by Raphael Pacheco, MBA

by Raphael Pacheco, MBA

February 10, 2017

The recent news that the Dow hit 20,000 bodes well for all investors—from working families with 401Ks to the beneficiaries of the state’s $15 billion Land Grant Permanent School Fund. The high volume of trading indicates that the nation’s economy is strong. It also reinforces the point that New Mexico’s permanent fund is robust. So robust that even if we increase the percentage that we take out—and invest it in early childhood care and learning services—the fund will continue to grow.

For six years now legislators have attempted to pass joint resolutions that would allow New Mexico voters to decide whether to spend a bit more of their fund on early childhood services. Polls show that voters overwhelming support this. Even though there is little debate among lawmakers as to the value of high-quality early childhood services in improving educational and life outcomes for our kids—which will translate to a stronger workforce and economy for us all—some lawmakers are still resistant to the idea of investing in these services via the permanent fund.

When these dissenters are quoted in the news media about the fund, they often note that its income comes from a finite resource—oil and natural gas. They inevitably fail to mention two things: 1) the fund is backed by billions of barrels of oil that will take many decades to harvest; and 2) that oil and natural gas extraction accounts for less than half of the fund’s annual income; the larger share of income comes from investments in the stock market. This means the fund will continue to grow even if we ever manage to pump the last barrel of crude out of the ground.

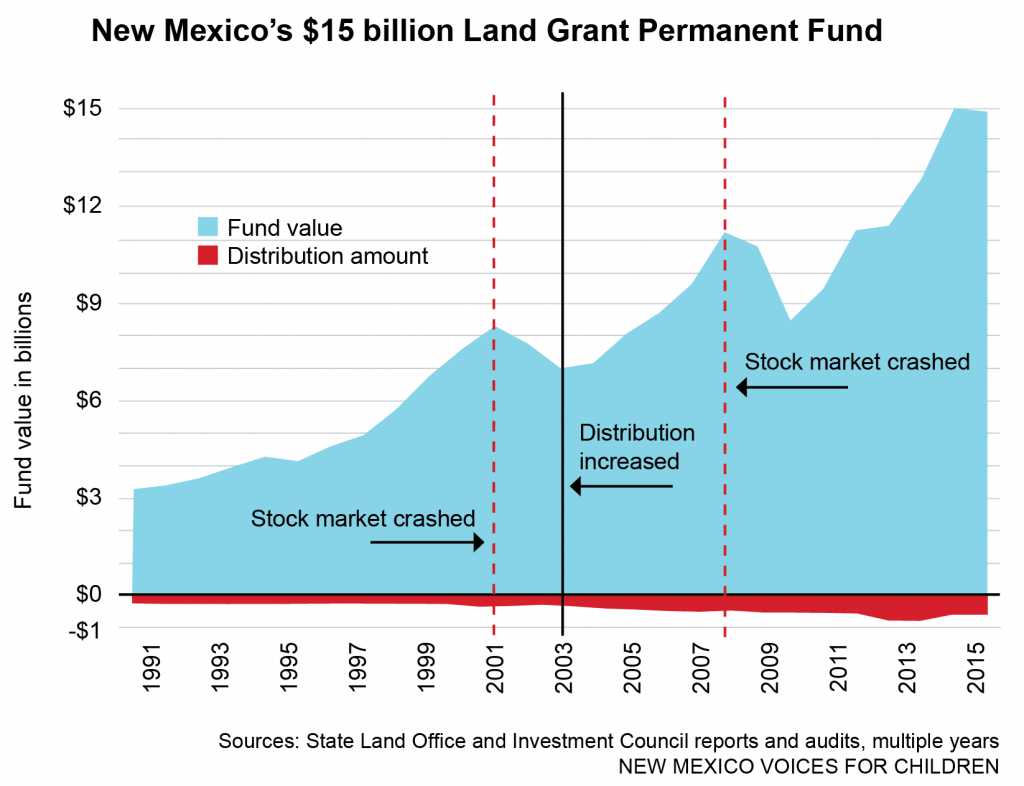

The last time voters decided to increase the distribution from the permanent fund was back in 2003 (shown by the black line in the figure below). Even then, prognosticators warned that the move would “deplete” the fund. Back in 2003 the fund was worth about $7 billion. Over the next dozen years we took as much as an additional 1.1 percent out of the fund. And while this had a minor impact on the fund’s growth, the fund still managed to more than double—growing from $7 billion to almost $15 billion—in the years since.

This growth also happened despite the fact that the stock market crashed in late 2007 (the two recent stock market crashes are shown by the red dotted lines). And it’s likely that the stock market will see another sharp downturn one day. But the fund’s massive size allows it to ride out market crashes—as well as downturns in oil and natural gas prices, and small increases in distributions.

While stock market returns have been a healthy 5.7 percent, economists say that investments in early childhood programs can yield returns as high as 13 percent. These returns come in the way of savings to school, health, and public safety budgets, along with increased tax revenue from the higher wages the children earn as adults.

Larger investments in early childhood would also leverage our much bigger investments in K-12 education. K-12 schools are the largest ticket item in our state budget and even though our high school graduation rates are inching up, few New Mexicans would give our overall educational outcomes a high score. Our nation’s schools have had to cope with extreme changes over the last hundred years in the economy, family structure, and technology—all of which impact a child’s ability to learn. We’ve raised our expectations and adapted how we educate children, but one thing that hasn’t changed is what we do as a nation to prepare children for success. The last big change was the addition of kindergarten in 1914.

It’s time for a sea change in how we ensure our kids are on the path to academic success when they start school. We can do this by expanding services like home visiting, high-quality child care, and pre-kindergarten. Expanding these programs to reach all children will have a small price tag relative to the $2.4 billion we’re spending this year on K-12 education. And that relatively small investment would vastly improve the outcomes on our much bigger K-12 investment. And we can safely use our permanent fund to cover much of the cost. It doesn’t take a financial expert to determine the smartest way forward.

Raphael Pacheco, MBA, is a Research and Policy Analyst and the State Priorities Partnership Fellow at NM Voices for Children.