Improving the Credit’s Benefits to the State, Its Businesses, and Its People

by Amber Wallin, MPA

Download this report (Jan. 2017; 16 pages; pdf)

Download just the appendix (6 pages; pdf)

Link to the fact sheet (Feb. 2017)

Our economy is strongest when people have money to spend and, while the rest of the nation is recovering from the recession, New Mexico is still struggling to attract good-paying jobs. When people work full time and still don’t earn enough money to cover the basics, our economy is not at its healthiest. Tax credits for low- and moderate-income working families are one common-sense way to spur economic activity and put money in the hands of consumers who will spend it, particularly when wages are low.

In New Mexico, the Working Families Tax Credit is one of the most sensible parts of our tax code: it encourages work, helps to raise hard-working families out of poverty, and benefits almost 300,000 children, while also pumping millions of dollars back into local communities. Increasing the credit is a smart investment in New Mexico’s businesses, working families, and future.

The History of the Credits

The Working Families Tax Credit (WFTC) is the state’s equivalent of the federal Earned Income Tax Credit (EITC). Its eligibility levels and amounts are based directly on the EITC, and it increases, complements, and leverages the EITC’s ability to directly benefit New Mexico. The purpose of the EITC is to help offset more regressive taxes, reduce poverty, and incentivize employment for low-income workers. The EITC was first passed with bipartisan support under President Gerald Ford in 1975. In 1986, the EITC was indexed to rise with inflation under President Ronald Reagan who called the program “the best anti-poverty, the best pro-family, the best job-creation measure to come out of Congress.”1

Since its passage, the EITC has been strongly supported by both Republican and Democratic lawmakers on both the national and state level, and 26 states plus the District of Columbia have modeled state credits after the EITC in order to help offset regressive state taxes for low-income workers while also improving conditions for families in their states and encouraging work among lower-income earners (see Appendix A, for list of states with EITC-based credits). New Mexico enacted the WFTC in 2007 at 8 percent of the EITC and raised it to 10 percent of the EITC in 2008.

How the Credits Work

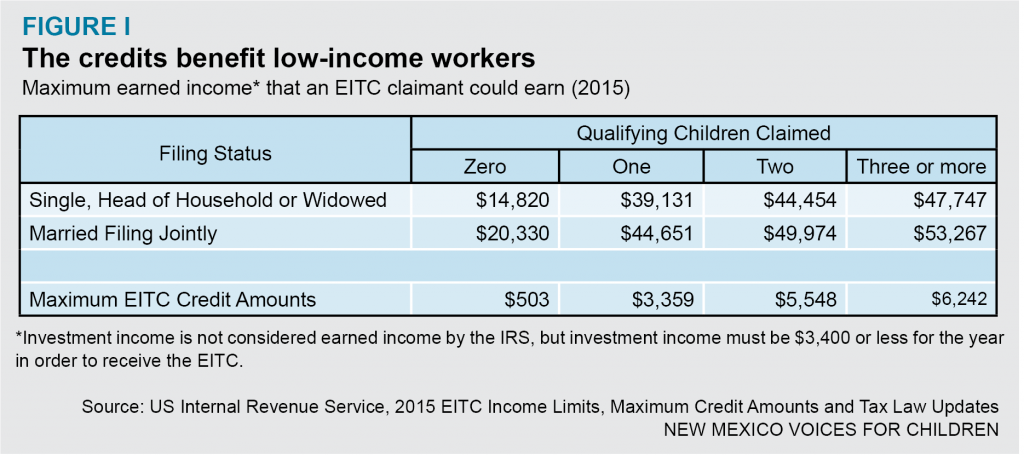

Eligibility for both credits depend on a filer’s earned income, marital status, and the number of dependent children (see Figure I). For tax year 2015, working parents who had incomes of up to $39,131 (for a single parent with one child) and $53,267 (for a married couple with three or more children) could receive the credits. Workers with no children had to earn no more than $14,820 (or $20,330, if married and filing jointly) to qualify for credits. The value of the refunds ranged between maximums of $503 (with no children) and $6,242 (with three or more children) for the EITC and $50 to $620 for the WFTC. The refund amounts increase as earned income increases until they reach a maximum level, at which point they plateau and then phase out as higher incomes lift families out of poverty.

Who Claims the Credits

In the 2013 tax year, the most recent year for which data are available, more than 212,000 New Mexico individuals and families (or 26 percent of the tax returns filed in the state) claimed the EITC and the WFTC.

That year, New Mexico’s working families received more than $513 million from the EITC and nearly $51 million from the WFTC. The average credit amount for each New Mexico tax return with the credits was about $2,700 when the two refunds are combined.2 Every legislative district and county in New Mexico benefits from the credits (see Appendices B, C, and D, for EITC and WFTC amounts and percent of claimants by county, state House and Senate districts).

