Download this fact sheet (January 2021; 2 pages; pdf)

Download this fact sheet (January 2021; 2 pages; pdf)

Changes to the personal income tax would stabilize our revenue streams and promote a more equitable recovery for New Mexico’s families.

The Problem

- In order to support the foundations for healthy, thriving communities and businesses – like quality education, affordable health care, and modern infrastructure – New Mexico needs revenue sources that are consistent, sustainable, adequate, and equitable. Our current revenue stream fails to meet these four principles. Our tax system is:

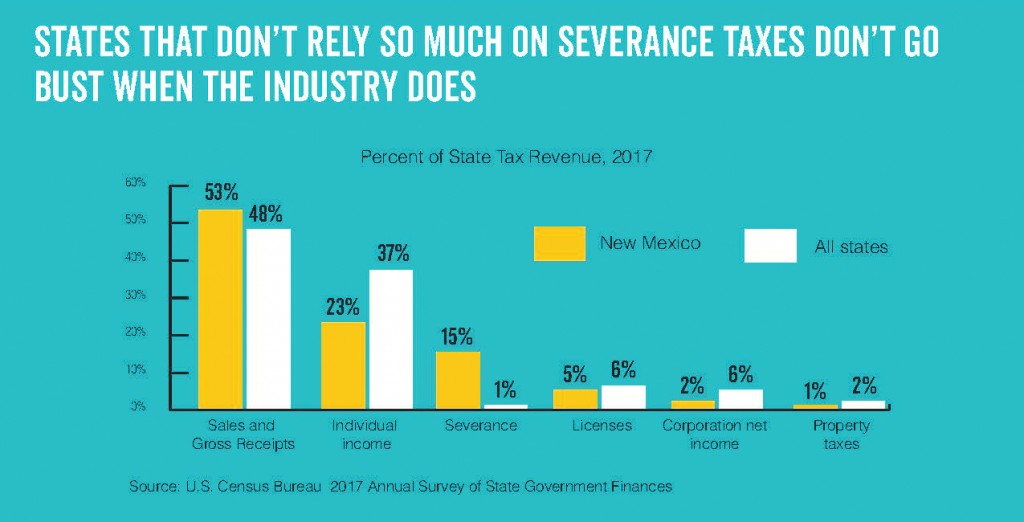

- Over-reliant on the volatile and declining oil and gas industries (inconsistent and unsustainable);

- Fails to raise enough revenue to meet the educational needs of our children (inadequate); and,

- Relies disproportionately on those earning the lowest incomes, who are disproportionately families of color (inequitable).

- New Mexico’s tax system wasn’t always this way – but in 2003 lawmakers cut the personal income tax rates for those at the top. Like most trickle-down tax cuts, this one failed to create the promised jobs. Instead, it ended up costing the state billions of dollars and made New Mexico overly reliant on revenue from the boom-and-bust oil and gas industry, setting us on a revenue roller coaster.

- Even before the pandemic-caused recession, the oil boom was starting to go bust. Over-production and a global price war sent an industry that was already in decline into the dumps.

- Many oil and gas producers have not been profitable for the past decade, and new analysis suggests that the industry may never return to its glory days.[1] The steady growth of renewables and changes in energy consumption patterns are making the fossil fuel sector look more and more, well, pre-historic.

- In New Mexico, the personal income tax is an underutilized tool to raise consistent, sustainable revenue and advance racial equity.

- New Mexico lawmakers did make our tax system more adequate and fairer in 2019 by enacting a new top rate. Unfortunately, it only applies to the top 3% of income earners. So families earning $25,000 per year are still paying the same top tax rate as families earning $250,000 per year even though their ability to pay is very different.

The Solution

- By increasing the income tax for just the highest-income earners – those who have been relatively unharmed by the pandemic and are in the best position to afford it – we can take an important first step in generating the stable revenue necessary to invest in the programs and services (like education, health care, and modern infrastructure) that promote shared prosperity and well-being for all New Mexicans.

- We can do this by introducing higher, more graduated tax rates for those at the top (and raise $100 to $200 million) or by introducing “tax benefit recapture,” which would have the New Mexicans with the highest-incomes pay the top rate on all – or most – of their income, rather than just the portion that’s above the threshold for their tax bracket (and raise $75 to $100 million).

Benefits

- An income tax increase could generate millions of dollars in new revenue per year to invest in our communities.

- With more consistent and stable revenue sources, New Mexico will recover from the recession more quickly and equitably.

- A more progressive income tax structure would improve fairness because the personal income tax is the only major source of revenue that can be based on a taxpayer’s ability to pay. A fairer tax system would help reduce racial inequities.

How this Impacts Racial Equity

Increasing the personal income tax on the highest-income earners would advance racial equity in New Mexico. High-income earners are disproportionately white and benefit the most from our current tax system, while families earning lower incomes are disproportionately families of color. Like many tax policies, this is another brick in the wall of structural racism that has unfairly disadvantaged too many Americans and New Mexicans. This structural racism – whether intentional or not – has prevented many families of color from having the same wealth- and income-building opportunities that white families have had.

[1] “New Mexico’s Risky Reliance on Oil Revenue Must Change: Industry Fundamentals Point to Long-term Decline,” Institute for Energy Economics and Financial Analysis (IEEFA), Oct. 2020 and “State of New Mexico Tax Structure: Key Issues and Alternatives,” PFM, Dec. 2020