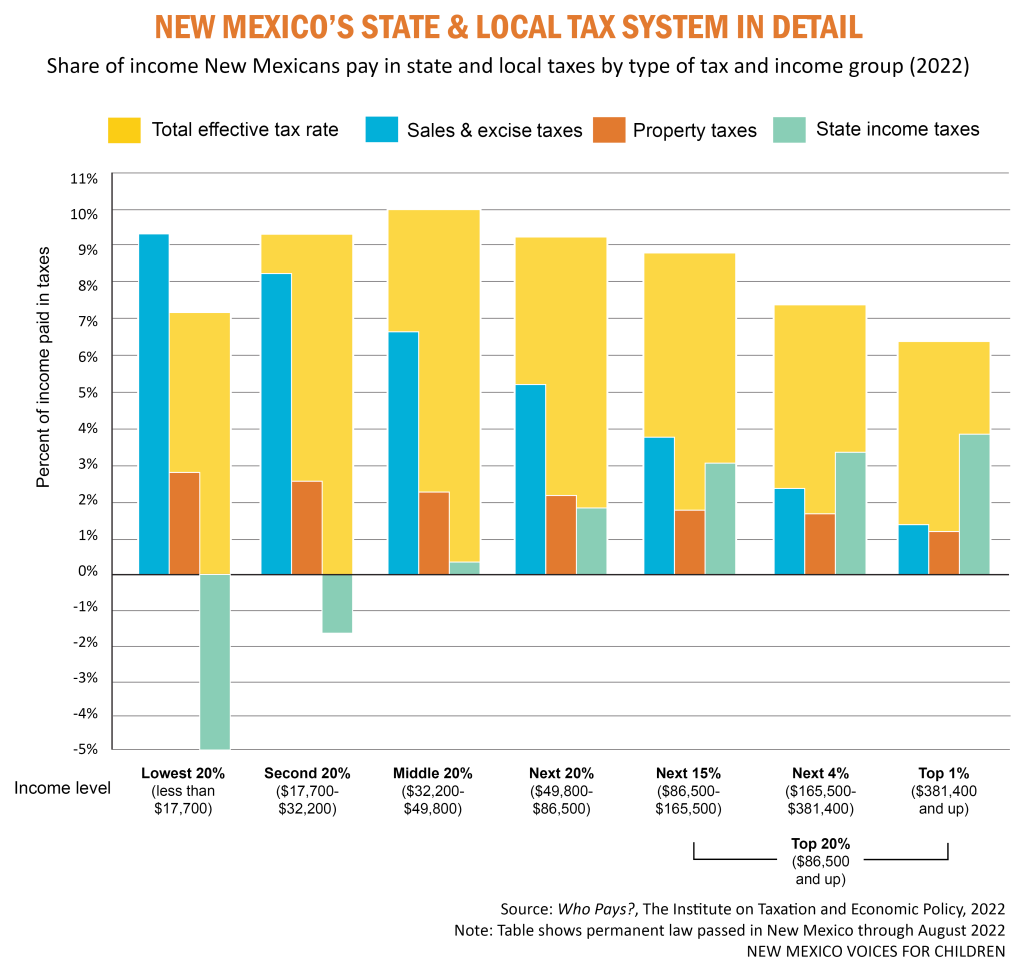

This graphic shows how that works.  The gold bars show the total share of your income that is paid in state and local taxes. This is your effective tax rate, and it varies depending upon where on the graph your income falls. As you can see, sales and excise taxes (the blue bars) are highest on the left – where the incomes are the lowest. Even property taxes (the orange bars) are highest for those earning the lowest incomes even though they are the least likely to own their homes. The state helps make up for that by the way personal income tax rates (the green bars) are structured, which are highest on the right – where incomes are the highest. While this structure has lowered the effective tax rate for those earning the very lowest incomes, they – along with those earning moderate and middle incomes – still pay a higher rate than those at the very top of the income scale.

The gold bars show the total share of your income that is paid in state and local taxes. This is your effective tax rate, and it varies depending upon where on the graph your income falls. As you can see, sales and excise taxes (the blue bars) are highest on the left – where the incomes are the lowest. Even property taxes (the orange bars) are highest for those earning the lowest incomes even though they are the least likely to own their homes. The state helps make up for that by the way personal income tax rates (the green bars) are structured, which are highest on the right – where incomes are the highest. While this structure has lowered the effective tax rate for those earning the very lowest incomes, they – along with those earning moderate and middle incomes – still pay a higher rate than those at the very top of the income scale.