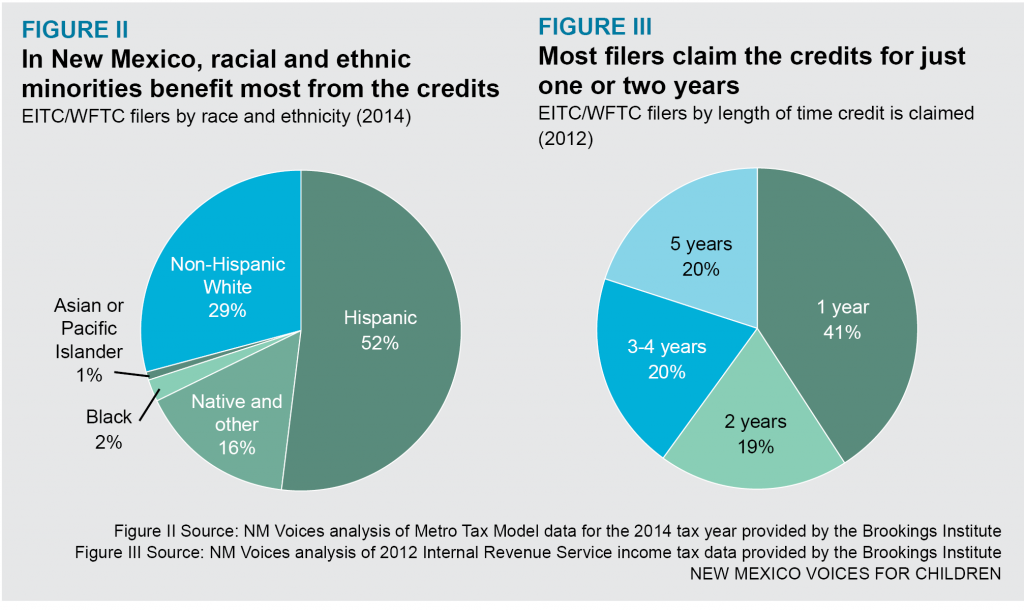

The majority of the more than 212,000 working New Mexicans who claim the EITC and WFTC every year are racial or ethnic minorities; 52 percent are Hispanic, nearly 16 percent are Native American, and 29 percent are non-Hispanic White (see Figure II). These filers have a median income of $14,058.3 The credits help most of these workers through tough―but temporary―economic troubles, such as a job loss or the birth of a child. In fact, three out of five workers claim the credits for only one or two years4 (See Figure III).

The vast majority of those who claim the EITC and WFTC are working, low-income parents who support the nearly 300,000 children living in the households that benefit from the credits. Only a tiny percentage are adults without dependent children, and their incomes must be very low for them to qualify. That most of those who benefit are parents and children is especially important, because according to the national KIDS COUNT program, New Mexico ranks 48th among the states in family economic well-being, and 49th in overall child well-being.5 More than 96 percent of the money returned to taxpayers via the EITC and WFTC goes to working families with children―14,000 of which are families headed by active duty military or by military veterans who are making their way back into the New Mexico workforce.6 The income boost from the credits helps families afford necessities like food, housing, and child care, especially in the month following when they receive their refund. It is estimated that 95 percent of EITC and WFTC recipients also use part the credits to pay off debt or make major car repairs.7

