by Gerry Bradley

January 21, 2015

When it comes to state and local taxes, middle- and low-income New Mexicans pay a tax rate double what the wealthiest pay (as discussed in this blog) and part of this inequity is due to an extremely generous tax cut enacted by the Legislature in 2003. Those who have capital gains income—that’s income from the sale of stocks, bonds, real estate, and the like—can deduct half of it from their personal income taxes.

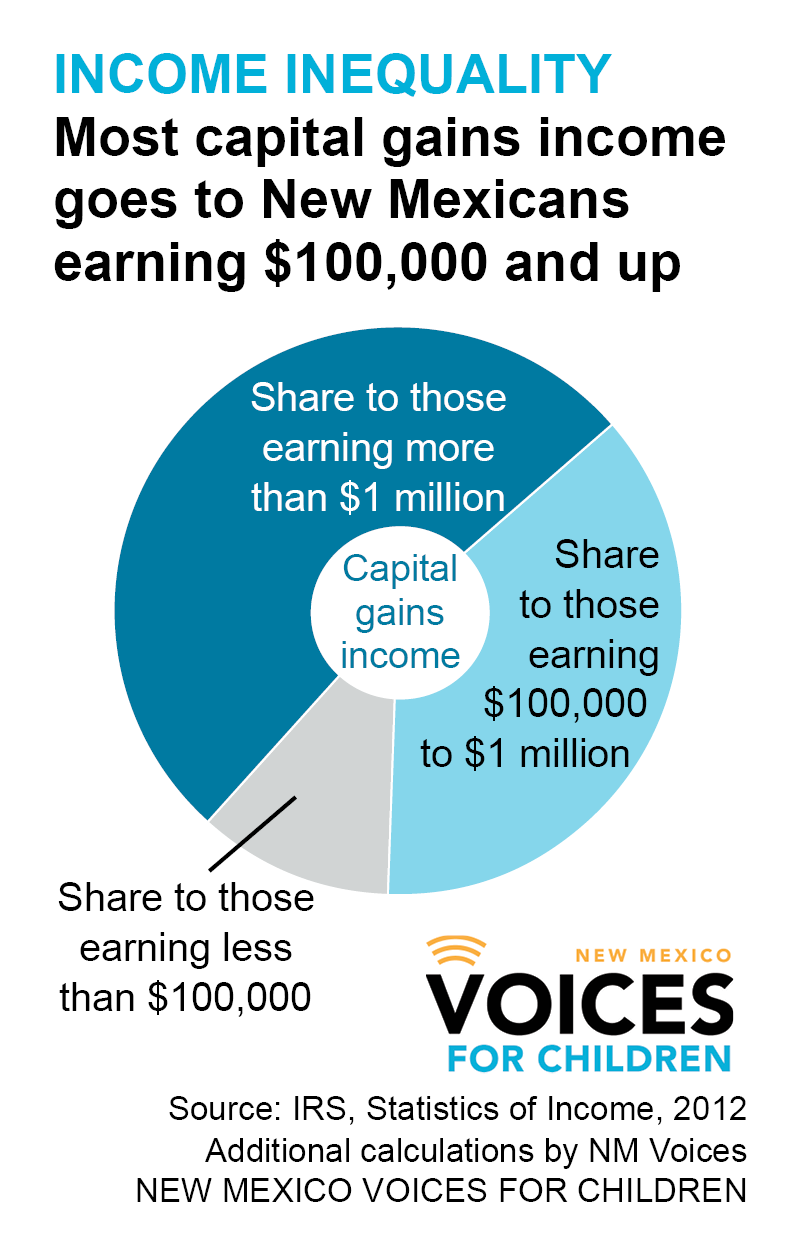

As most capital gains income goes to people who already have the most money, those are the tax filers who receive the most benefit from the deduction. Almost 90 percent of the value of the deduction goes to taxpayers with an adjusted gross income of more than $100,000—which is more than double the state’s median household income. More than half is claimed by taxpayers with adjusted gross income over $1 million. Less than 1 percent of the state’s taxpayers earn this much money. Clearly, the benefits of the capital gains deduction are skewed to those who need it the least. The deduction also means that wage income is taxed at a higher rate than un-earned income. It also costs the state millions of dollars in lost revenue every year and we get no benefit in return.

When the capital gains deduction was enacted—as part of a larger tax package that drastically cut marginal income tax rates for those at the top of the income scale—it was touted as a way to encourage corporations to move their headquarters to New Mexico. There is no evidence that this deduction has brought corporate headquarters to New Mexico or that the deduction has helped the state’s economic development. Recently, one of the few companies with corporate headquarters in New Mexico—EMCORE—was sold and is in the process of moving its headquarters to California.

