The proposals to exempt Social Security income from state income tax will benefit those with high incomes. And at a cost of at least $120 million, will mean less money for the programs that matter most to our communities.

Download this fact sheet (Jan. 2022; 4 pages; pdf)

Download the previous fact sheet (Aug. 2021; 2 pages; pdf)

The Low-Down

Half of all New Mexico’s seniors on low incomes – less than $25,000 for individuals or $32,000 for couples – already pay no income taxes on their Social Security benefits. And the rest pay taxes on only a portion.[1]

For seniors with slightly higher incomes – $25,000-$34,000 for individuals or $32,000-$44,000 for couples – state taxes are only assessed on, at most, 50% of their Social Security income.[*]

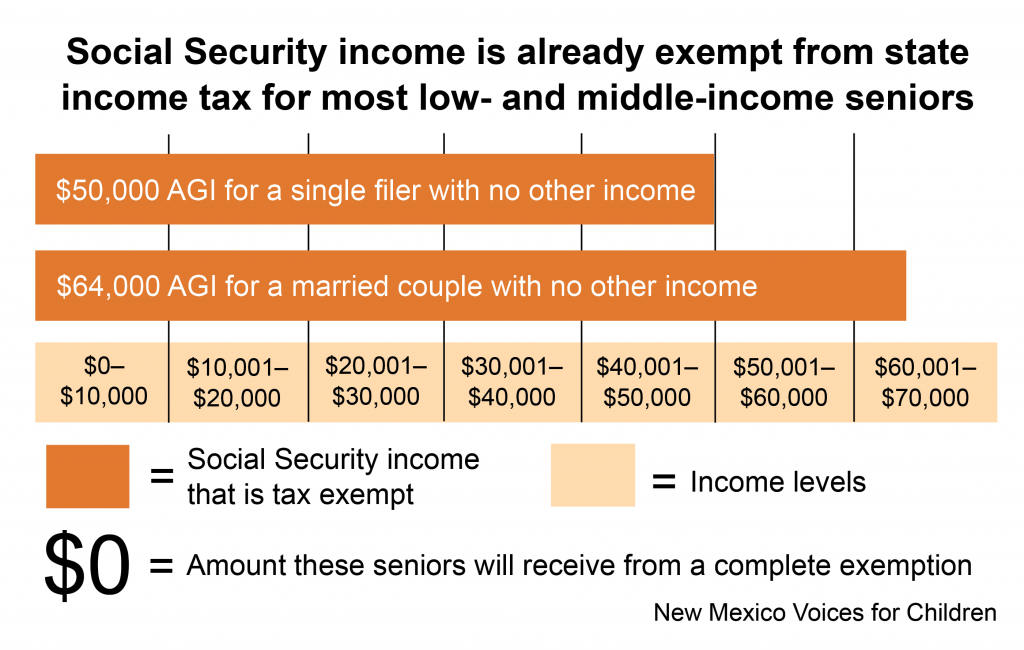

When determining what income threshold seniors fall into, it’s important to note that only one-half of Social Security income is counted. That means seniors with no other income won’t actually owe any taxes until their Social Security income reaches $50,000 for an individual and $64,000 for a couple.

How it works:

- For a single filer, if their adjusted gross income (AGI) – including half of Social Security income – is less than $25,000, none of the benefit amount is included in gross income and is not taxed (see figure below).

- So, a single filer earning up to $50,000 in Social Security income alone would owe nothing in taxes, since half of $50,000 is $25,000.

- The same is true for married couples filing jointly, with income less than $32,000.

- So, a married couple filing jointly can earn up to $64,000 in Social Security income alone without owing income tax.

Even higher-income seniors pay tax on only a portion of their Social Security income

- Income taxes are paid on – at most – 85% of Social Security income only by higher-income seniors (individuals earning more than $34,000 or couples earning more than $44,000).

- Again, when determining if this income threshold is met, only one-half of Social Security benefits is counted.

- The remaining 15% is exempt from federal and state taxation for even the highest income earners because that is the only portion beneficiaries have already paid taxes on.