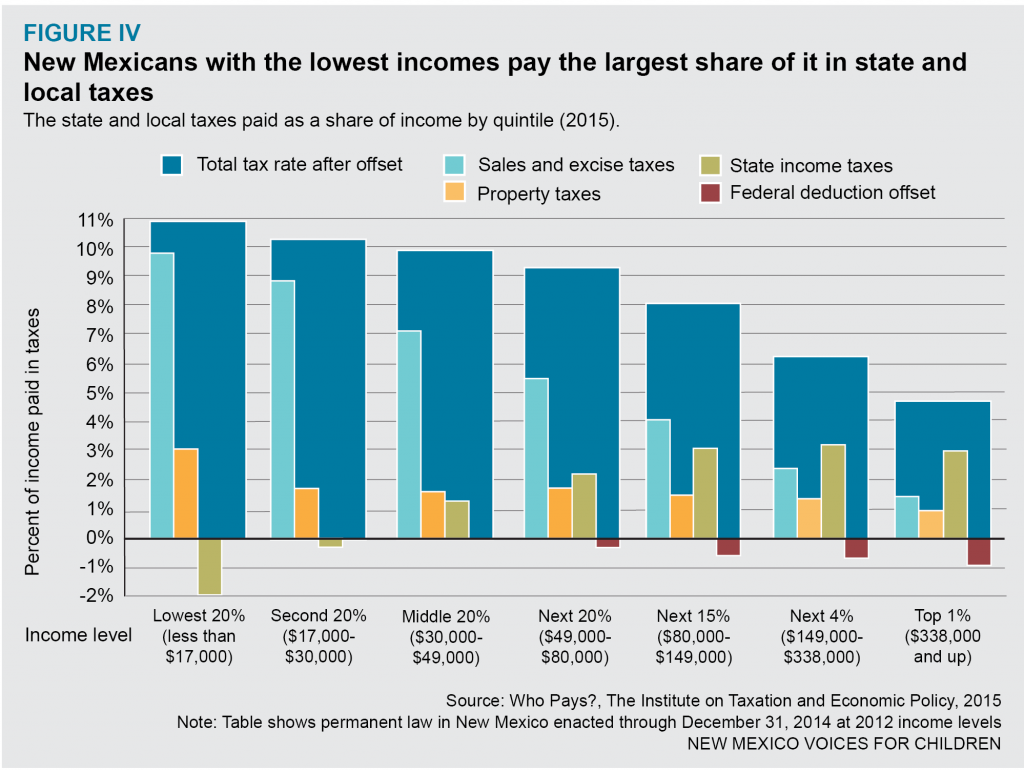

As a group, those who claim the EITC and WFTC pay a large share of their incomes in taxes. In fact, in addition to the federal payroll taxes they pay, New Mexico’s lowest-income households pay a larger share of their income in state and local taxes than the households in every other income group. Those making less than $17,000 a year pay more than 10 percent of their incomes in state and local taxes. Meanwhile, New Mexicans who make more than $340,000 pay less than 5 percent of their incomes in those same taxes8 (see Figure IV). This huge disparity exists even after the current value of the EITC and WFTC are taken into account.

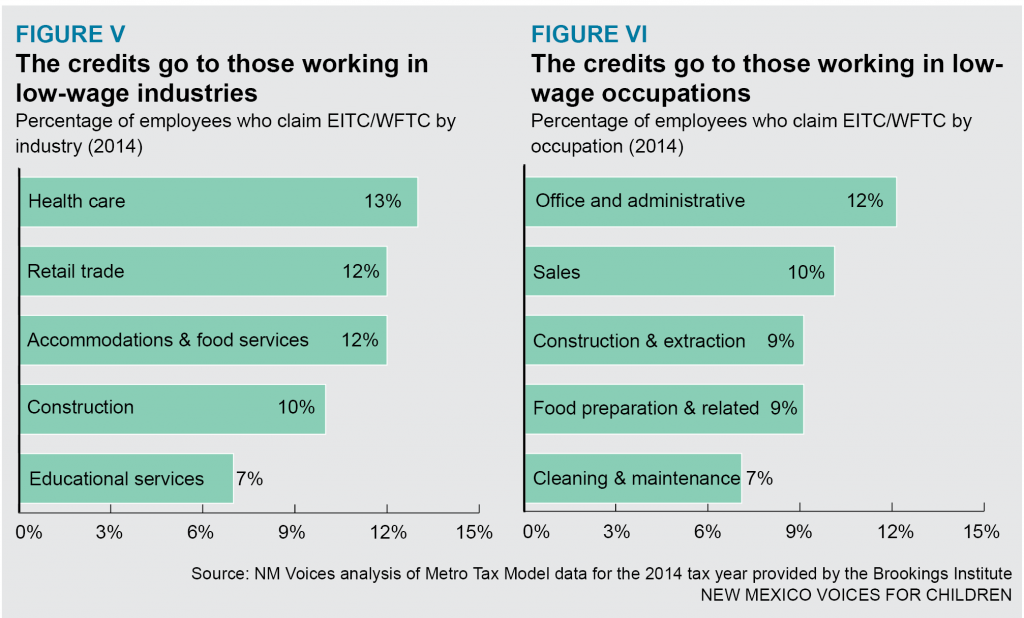

Many types of occupations and industries are represented among EITC/WFTC-eligible tax claimants. The occupations that have the highest shares of EITC/WFTC filers are office and administrative work, sales, and construction and extraction (see Figure V). The health care, retail trade, accommodation and food service, and construction sectors are the industries with the highest shares of workers who claim the credits (see Figure VI). Tax credits for workers in these industries help make up for what are often very low wages and, in doing so, directly help support the businesses in these industries.

