Download this fact sheet (updated Jan. 2019; 2 pages; pdf)

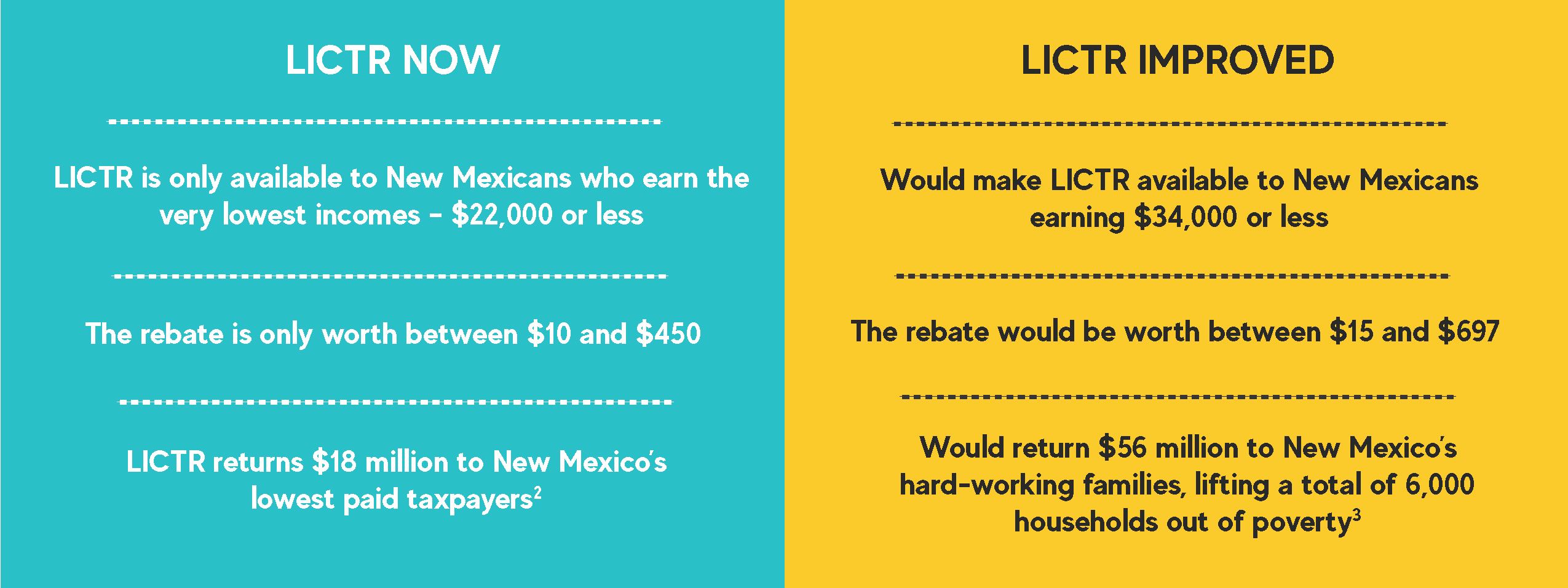

The Low Income Comprehensive Tax Rebate was enacted to make our tax system fairer but because it hasn’t been updated in 20 years, it no longer does the job.

Support HB 365

In New Mexico, the less money you make, the bigger the bite that’s taken out of your income by state and local taxes.

The Problem

- New Mexico is a high-poverty state with a large share of jobs that pay low wages.

- We’re ranked 50th in child well-being, with 27 percent of our children living in poverty.[1] Our families are struggling to make ends meet and every dollar matters.

- LICTR was last amended in 1998. Over the last two decades, the rebate has lost much of its value, because a dollar is worth much less today that it was back in 1998.

- Over the same time period, our tax system has only gotten more regressive – falling even harder on those with the lowest incomes.

The Proposal

Simply indexing LICTR from 1998 dollars to 2018 dollars to account for inflation would make a huge difference in the number of people who receive it and the amount of rebate they receive. LICTR should also be indexed going forward, so it can continue to keep pace with inflation.

- One of the best ways to reduce poverty is through tax policy. It’s a cost-effective and non-stigmatizing way to help families get by.

- Investments in LICTR mean investments in our communities. Tax rebates like LICTR are often spent quickly and locally on everyday goods and services – like food, transportation, and child care.

The Bottom Line

This tax rebate needs to be adjusted to account for inflation and to bring some fairness back to our tax system.

Endnotes

[1] U.S. Census Bureau, American Community Survey 2017 1-year data

[2] 2017 New Mexico Tax Expenditure Report

[3] Estimate by O’Donnell Economics, 2018

This fact sheet is part of our Roadmap to a Stronger New Mexico initiative. Find out more and sign up for email alerts here.