- In all, New Mexico taxes only about one-third of all Social Security income.[2]

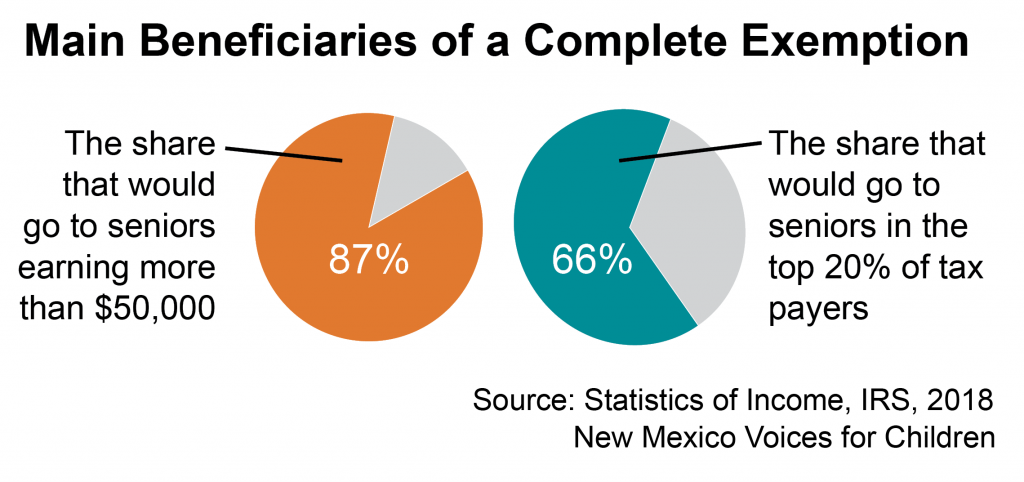

A complete state exemption would almost entirely benefit higher-income seniors

- 87% of the value – or about $104 million – would go to those making more than $50,000.

- That’s roughly the state’s median household income.

- 66% of the value would go to those making more than $75,000.

- That’s the top 20% of taxpayers.

Social Security FAQs

- Social Security is a savings program for senior citizens. While you’re working, deductions are made from your paycheck and deposited into the Social Security Trust Fund, which then earns interest.

- The size of your Social Security benefit depends on how much you earned while you were working and your age when you retired.

- These benefits include more than just the money you paid into the Trust Fund while you worked. It also includes payments made by your employers, which matched the amounts you paid in, as well as interest income earned on the payments made by both you and your employers.

- Because people live longer now than they did when the program began, most retirees receive far more in benefits than they and their employers paid in.

- In 1983, the Reagan Administration determined that 85% of the benefits retirees received was income that had never been taxed before. That means the money you paid in is just 15% of your total benefits – and that’s the only income you’ve already paid taxes on.

- Supplemental Security Income (SSI) is already never taxable.

New Mexico already has tax breaks targeted to low-income seniors

- A state tax exemption specifically for low-income seniors is worth up to $8,000.

- Low-income seniors can take another exemption worth $2,500.

- Low-income seniors can claim extra exemptions, which allows them to get a much bigger rebate from the Low-Income Comprehensive Tax Rebate (LICTR)

Low-income seniors also got a big tax break during the 2021 legislative session:

In 2021, lawmakers increased the amount of the rebate for LICTR and expanded eligibility. Lawmakers:

- Tripled the amount of the rebate. The average LICTR rebate increased to $195, returning up to $48.8 million to New Mexicans with the lowest incomes.

- LICTR eligibility increased to those earning $36,000.

- Those changes benefit 56,000 current and newly eligible seniors throughout our state.

- LICTR is now indexed to rise with inflation – meaning it won’t lose its value over time like it had since it was last updated more than 20 years ago.

LICTR is a much more effective way to help low-income seniors.

Pain Points

Exempting all Social Security income from taxes would be very expensive – costing as much as $120 million

Whenever we give tax breaks, we take in less money. That means less money for the services and programs that we all depend upon.

One of those programs is the Aging and Long-Term Services Department, which helps our seniors with many issues, including:

- Transportation

- Home-delivered meals

- Assisted living and long-term care facilities

- Independent living centers

- Medicare and Medicaid help

- Prescription drug assistance

- Legal services

The proposed tax cut will cost the state more than twice the entire budget of the Aging and Long-Term Services Department ($48.4 million).[3]

The Bottom Line

We can’t help low-income seniors by giving tax cuts to high-income seniors

If we give tax cuts to seniors who don’t need help, we’ll have less money to serve those seniors who do.