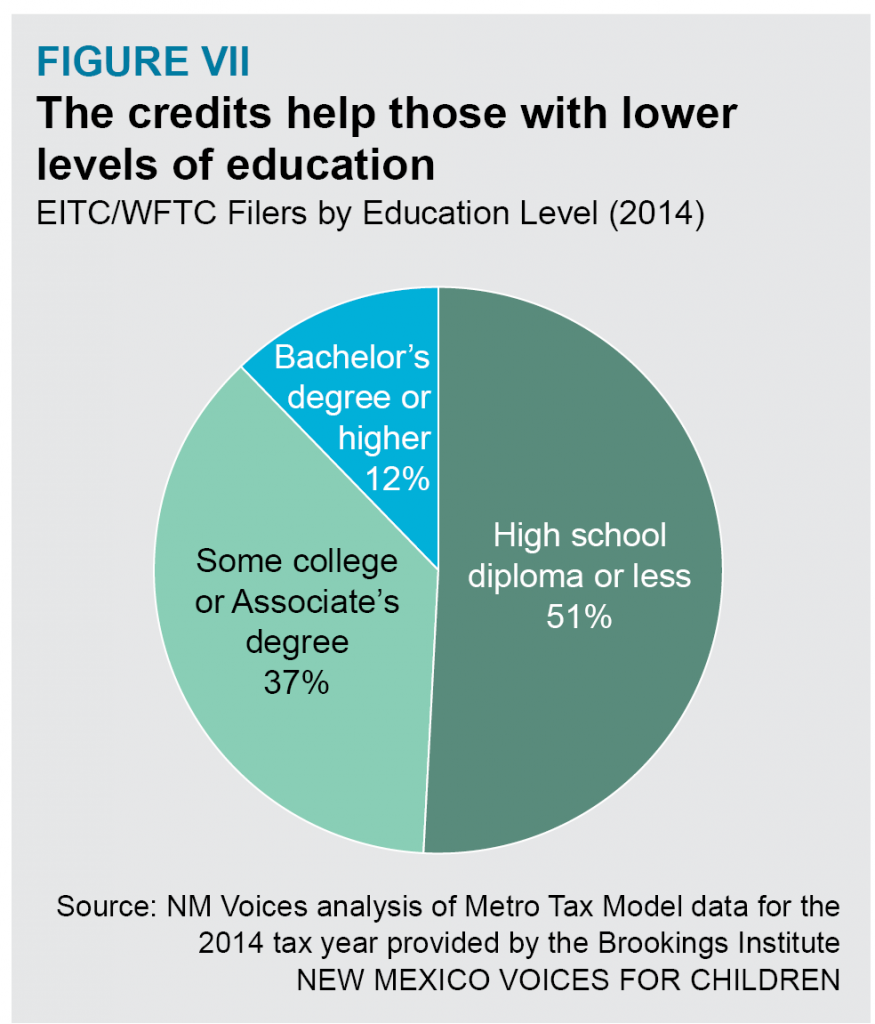

Both highly educated New Mexicans and those with limited educations benefit substantially from the EITC and the WFTC. While half of filers have a high school diploma or less, half have at least some college, and 12 percent of claimants have a bachelor’s degree or higher (see Figure VII).

Putting the Credits to Work for New Mexico

The Credits Benefit New Mexico Families

New Mexico has the second highest overall poverty rate (20 percent) and second highest child poverty rate (29 percent) in the nation,9 but our high poverty rates would be even worse without the EITC and WFTC. Without these credits, nearly 40,000 more New Mexico families—including 20,000 more children—would live in poverty.10

New Mexico has the second highest overall poverty rate (20 percent) and second highest child poverty rate (29 percent) in the nation,9 but our high poverty rates would be even worse without the EITC and WFTC. Without these credits, nearly 40,000 more New Mexico families—including 20,000 more children—would live in poverty.10

New Mexico’s high poverty rates among children and the overall population extend to workers and their families as well. The state is ranked worst in the nation in terms of poverty among the employed, among people who work full-time year-round, and among people who have a bachelor’s degree or higher.11 We also have one of the highest percentages in the nation of workers in low-wage jobs, so it is not surprising that New Mexico has the highest percentage (17 percent) of families that are working but still living below the poverty line, and the highest percentage (42 percent) of working families that are low-income (below 200 percent of the federal poverty level). Because so many of our working families are poor or living in poverty, we also have the worst rankings in the nation of the percent of children in working families that are poor or living in poverty.12

Of these low-income working families, 41 percent are headed by working mothers. This is important because working mothers who are low-income are often employed in retail and service-sector jobs that pay low wages, limit hours, and fail to provide benefits such as health insurance and paid sick leave that are crucial to the health and success of families and children.13

New Mexico also has one of the highest rates of income inequality in the nation—meaning there is a large gap between what the lowest-income New Mexicans earn and what the highest-income New Mexicans earn.14 Income inequality puts our economy out of balance in part because too much income is concentrated into too few hands where it is less likely to be spent. Growing income inequality is especially destructive in New Mexico because while the rest of the nation has already bounced back from the Great Recession of 2007-2009, New Mexico’s recovery has largely flat-lined for most workers. Economic recoveries happen more quickly when recoveries in income and employment are more broadly shared and spread across all income levels. However, in contrast with historical economic recoveries, income and employment recoveries of the last recession have taken longer to reach low- and middle-income earners, especially in New Mexico. As the gap between the wealthiest and the poorest gets bigger, gains—including recession recovery gains—go very disproportionately to the richest. Tax credits like the EITC and WFTC that target benefits to low-income workers give low-income groups a hand-up while helping to limit the growing gap in wealth inequality.

