Download this fact sheet (Sept. 2021; 4 pages; pdf)

Download this fact sheet (Sept. 2021; 4 pages; pdf)

During the 2021 legislative session, policymakers, advocates, and everyday New Mexicans worked together to craft and pass a bill that provides economic relief for most New Mexicans, enhances equity in our tax code, and will ensure that millions of dollars flow back into the pockets of the New Mexicans who need it most – and into the small businesses where they will spend it.

Who will benefit:[1]

- 512,000 tax filers will see an income tax cut or a bigger rebate

- $100 million more will be returned to hard-working and low-to-moderate income New Mexicans every year

- 260,000 families with children will see an income tax cut

- 56,000 seniors will see an income tax cut or rebate[2]

These benefits are provided through two important tax changes:[3]

1. Giving a big boost to hard-working families by

- Increasing the Working Families Tax Credit (WFTC) from 17% to 25% of the federal Earned Income Tax Credit, plus

- Increasing the overall dollar amount going to New Mexico families by 47%, plus

- Ending two exclusions to the WFTC by (1) allowing working New Mexicans who file their tax returns with an Individual Taxpayer Identification Number (ITIN) to claim the credit and (2) by allowing childless workers aged 18-24 to claim the credit.

WFTC changes will benefit

- 201,000 tax filers who currently claim the WFTC will benefit from the amount increase

- 10,000 New Mexicans who file with an ITIN will benefit from the expansion

- 41,000 childless workers aged 18-24 will benefit from the expansion.

2. Modernizing an out-of-date tax rebate for low-income New Mexicans by[4]

- Expanding the income eligibility and rebate amounts of the Low-Income Comprehensive Tax Rebate (LICTR). The rebate had not been updated in 20 years, so it was no longer helping people the way it was intended, plus

- More than tripling the dollar amount going to New Mexico families, plus

- Indexing the rebate to inflation moving forward, meaning it won’t lose its value over time like it did over the past two decades.

LICTR changes will benefit

- 220,000 tax filers – including seniors – who currently claim LICTR will benefit from the amount increase

- 160,000 tax filers – including seniors – will be eligible for LICTR due to the increased income threshold

Changes to the tax code improve equity for those earning the lowest incomes

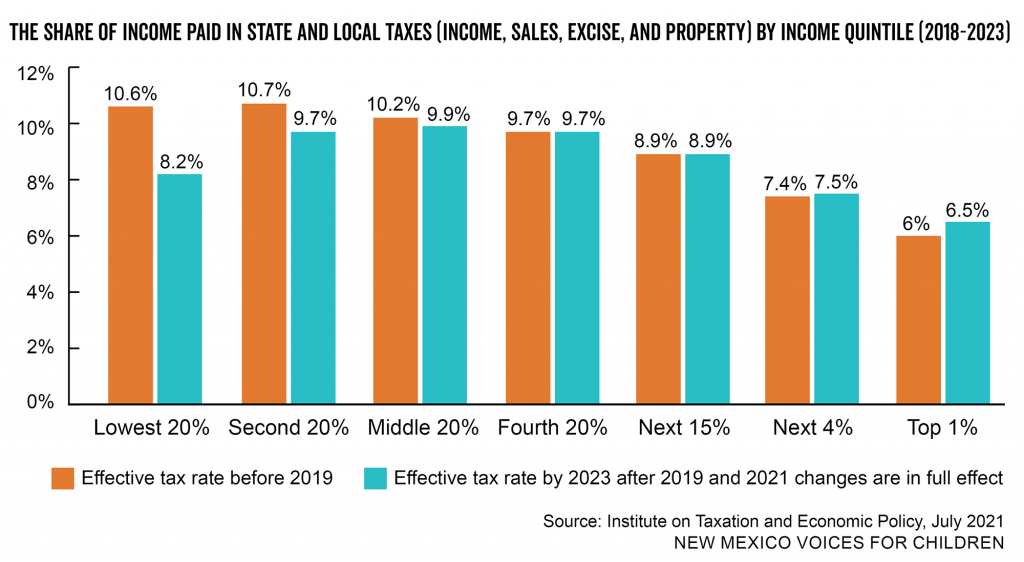

THEN: As the chart below shows, our tax system has been upside-down for years, with the New Mexicans who earn the least paying the largest share of their income in state and local taxes. The orange bars show that residents earning the lowest incomes paid more than 10% of their income in state and local taxes, while those at the very top paid just 6%.

In 2019, a number of changes to the personal income tax greatly improved the fairness of our tax code, ensuring that the very wealthiest were paying more of their fair share. That money then went to help pay for tax cuts for 70% of the families with children in the state.[5]

NOW: The changes enacted in 2021 built off of the 2019 improvements. While our tax system is still upside-down, the chart shows how it’s starting to even out. The blue bars reflect the share of their income New Mexicans will be paying as a result of the combined changes in 2019 and 2021. Those in the lowest bracket will pay 8.2% of their income in state and local taxes, which – while still high compared to the 6.5% the top 1% of income-earners are paying – is a big improvement from just a few years ago.

[1] All estimates based on tax year 2019 filers, as of 6/29/2021

[2] The majority of seniors who benefit from the 2021 changes benefited from the LICTR expansion

[3] WFTC will increase to 20% for tax years 2021 and 2022, and to 25% in tax year 2023 and beyond

[4] LICTR will increase in tax year 2021 and will be indexed to the Consumer Price Index (CPI) moving forward

[5] For more information on the tax changes in 2019 link to this fact sheet: Fairer Taxes Put Us on the Road to a Stronger New Mexico (Oct. 2019)