Tax cuts like this narrow our revenue streams and make us even more reliant on revenue from the boom-or-bust oil and gas industry. So next time oil prices go bust, we’ll either need to raise taxes or cut the services and programs everyone – our kids, our families, seniors, and small businesses – depend upon.

When that happens, all low-income New Mexicans get hurt. We have one of the highest poverty rates in the nation. Why would we do anything to make that situation worse?

Final Thoughts

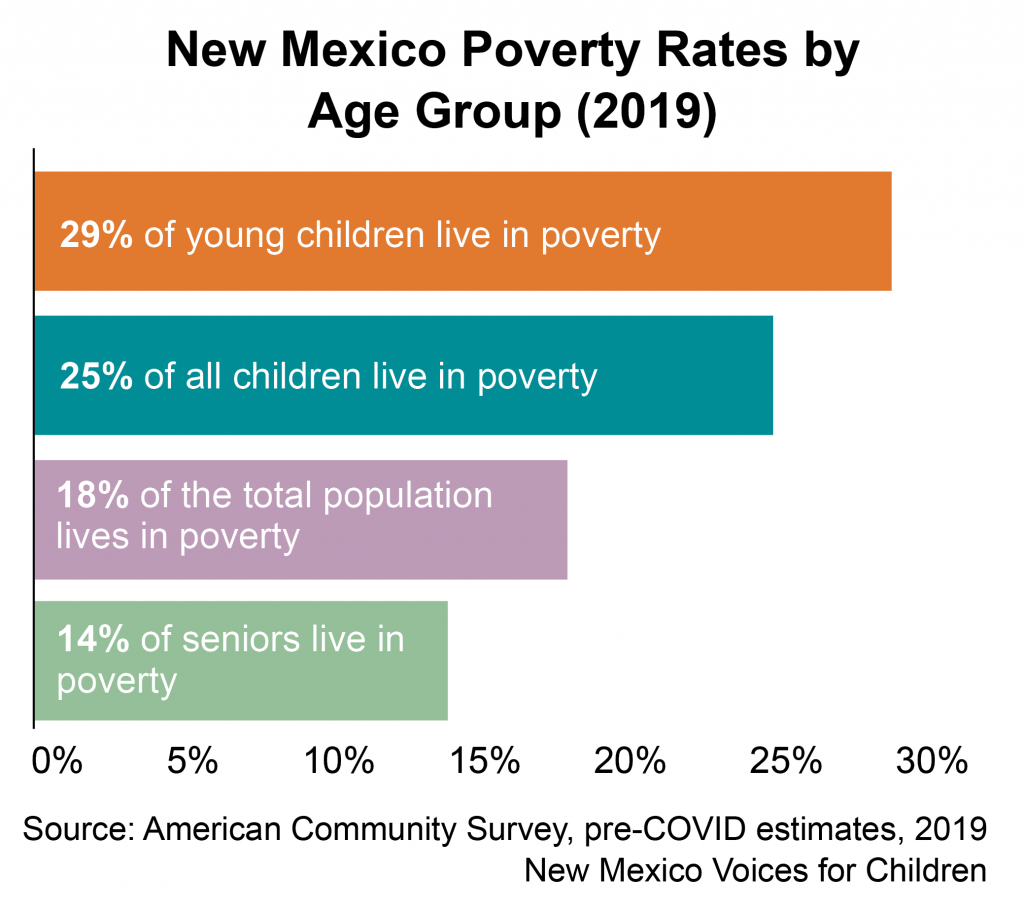

New Mexico’s seniors are better off financially than much of the population

Despite the fact that many of our seniors are low-income, as a group, they have a low poverty rate:

- The age group in New Mexico that has the highest poverty rate is young children (ages 0-5 years), who have a poverty rate of 29%.

- Following closely are all children (ages 0-18 years), with a poverty rate of 25%.

- Seniors have the lowest poverty rate of all age groups at 14%.