The EITC and WFTC not only help increase workers’ incomes, but they also help low-income families continue to participate in the workforce because they help pay for necessities like child care, transportation, and education or job training programs. This is good for businesses because workers who can pay for these basic needs are more reliable employees. Families with very low wages see higher refunds as their incomes rise, which encourages them to work more hours. Extensive research shows that the EITC has been successful at encouraging and increasing work, especially among single parents, and particularly among single mothers.15 Increased work and earnings among low-income families has the effect, in turn, of reducing dependence on public assistance and shrinking Temporary Assistance for Needy Families (TANF, the program formerly known as welfare) caseloads. Workers who receive credits like the EITC and WFTC also boost their Social Security earnings and retirement benefits, which can help reduce the incidence or severity of poverty in old age.16 Research shows that the EITC increases employment and reduces the need for public assistance across generations.

The Credits Benefit New Mexico Kids

The WFTC is a relatively small investment on the part of the state that can make a big difference in the lives of New Mexico’s working families and their children. The effects start early and are long-lasting. Increases in EITCs and the creation of state-based EITCs have been linked with earlier prenatal care, an increased likelihood for prenatal care, lowered maternal stress, decreased smoking and drinking during pregnancy, and improved infant birthweight.17 The extra income helps families meet their kids’ basic needs, which in turn, improves children’s chances of success. Children in EITC families have better health outcomes,18 perform better on math and reading tests, and are more likely to graduate high school and go to college than children in low-income families that do not receive the EITC.19

Because higher incomes from refundable tax credits are associated with better health, more education, and higher skills, children in EITC/WFTC families are more likely to work and earn more as adults.20 In fact, children from EITC families, on average, go on to earn 17 percent more when they reach adulthood then do children from low-income families who do not receive the EITC.21 Research finds that progressive state income tax provisions—including state-based EITCs like the WFTC—are linked to increased intergenerational income mobility.22 This relationship strengthens with the size of the state-based EITC, and in states with larger credits, low-income children are even more likely to move up the income ladder over time.23

The Credits Benefit New Mexico Businesses

The EITC and WFTC are also good for business because they are good for the state’s economy. Last year alone, New Mexico’s low-wage workers received more than $560 million from the EITC and WFTC—much of which was pumped right back into the economy through rent payments, purchases of cars, groceries and other household necessities, and to pay for child care. Research shows that EITC households spend their credits quickly and locally, and that local economies benefit as a result. Economists categorize economic impacts of injections of money into an economy (in this case, federal EITC money into New Mexico’s economy) as the sum of direct impacts (EITC recipients spending their refunds), indirect impacts (businesses spending more in response to EITC spending at those businesses), and induced impacts (changes in spending patterns caused by direct and indirect impacts). Together these economic impacts are referred to as the “multiplier” effect of a program.24 The EITC is widely known to have a very strong multiplier effect. In fact, it is estimated that for every $1.00 claimed from the EITC, $1.50 to $2.00 is generated in local economic activity.25 That means the EITC alone is responsible for somewhere between $770 million and more than $1 billion in economic activity in New Mexico each year. This economic activity is important in metro areas, but may be especially crucial in rural areas of New Mexico (see Appendix B for EITC amounts and percent of claimants by county).

The EITC has other economic benefits as well. Though it is widely regarded as one of our nation’s most successful anti-poverty programs,26 the EITC was originally intended to primarily act as an economic stimulus.27 Over time, many governments have pushed for expanded EITC participation in their states for this very reason—to increase spending in their economies.28 The EITC and WFTC also benefit employers by enabling workers to better support their families even on meager wages. It has been estimated that as much as 36 cents of every dollar of an EITC credit directly benefits employers by lowering the cost of labor.29 This trend is likely to hold up in New Mexico, where we not only have one of the highest rates of working poor and working low-income families in the nation (as noted above), but also one of the highest rates—34 percent—of employment within occupations whose median annual pay is below the poverty threshold for a family of four.30

The Truth About Overpayments and Errors

In recent years, potential issues about EITC overpayments have been discussed. However, the debate around EITC errors is often misleading and ignores three important points:

1. The overpayment rate is overstated and based on older data.

• More than 40 percent of claims counted as “overpayments” were determined to be valid on further review.31

• The overpayment rate does not fully account for corresponding underpayments. For example, if a father mistakenly claims an EITC for a child that lives with the mother, the full amount is counted as an overpayment but the amount unclaimed by the eligible mother is not taken into account.

