by James Jimenez

June 10, 2014

Changing tax rates nearly always has consequences, some of which are intended, some of which are not. If we are to believe anti-tax advocates, taxes inhibit economic development, distort our economy, and cause people to “vote with their feet” by moving to a place with lower rates. Usually these claims are mere assertions without data to support them. And in fact, most unbiased analyses show that taxes have a negligible impact on economic development and that other factors—such as an educated workforce, access to markets, and quality-of-life considerations—are more important in business location decisions. The impact that taxes have on the interstate mobility of individuals and families has been less clear. Could taxes be the reason that New Mexico has seen population growth stagnate in recent years after decades of growth? The answer is a resounding no, according to a new research report.

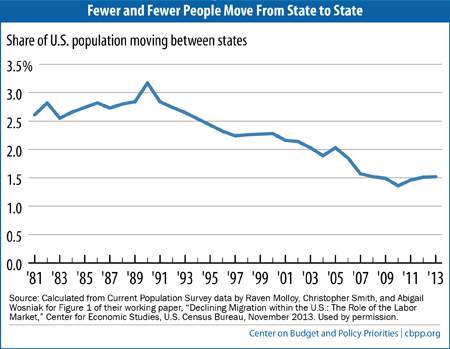

According to the “anti-taxists,” taxes need to be slashed to reverse population declines, and this seems to be the approach that Kansas has taken. However, a new report from the Center on Budget and Policy Priorities (CBPP), titled State Taxes Have a Negligible Impact on Americans’ Interstate Moves, debunks the claim by anti-tax advocates that high taxes cause people to flee a state. The report concludes that “Differences in tax levels among the states had little to no effect on whether and where people move.” Interestingly, fully 69 percent of Americans still reside in the state in which they were born and only about 2 percent make interstate moves. So what causes us to decide to move to another state?

Just as with economic development, other factors seem to be more important. Not surprisingly, it’s jobs—either new, transferred or lost—and family issues that a vast majority cite as the reasons for moving across state lines, according to the report’s author Michael Mazerov. Notably, evidence also shows that people are almost as likely to move to high-tax states as low-tax states. This is clearly not consistent with the policy recommendations espoused by the anti-tax advocates. So what gives?

Those who constantly cry for tax cuts seem not to comprehend that communities with well-paying jobs with great schools, decent streets, strong public safety, cultural amenities, and parks are what draws residents and business. Working to establish an appropriate balance between taxes and these other factors that make a community a great place to live is much more productive work for public officials than fixating on tax cuts.

The state of Kansas is a great illustration of the folly of basing economic development strategy and resident retention on tax cuts. Since Kansas slashed their personal income taxes, their courts have ruled that the state is not adequately funding their public schools, and now bond rating agencies have warned investors to be careful about investing in bonds issued by the state.

Just like Kansas, we are now facing lawsuits on the funding for our public schools. And just like Kansas we have been making poor decisions about taxes, such as the misguided and unnecessary corporate income tax cuts of 2013 and the annual erosion of our gross receipts tax revenue through the granting of special tax breaks. And, just like Kansas, our population growth has stopped.

So what are we to conclude from this comparison with Kansas? Oliver Wendell Holmes, Jr. got it right when he said, “Taxes are the price we pay for civilized society.” I also believe—and evidence backs me up—that we can’t tax-cut our way to prosperity. What we really we need is sustained investment in people, transportation, and water management to change the direction of our state not more tax cuts.

James Jimenez is Director of Research, Policy and Advocacy Integration at NM Voices for Children. Reach him at jjimenez@www.nmvoices.org.