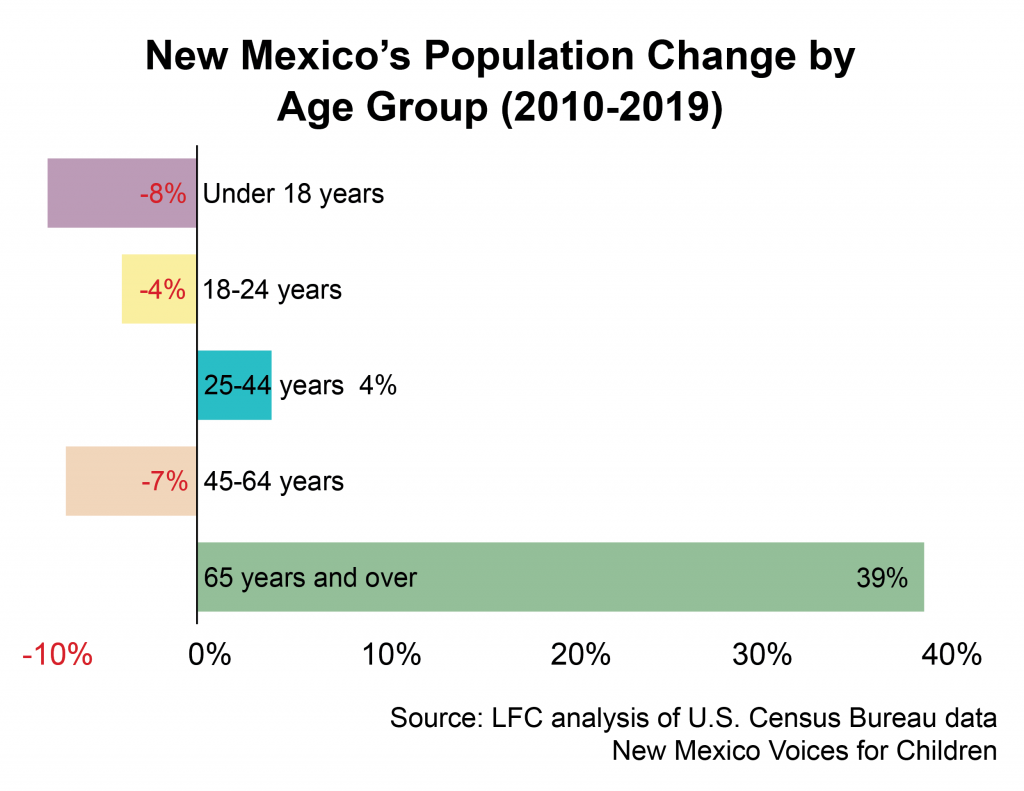

There’s no need to lure seniors here – our senior population is already booming

Seniors are, by far, the fastest-growing age group in New Mexico:

Seniors are, by far, the fastest-growing age group in New Mexico:

- The growth of our over-65 population has outpaced the rest of the nation, and we’re projected to have the third highest share of seniors of any state.

- Our senior population grew by nearly 40% over the last decade.

- Seniors are drawn here by the great weather and low cost of living.

Meanwhile, younger New Mexicans are leaving for better job opportunities

- We believe we’d be better off investing that money in the kinds of services that build a stronger New Mexico for all our children and families.

13 states, D.C., and the federal government tax some Social Security income

- Like most states, New Mexico’s income tax law follows federal income tax law except, in this case, we exempt a much larger share of Social Security income from taxes.

- 12 other states tax Social Security income: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, North Dakota, Rhode Island, Vermont, Utah, and West Virginia.

[*] Whether a taxpayer ultimately owes income tax will then depend on the taxpayer’s exemption and deductions before arriving at taxable income.

[1] “Effect of Taxing Social Security Benefits by income Class Estimated for Tax Year 2014,” Congressional Budget Office

[2] NMVC analysis of IRS 2017 Statistics of Income and Social Security Administration, Master Beneficiary Record, 100 percent data; U.S. Postal Service geographic data; and December 2019 testimony of Jim O’Neill, former Tax Policy Director, NM Taxation and Revenue Department

[3] Post-Session Review, LFC, May 2021