How COVID-19 Relief has Bypassed Immigrant Communities in New Mexico

Download this report (April 2020; 16 pages; pdf)

Download this report in Spanish

Link to the follow-up report, Eligible but Excluded: How Systemic Inequities in Language Access are Impacting Asian, Pacific Islander and African Immigrant and Refugee Communities During the Pandemic (Aug. 2021)

Created in conjunction with El Centro de Igualdad y Derechos, NM CAFé (Comunidades en Acción y de Fe), Partnership for Community Action, and Somos Un Pueblo Unido, with a special thanks to the New Mexico Center on Law and Poverty.

The COVID-19 public health pandemic has caused an economic crisis and unprecedented challenges for our communities, our state, and the entire country. As we collectively face these challenges, it has become clear how interconnected we all are and how much the well-being of our state and nation depends on the health and economic well-being of each one of us. As we look for equitable and productive ways to move forward, and as different forms of relief are considered at the federal, state, and local levels, policy makers must ensure that all New Mexicans – regardless of where they were born or their immigration status – can survive during and continue to thrive beyond this crisis. This policy brief reviews some of the ways in which immigrants are a crucial part of our state’s economy, how COVID-19 relief impacts them, and what gaps need to be filled to ensure that all New Mexicans have access to necessary relief during these difficult times so that New Mexico’s economy can continue to benefit from the enormous contributions of our foreign-born residents.[1]

Immigrants Help Drive New Mexico’s Economy

Immigrants Pay Taxes

Immigrants pay taxes and are important contributors to New Mexico’s economy. Nationwide, immigrants pay hundreds of billions of dollars in federal, state, and local income and other taxes. New Mexico immigrants – both legal residents and those who are undocumented – contribute more than $996 million in federal, state, and local taxes that help support public schools, hospitals, roads, and more. Of that nearly billion dollars, $393 million is paid in New Mexico state and local taxes.[2]

More specifically, undocumented immigrants contribute more money to our nation, states, and cities through taxes than they consume in tax-supported services.[3] Undocumented workers can file tax returns using an Individual Taxpayer Identification Number (ITIN) provided by the IRS, since they do not have Social Security numbers (SSNs). In 2017 it was estimated that the 11 million undocumented immigrants living and working in the United States contributed more than $11.74 billion in state and local taxes.[4] New Mexico is home to an estimated 60,000 undocumented immigrants. As a group, they pay more than $67.7 million annually in state and local taxes. For perspective, that is enough to hire approximately 1,860 teachers,[5] 1,320 police officers[6] or 1,115 public defenders.[7] New Mexico could be collecting $8 million more in taxes annually if undocumented immigrants were granted full legal status.[8] This new revenue would come from increased incomes and better compliance with the tax code.

The nearly $68 million paid by undocumented immigrants in New Mexico breaks down like this: almost $4 million in personal income taxes; nearly $14 million in property taxes; and $50 million in sales (or gross receipts taxes) and excise taxes (e.g., taxes on non-food purchases like household goods and clothing, and gasoline).[9] These three revenue streams are the principal ways local governments fund public services. Undocumented immigrants pay property taxes both as homeowners and as renters, because landlords typically pass their property tax expense on to renters.[10] Currently in New Mexico nearly half of undocumented immigrants are homeowners[11] and those who are renting pay nearly $232.4 million for a place to live and rest.[12]

Immigrants Create Jobs and Strengthen Our Workforce

Nationwide, immigrants are twice as likely as U.S.-born individuals to start a business,[13] and 40 percent of fortune 500 companies were founded by immigrants or children of immigrants.[14] These businesses create jobs, and as of 2018, 15,433 immigrant entrepreneurs in New Mexico employed more than 27,000 New Mexicans.[15] These immigrant-owned businesses had $4.4 billion in sales.

