Download this fact sheet (Feb. 2023; 3 pages; pdf)

Download this fact sheet (Feb. 2023; 3 pages; pdf)

For more on the state’s tax system see our Guide to New Mexico’s Tax System (updated March 2021)

Most people agree that low-income households shouldn’t pay a higher percentage of their income in taxes than the rich. However, the truth is that those with low and middle incomes do pay a higher share of their income in taxes than the rich in New Mexico.

Taxes can either be regressive, proportional or progressive depending on who they impact the most. These graphics divide New Mexico tax filers by income levels to show what share of their income each group pays in state and local taxes. This is their effective tax rate. But first, a brief explanation of the above terms:

A regressive tax means those with lower incomes pay a higher share of their income in these taxes. Sales and excise taxes tend to be regressive because the lower a person’s income, the higher the share that must be spent on day-to-day necessities – such as gas, utilities, and non-food groceries – most of which are taxed. Families with lower incomes spend a greater proportion of their income on sales taxes than do upper-income households, who can save or invest some of their earnings because they do not need to spend it all to make ends meet.

A proportional system in one in which everyone pays the same percentage of their income in taxes. This may sound like the most equitable option, but it does not take into account one’s ability to pay or minimize taxes on low-income households. For example, imagine a proportional tax system in which everyone paid 10% of their income in taxes. Consider a household living on just $20,000 a year – that’s less than half the state’s median income. A 10% tax rate means a loss of $2,000 – which is a lot of money for a family in that situation. At that income level, 10% equals a month’s rent or groceries. For the household earning $200,000, a 10% tax rate leaves them with $180,000 – a healthy, six-figure income that’s four times the median household income in New Mexico. With an income of $200,000, a 10% tax rate isn’t going to lead to skipping meals or medications in order to make the rent.

Taxes are progressive when those who earn the least pay the lowest rates, with rates increasing as income increases. The federal income tax was designed this way to help make up for the fact that state and local taxes tend to be regressive.

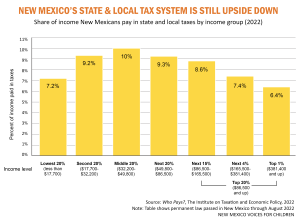

When we look at taxes as a share of income, the ideas of regressivity and progressivity become clearer. The bar chart below illustrates what percentage of their income non-elderly New Mexicans pay in taxes. The chart is organized by income levels, from the lowest 20% to the highest 1%, in order to show how the impact of taxes varies depending on one’s income.