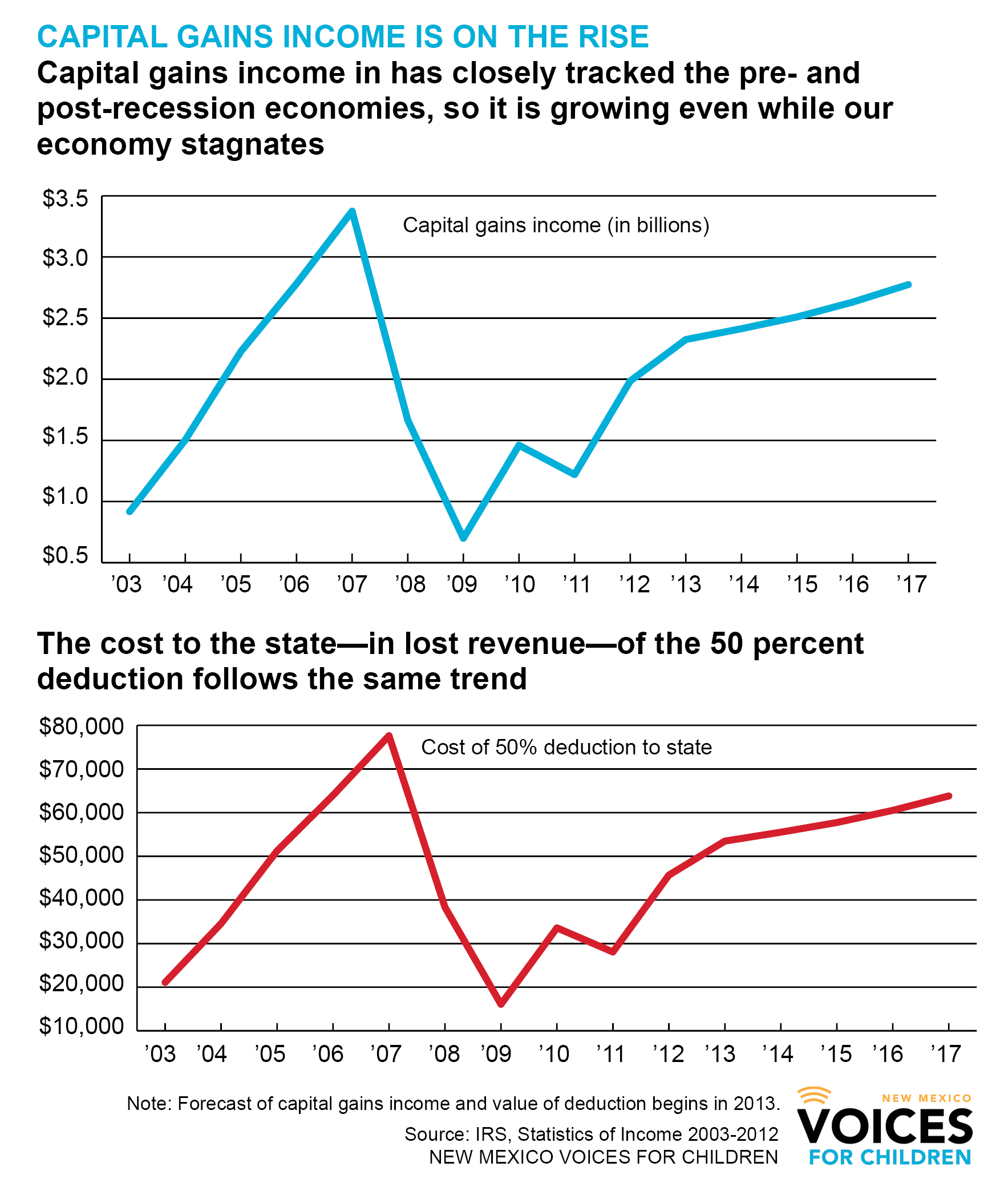

The state’s employment pattern since the enactment of the deduction has followed the national trend; first a housing construction and price bubble between 2003 and 2007, then a collapse and a slow recovery since 2009. New Mexico’s recovery has been much weaker than it has been for the nation as a whole, as our job and personal income growth still struggle to reach national rates. Clearly, the capital gains deduction has not helped our economy.

In 2007, 140,000 New Mexico tax returns claimed capital gains income, worth more than $3.3 billion. Though that fell to a low of 103,000 returns during the recession (with capital gains income of less than $700,000), it is expected to be back to more than 140,000 by this tax year. It’s very unlikely that New Mexico’s economy will have regained all the jobs lost during the recession by the end of 2015.

The table below provides a timeline and forecast of capital gain income and the cost of the deduction to New Mexico. The cost of the deduction rose from an estimated $21.2 million in 2003 to $77.6 million in 2007, at the peak of the housing bubble. The cost of the deduction fell to its lowest point of $16.1 million in 2009 and is expected to rise to $63.8 million by 2017.

The capital gains deduction is ineffective, benefits those taxpayers who need the break the least, and is expensive—likely reducing general fund revenues by $64 million in 2017. This is funding needed for education, health care, public safety, and other vital services. The capital gains deduction should be repealed by the Legislature.

Gerry Bradley is Senior Researcher and Policy Analyst for NM Voices for Children. Reach him at gbradley@www.nmvoices.org.