• Overpayment estimates are based on 2009 data, and do not reflect the significant additional enforcement measures the IRS has implemented since then.

2. Most EITC overpayments are due to honest mistakes, not intentional fraud.

• IRS studies acknowledge the majority of errors are unintentional32 and stem from the combination of the complexity of the EITC’s rules and the complexity of many family arrangements.33

• Most EITC errors occur on commercially prepared returns,34 and commercial tax preparers, not individual filers, are responsible for 75 percent of the value of EITC overpayments.35

3. EITC errors cost significantly less than business tax noncompliance.

• A 2012 IRS study found that 56 percent of business income went unreported in 2006. This cost $122 billion in uncollected revenue—more than ten times the size of estimated EITC overpayments that year.36

• The EITC rate of noncompliance is substantially lower than the rate in a number of other parts of the tax code, and accounts for a very small share (less than 3 percent) of the estimated $450 billion tax compliance gap.

IRS Actions to Reduce EITC Overpayments37

• More than 80 percent of EITC claims are now filed electronically, better enabling the IRS to identify questionable EITC claims before paying them.

• A powerful IRS database identifies questionable EITC claims, targeting nearly 500,000 claims annually for examination.

• The IRS is implementing rules to require preparers to register and pass a competency exam that promises to be a major step forward.

• In 2013, the IRS identified 7,000 preparers with high error rates in the EITC claims they filed. It carried out a range of interventions with these preparers before and during the 2013 filing season, including educational visits by IRS agents. Overall, this strategy alone averted an estimated $590 million in erroneous claims, according to the IRS.

Policy Recommendations

Evidence that New Mexico’s Working Families Tax Credit helps working families and spurs the economy is abundant. However, the credit could do even more with some improvements.

• Increase the value of the WFTC

At 10 percent, New Mexico’s WFTC is below the national average among states that have a similar EITC-based tax credit (see Appendix A). Lawmakers should increase the credit from 10 percent to at least 15 percent of the federal Earned Income Tax Credit. Raising the credit to 15 percent of the EITC would mean investing $26 million more in our economy and our hard-working, low-income families. This practical investment will make a big difference for New Mexico families struggling to get by on low wages.

• Expand outreach efforts and tax preparation assistance

One in five eligible workers in New Mexico miss out on the EITC and WFTC, either because they don’t claim it when filing, or they don’t file a return. Tax assistance programs—such as the United Way and CNM’s Tax Help New Mexico program—that provide free (and bilingual) tax preparation for low-income New Mexicans are great models for tax preparation outreach. Lawmakers should expand outreach efforts like these and support free or low-cost tax preparation assistance in order to maximize the benefit of the credit. Expanding access to volunteer tax preparation services and free online tax filing would preserve more of the credits’ values for those filers that might otherwise face significant tax preparation fees or be pressured to buy costly refund products that eat up a large part of the credits, blunting their otherwise positive impacts. Additionally, due to the proven economic benefits of the EITC, expanding participation among eligible filers would increase transfer payments and benefit New Mexico’s economy.

• Restrict refund anticipation loans and checks

Another good reason for increasing access to free or low-cost tax preparation for low-income New Mexicans is that it keeps them from being preyed upon by commercial preparers offering refund anticipation loans (RALs) and refund anticipation checks (RACs). Thirty nine percent of New Mexico EITC and WFTC claimants receive RALs or RACs,38 and low-income taxpayers who claim the EITC represent the majority of the consumers for both products.39 RALs are very short-term loans made to the tax filer so they can receive a refund the same day, but they often come with significant fees and high interest rates. RACs are essentially the same thing except that a taxpayer must open a temporary bank account. Fees for preparation of the return and the RAC account are then deducted from the taxpayer’s refund before a check is issued. Tax preparers who push RALs and RACs often fail to tell their customers that they could receive their refund by electronic transfer in as little as two weeks at no cost. While IRS rules have led to a dramatic decrease in RALs among EITC claimants from 2007 to 2010, during the same time period, the percent of EITC recipients requesting RACs more than doubled, from 26 percent to 56 percent.40 Both RALs and RACs disproportionately harm EITC and WFTC tax filers and can syphon off much of the value of the credits that is intended to help low-wage workers. New Mexico should limit the rate that can be charged on these refund options, mandate and standardize disclosure and marketing practices, and strictly enforce compliance among lenders.