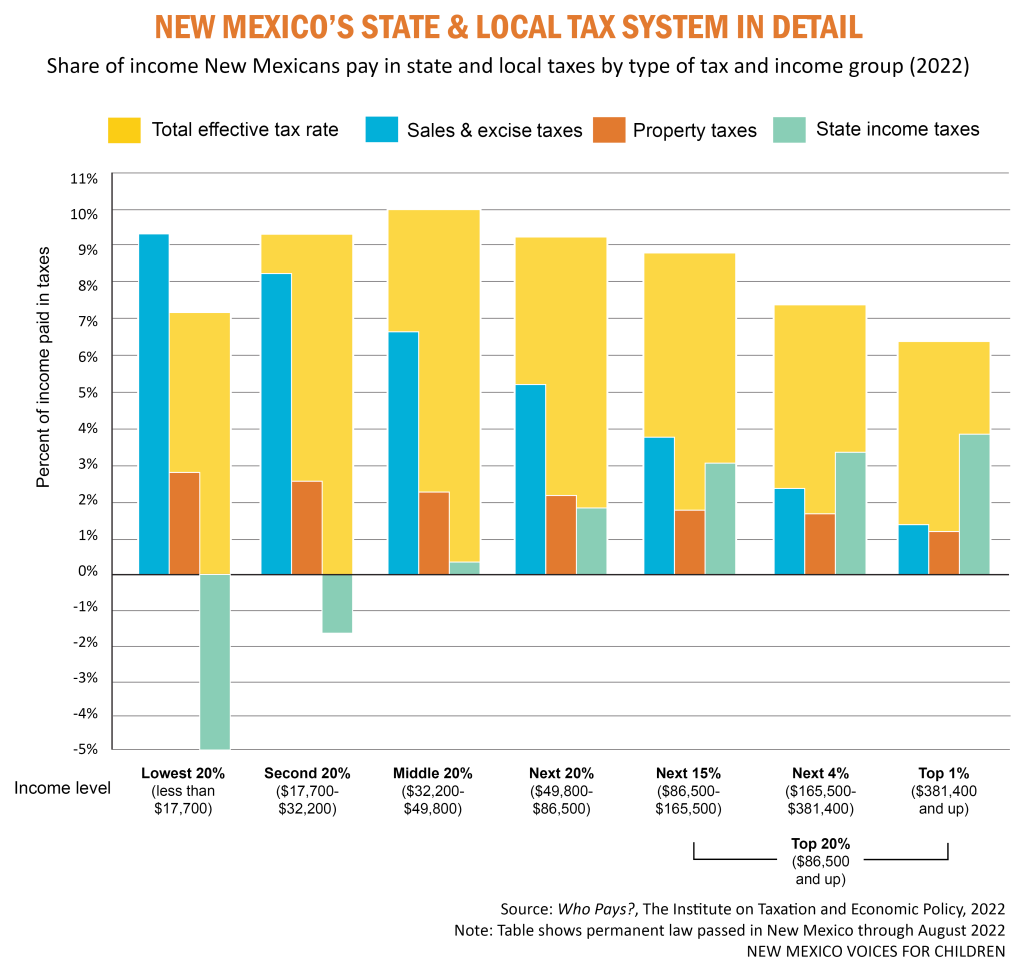

The yellow bars show the total share of income paid in state and local taxes. While it’s progressive at the lower incomes, it becomes regressive for those in the middle. This is primarily because sales and excise taxes (the blue bars) eat up a larger share of the income for those in the bottom brackets. The same is true for property taxes (the orange bars). People often assume that property taxes are only paid by homeowners, but the cost of property taxes – along with the costs of upkeep, insurance, and the interest paid on a mortgage – is generally passed along to renters.

State income taxes (the green bars) are the only progressive part of the state and local tax systems. As the amount earned increases, the percentage paid to income taxes also increases. Several refundable income tax credits are available for many New Mexicans whose earnings put them in the lowest income brackets. That is why the green lines for the bottom 40% dip below the 0% line. For families who owe income taxes, the credits reduce their overall tax bill. For families who do not owe taxes, or if the tax credit amount is greater than what they owe in taxes, the credits refund money they’ve already spent (for example, on child care).

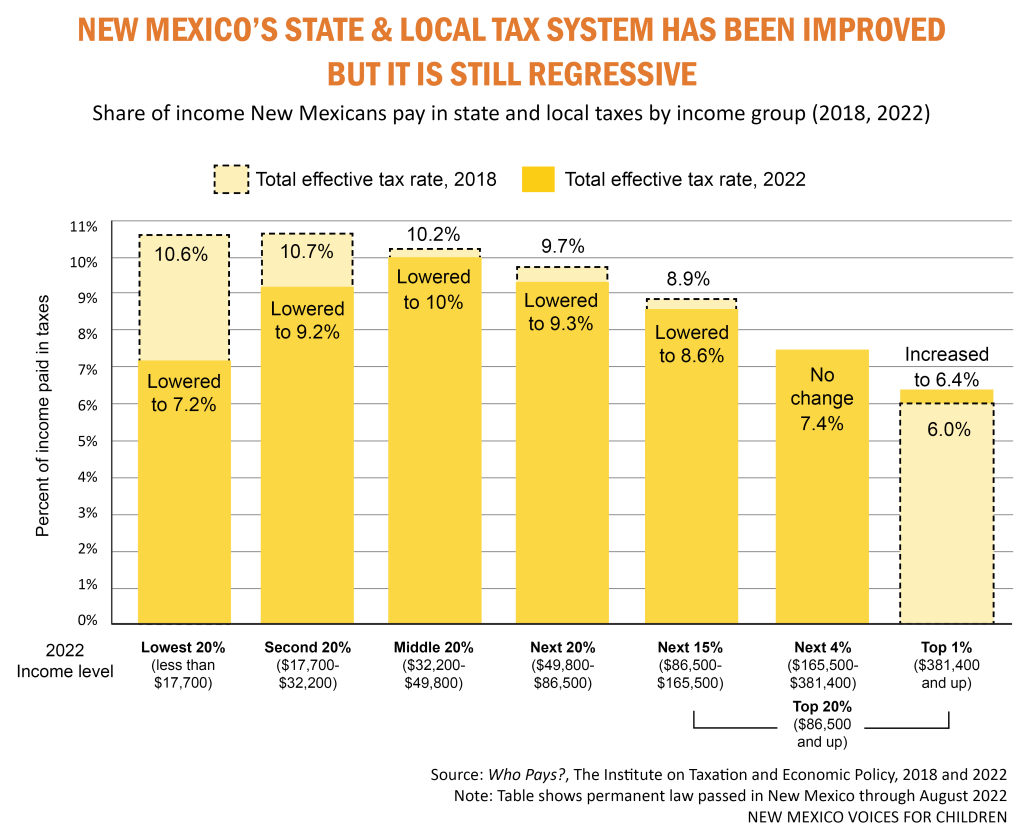

While New Mexico’s state and local tax system is not terribly progressive, it used to be much more regressive. The light yellow bars in the chart below show effective tax rates in 2018 – before some important changes were made to help those earning lower incomes. These changes included an increase and expansion of the state’s Working Families Tax Credit, a long-overdue increase in the Low-Income Comprehensive Tax Rebate, and the creation of the Child Tax Credit, which is based on income. These changes significantly lowered the effective tax rate for those in the bottom 20% of income earners, and moderately lowered the rate for other groups as well. Unfortunately, those in the middle 20% – who earn less than the state’s median income – did not receive any significant benefit and those in the top 5% did not see significant increases. So hard-working New Mexicans who earn between $32,300 and $49,800 now pay the highest effective tax rate. And those in the top 1% – who are earning $381,400 and up – still pay the lowest effective tax rate in the state.

Lawmakers have the opportunity to make more improvements to this tax system during the 2023 legislative session. One way they can do this is by increasing the Child Tax Credit for families earning the least while increasing income tax rates for those earning the most. In addition, they could end – or at least curtail – an overly-generous tax break for those with capital gains income, most of whom are in the highest earning brackets.