by Kwaku Sraha

April 9, 2012

The US Congressional Progressive Caucus (CPC) unveiled a budget proposal last week – A Budget for All – that seeks to balance the federal budget through higher taxes on the rich, cuts to defense spending, reforms to Medicaid to curb abuse and waste, and the adoption of a public option to reduce the cost of the Affordable Care Act (ACA). The proposed tax increase would mostly affect the top 2 percent of income earners. The proposal calls for reforming the tax system by allowing the Bush-era tax breaks for the rich, like Warren Buffet, to expire. It would reduce the overall deductions that the rich can claim on their taxes, tax capital income as ordinary income, and enact the Fairness in Taxation Act, which would bring some progressivity back to the federal income tax code.

In contrast, Representative Paul Ryan’s budget proposal – A Road Map for America’s Prosperity – which debuted last month, calls for lower taxes for the rich and big corporations, whose tax rates are already the lowest they’ve been in 50 years. Ryan’s proposal calls for reducing the top income tax rate from 35 percent to 25 percent, a reduction that would benefit the top 2 percent the most.

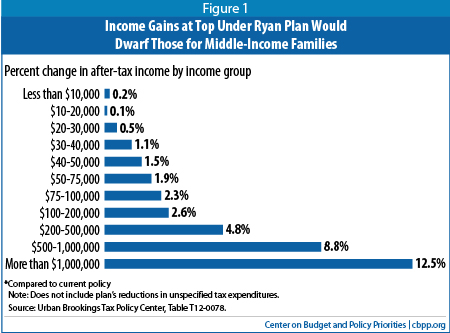

A report recently released by the nonpartisan Center on Budget and Policy Priorities (CBPP) shows that people with incomes above $1 million would receive an average annual benefit of $265,000 from the Ryan tax cuts alone – not counting what they would also receive from the budget’s plan to make the Bush tax cuts permanent. Middle-income taxpayers – those with incomes between $50,000 and $75,000 – would receive $1,045, on average. The report explains that the best gauge of the distributional impact of a tax cut is the percentage changes that it causes in the after-tax incomes of households at different income levels. A progressive tax cut raises after-tax incomes by a greater percentage among lower- and middle-income people than among higher-income people. A regressive tax cut provides a larger percentage of after-tax income gain at the top of the income scale and thereby widens income inequality.

Both budget proposals claim to balance the federal budget within 10 years, however, a new report released by the Economic Policy Institute (EPI) shows that while Ryan’s budget reduces the deficit over the short term, it increases it over the long term. The CPC’s budget does the opposite.

According to the nonpartisan Congressional Budget Office (CBO), Ryan’s budget proposal would also essentially repeal the Affordable Care Act, (commonly referred to as “Obamacare”), which will extend health insurance millions of Americans. It would also cut programs like Medicaid and the Children’s Health Insurance Program (CHIP) that serve the most vulnerable among us.

What we need is a balanced approach that requires higher-income earners and corporations to pay their fair share of taxes while protecting the social safety net and other discretionary programs. The CPC budget preserves the safety net, protects the middle class, and invests heavily in job creation measures. Ryan’s budget gives more tax breaks to the rich and big corporations. The Ryan budget, which was passed by the House but has not been voted on in the Senate, has also received wide media coverage. The CPC budget, which will not likely be brought up for a vote, has received almost no media coverage.

Kwaku Sraha is NM Voices’ Finance Manager