• Support federal efforts to increase the EITC for childless workers

Working, childless adults are the only group effectively taxed into poverty or deeper into poverty by federal income taxes.41 These workers pay significant federal income and payroll taxes, yet receive little to no EITC, the credit that otherwise offsets significant portions of these taxes for low-income workers. In tax year 2013, the average combined credit for recipients in New Mexico with qualifying children was $3,334, while the average combined credit for New Mexico recipients without children was only $301. About 22 percent of EITC and WFTC returns in New Mexico are filed by childless workers, but less than 4 percent of the total EITC credit amount goes to these workers.42 Increasing the EITC for childless workers would not only raise their incomes and help offset taxes that send them into poverty, but, according to recent research, it could also help address low labor-force participation and high incarceration rates of childless, low-income workers.43

• Consider periodic payment options of the EITC and WFTC

The single annual disbursement of the EITC and WFTC can present challenges for workers struggling to support their families throughout the year. Research shows that about 95 percent of EITC recipients carry debt of some kind, and that in many families, significant portions of refunds may be spent on debt payments.44 Paying out a portion of filers’ refunds throughout the year would better enable them to cover daily and monthly expenses without taking on additional debt and then using the refund to pay off that debt (with added interest).45 This would also increase the chances that refunds are spent on local goods and services at local businesses, rather than on high-cost financial products (like payday loans), many of which are serviced by large, multi-state financial institutions. A pilot program in Chicago that issued EITC recipients their refunds on a quarterly—rather than an annual—basis found that periodic payments improved overall financial stability for and reduced financial stress of EITC families. Pilot project researchers also reported that 83 percent of families in the program preferred quarterly payments to the standard annual method.46

Endnotes

1. Quoted by Lea Donosky in “Sweeping Tax Overhaul Now The Law,” Chicago Tribune, October 23, 1986

2. NM Voices for Children analysis of 2013 Internal Revenue Service (IRS) income tax data provided by the Brookings Institute

3. Ibid

4. Income Mobility and the Earned Income Tax Credit: Short-Term Safety Net or Long-Term Income Support, Tim Dowd and John B. Horowitz, 2011

5. KIDS COUNT Data Book, Annie E. Casey Foundation, 2016

6. Center on Budget and Policy Priorities analysis of 2009-2012 American Community Survey data

7. Two Generation Approaches to Poverty Reduction and the EITC, Grantmakers Income Security Taskforce, 2015

8. Who Pays? A Distributional Analysis of the Tax Systems in All 50 States, Institute on Taxation and Economic Policy, 2015

9. U.S. Census Bureau, American Community Survey data, 2015

10. Brookings Institute analysis of 2011 tax year data

11. US Census Bureau, American Community Survey data, 2015

12. Conditions of Low-Income Working Families in the States, The Working Poor Families Project, Population Reference Bureau analysis of U.S. Census American Community Survey data, 2014

13. Low-Income Working Mothers and State Policy: Investing for a Better Economic Future, Deborah Povich, Brandon Roberts and Mark Mather, The Working Poor Families Project, 2014

14. On the Gini Coefficient measure, NM is 40th; on shares of income by quintile, NM is 44th. US Census, American Community Survey, 2014 data (1st being the best ranking a state can have, 50th being the worst ranking)

15. Behavioral Responses to Taxes: Lessons from the EITC and Labor Supply, Nada Eissa and Hilary Hoynes, National Bureau of Economic Research, 2006

16. Two Generation Approaches to Poverty Reduction and the EITC, Grantmakers Income Security Taskforce, 2015

17. Income, The Earned Income Tax Credit, and Infant Health, Hilary W. Hoynes, Douglas L. Miller, and David Simon, National Bureau of Economic Research, 2012; Do Cash Transfer Programs Improve Infant Health: Evidence from the 1993 Expansion of the Earned Income Tax Credit, Kevin Baker, University of Notre Dame mimeo, 2008; and “Effects of Prenatal Poverty on Infant Health: State Earned Income Tax Credits and Birth Weight,” Kate W. Strully, David H. Rehkopf, and Ziming Xuan, American Sociological Review (August 2010), 1-29

18. The EITC: Linking Income to Real Health Outcomes, Hilary W. Hoynes, Douglas L. Miller, and David Simon, University of California Davis Center for Poverty Research, 2013

19. EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds, Center on Budget and Policy Priorities, revised in 2015

20. “Early-Childhood Poverty and Adult Attainment, Behavior, and Health,” Greg J. Duncan, Kathleen M. Ziol-Guest, and Ariel Kalil, Child Development, January/February 2010, pp. 306-325