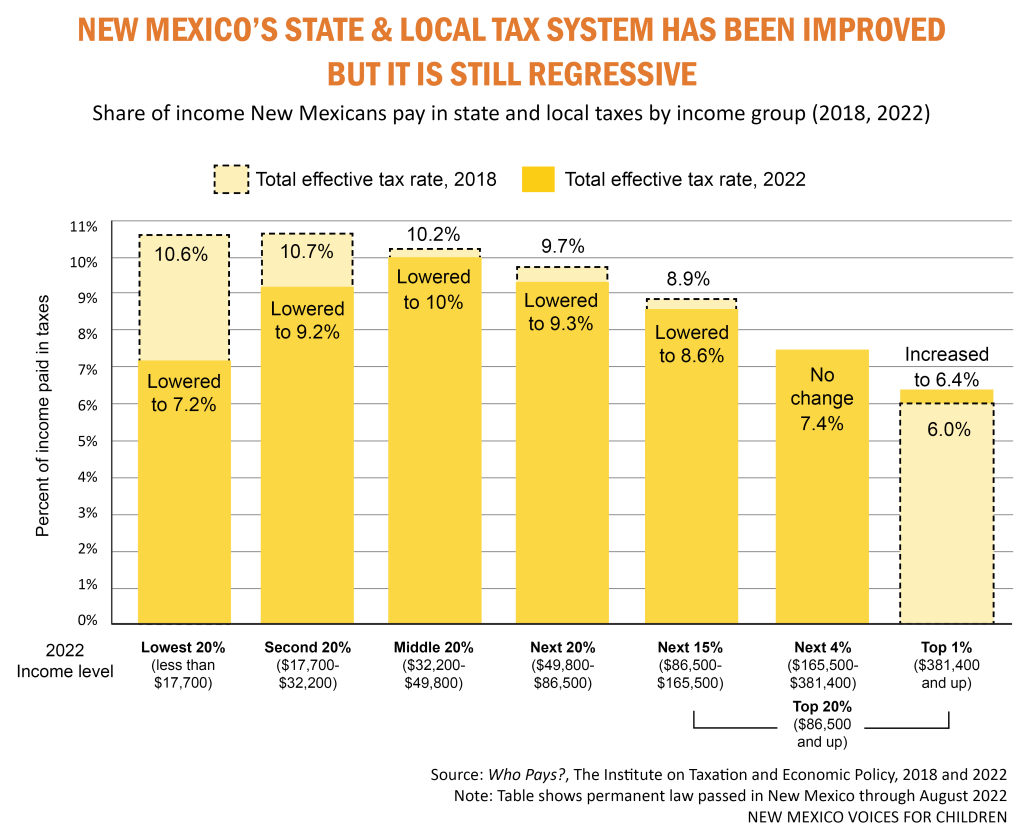

Still, this is a vast improvement over what our tax system looked like just a few years ago.  You can see how much more equitable our tax code has become in the next graphic, which shows the current effective tax rate for all income levels in the gold bars contrasted with the effective rates from 2018 (in the light-yellow bars). Tax rates were lowered for nearly every income level – most especially for those earning the lowest incomes – while it was raised just a bit for those at the very top. The improvements at the lower end were due largely to the creation of the CTC in 2022, which is factored in on these graphics (although the recent increase has yet to be included), as well as increases and expansions of the WFTC and LICTR. The increase for those earning the very highest incomes was due to a new marginal income tax bracket for the highest-earners and a slight lowering of the huge deduction for capital gains income – that’s money earned when you sell an asset such as stocks, real estate, or art at a profit, and most of this income goes to those at the very top.

You can see how much more equitable our tax code has become in the next graphic, which shows the current effective tax rate for all income levels in the gold bars contrasted with the effective rates from 2018 (in the light-yellow bars). Tax rates were lowered for nearly every income level – most especially for those earning the lowest incomes – while it was raised just a bit for those at the very top. The improvements at the lower end were due largely to the creation of the CTC in 2022, which is factored in on these graphics (although the recent increase has yet to be included), as well as increases and expansions of the WFTC and LICTR. The increase for those earning the very highest incomes was due to a new marginal income tax bracket for the highest-earners and a slight lowering of the huge deduction for capital gains income – that’s money earned when you sell an asset such as stocks, real estate, or art at a profit, and most of this income goes to those at the very top.

We’ve seen great improvements in our tax system but there is still more work to be done, such as raising personal income tax rates for those who earn the most money, reducing our over-reliance on the boom-or-bust revenue from oil and gas, and continuing to improve fairness and racial equity. Our elected officials enacted some excellent and family-focused changes over the past few years that will give more kids and communities the chance to thrive and make our state’s future brighter.

Amber Wallin, MPA, is the executive director of New Mexico Voices for Children.