21. Two Generation Approaches to Poverty Reduction and the EITC, Grantmakers Income Security Taskforce, 2015

22. The Economic Impacts of Tax Expenditures: Evidence from Spatial Variation Across the U.S., Raj Chetty, Nathaniel Hendren, Patrick Kline, and Emmanuel Saez, special report for the US Internal Revenue Service, 2015

23. The Earned Income Tax Credit and Community Economic Stability, Natalie Holmes and Alan Berube, The Brookings Institute, 2015

24. “The economic impact of the Earned Income Tax Credit (EITC) in California.” Antonio Avalos and Sean Alley, California Journal of Politics and Policy, 2010

25. Dollar Wise: The Best Practices on the Earned Income Tax Credit, U.S. Conference of Mayors, 2008

26. An Assessment of the Effectiveness of Anti-Poverty Programs in the United States, Yonatan Ben-Shalom, Robert A. Moffitt, and John Karl Scholz, National Bureau of Economic Research, 2011; The Earned Income Tax Credit at Age 30: What We Know, Steve Holt, The Brookings Institution, 2006

27. The Earned Income Tax Credit, Austin Nichols and Jesse Rothstein, National Bureau of Economic Research, 2015

28. Using the Earned Income Tax Credit to Stimulate Local Economies, Alan Berube, The Brookings Institution, 2006

28. The Earned Income Tax Credit, Austin Nichols and Jesse Rothstein, National Bureau of Economic Research, 2015

30. This rate ranks New Mexico as 42nd in the nation on this measure. Working Poor Families Project analysis of Bureau of Labor Statistics May 2015 Occupational Employment Statistics

31. Testimony of Nina Olson, IRS National Taxpayer Advocate, before U.S. House Appropriations Subcommittee on Financial Services and General Government, February 26, 2014, p. 32

32. “Issues Affecting Low-Income Filers,” Janet Holtzblatt and Janet McCubbin, in The Crisis in Tax Administration, Henry Aaron and Joel Slemrod, Brookings Institution Press, November 2002; and “Noncompliance and the EITC: Taxpayer Error or Taxpayer Fraud,” Jeffrey Liebman, Harvard University, November 1995

33. Department of the Treasury, Agency Financial Report (AFR), fiscal year 2013, p. 207. It is estimated 70 percent of issues relate to complex residency and relationship requirements and confusion on claiming eligible children. The remaining 30 percent of EITC improper payments stem from verification of wage and self-employment income. (EITC recipients are as likely to be self-employed as other taxpayers.) Income verification issues regarding self-employment are a concern in the tax code as a whole, not unique to the EITC.

34. Testimony of John A. Koskinen, IRS Commissioner, before US House Ways and Means Subcommittee on Oversight, February 5, 2014

35. Based on IRS audits of EITC claims in the IRS study, “Compliance Estimates for the Earned Income Tax Credit Claimed on 2006-2008 Returns,” as reported in Estimated Earned Income Tax Credit Annual Overclaims, by the Center on Budget and Policy Priorities

36. “Tax Gap for Tax Year 2006: Overview,” Internal Revenue Service, January 6, 2012. These figures, which are for 2006 tax returns, represent the estimated impact of business under-reporting in the personal income tax; they do not include under-reporting or other sources of error in the corporate income tax.

37. “Reducing Overpayments in the Earned Income Tax Credit,” by Robert Greenstein, John Wancheck, and Chuck Marr, Center on Budget and Policy Priorities, April 7, 2014.

38. NM Voices for Children analysis of 2013 Internal Revenue Service income tax data provided by The Brookings Institute

39. EITC Interactive: User Guide and Data Dictionary, The Brookings Institute, 2015

40. Ibid

41. Strengthening the EITC for Childless Workers Would Promote Work and Reduce Poverty, Chuck Marr, Chye-Ching Huang, Cecile Murray, and Arloc Sherman, Center on Budget and Policy Priorities, 2016

42. NM Voices for Children analysis of 2013 IRS tax data provided by The Brookings Institute

43. Strengthening the EITC for Childless Workers Would Promote Work and Reduce Poverty, Chuck Marr, Chye-Ching Huang, Cecile Murray, and Arloc Sherman, Center on Budget and Policy Priorities, 2016

44. The Earned Income Tax Credit and Community Economic Stability, Natalie Holmes and Alan Berube, The Brookings Institute, 2015

45. Periodic Payment of the Earned Income Tax Credit Revisited, Steve Holt, The Brookings Institution, 2015.

46. Restructuring the EITC: A Credit for the Modern Worker, Dylan Bellisle and David Marzahl, Center for Economic Progress, 2015

A Working Poor Families Project report.

The Working Poor Families Project is funded by the Annie E. Casey Foundation, Ford Foundation, Joyce Foundation, and The Kresge Foundation.