Foreign-born residents are also vital members of New Mexico’s labor force, with immigrants accounting for more than 37 percent of the state’s fishers, farmers, and foresters.[16] In New Mexico, the industries with the highest shares of foreign-born employees are construction (22.9 percent), restaurants or other food service (21.9 percent), and higher education, including junior colleges (17.3 percent). The occupations with the highest shares of foreign-born employees in New Mexico are janitors or building cleaning (24.6 percent), cooks (23.5 percent), and commercial drivers, including truckers (19.3 percent). Immigrants also do some of the most dangerous jobs in the workforce, and about 65,000 immigrants are serving on active duty in the U.S. military. They are also food producers, caretakers, builders, and landscapers, and are integral to the local economy. Importantly for New Mexico, immigrants are more than two times as likely as U.S-born workers to be employed in the agriculture and mineral extraction sectors that make up 12 percent of our state’s gross domestic product (GDP).[17] Many of these industries and jobs are deemed “essential” during the current pandemic.

Without immigrants, our economy would be less productive and dynamic. We would also have fewer small businesses. Immigrants fill niches in the labor market, typically at both the higher and lower ends of the skills spectrum. Nationally, immigrants are more likely to hold an advanced degree than are their U.S.-born counterparts. They are also more likely to have less than a high school education.[18] Uniquely, this allows them to fill critical shortages in the labor market at both ends of the income scale. Undocumented immigrants, in particular, largely work in the positions that an aging and more educated U.S. workforce is unable or unwilling to fill.

In fact, the growth in the immigrant population has helped to strengthen America’s labor force. The role of immigrants in the workforce is particularly important as family sizes shrink and the baby boomer generation ages, both of which reduce the share of New Mexico’s native-born population that is of working age. By 2024, 20 percent of New Mexico’s population will be over the age of 65, whereas, that share is currently 17.5 percent.[19] That change is equal to a 15 percent growth in the share of the population older than 65. Younger immigrants are, therefore, filling crucial gaps in the workforce. Without more working-age migration into New Mexico, our economy will be less vibrant and today’s children and young adults could struggle in the future to find care for their aging parents, and tomorrow’s entrepreneurs may struggle to find enough people to help their businesses reach their full potential.

Like all residents in the United States, immigrants make use of public services like education, health care, and public safety. However, immigrants’ economic contributions far outweigh the cost of the public services they use. Immigrants hold a tremendous amount of purchasing power, and New Mexico immigrants inject $3.2 billion[20] every year into the economy in spending which keeps thousands of New Mexicans employed.

Immigrants Face Unique Challenges During National Emergencies

Though they are disproportionately represented in “essential” frontline industries that are providing crucial services during this pandemic,[21] immigrants face unique challenges during national emergencies.

- Immigrants often are not provided timely and accurate information about the services and benefits available to them.

- Immigrants are less likely to have access to emergency supplies.

- Undocumented immigrants, although eligible for non-cash emergency disaster relief, are not eligible for cash benefits or assistance from many existing programs such as non-emergency Medicaid.

- Undocumented immigrants are left out of many forms of federal relief, including recovery rebates, unemployment insurance (UI), and the Supplemental Nutrition Assistance Program (SNAP). Even when lawfully residing immigrants qualify for these benefits, the processes for enrolling can be complicated and burdensome, leading in some cases to families not applying or to having incorrect decisions rendered on their cases.

- A new Public Charge rule put into effect by the Trump Administration in February makes immigrants who receive non-cash benefits such as Medicaid, SNAP, and housing assistance potentially ineligible for permanent residency. While the rule only applies to adults, many immigrants will not access any benefits for their eligible U.S.-citizen children – even during this health and economic crisis – for fear it may lead to being denied permanent residency in the future.

These federal restrictions also negatively impact the broader, mixed-status immigrant community, including lawful permanent residents (green card holders), and even U.S. citizens. In mixed-status families, the U.S.-citizen spouses and children may refrain from using social services in fear of endangering undocumented family members.

The Impact of Federal Aid on New Mexico Immigrants

Though immigrants are an important part of the cultural and economic fabric of our state and a key part of the workforce that is keeping New Mexico running during this crisis, and though they face unique challenges during national emergencies, they’ve largely been left out of relief efforts. This not only leaves many New Mexico workers, families, and children struggling, but could have serious detrimental impacts on our state and local economies.

Though immigrants are an important part of the cultural and economic fabric of our state and a key part of the workforce that is keeping New Mexico running during this crisis, and though they face unique challenges during national emergencies, they’ve largely been left out of relief efforts. This not only leaves many New Mexico workers, families, and children struggling, but could have serious detrimental impacts on our state and local economies.

Individual Rebate Relief

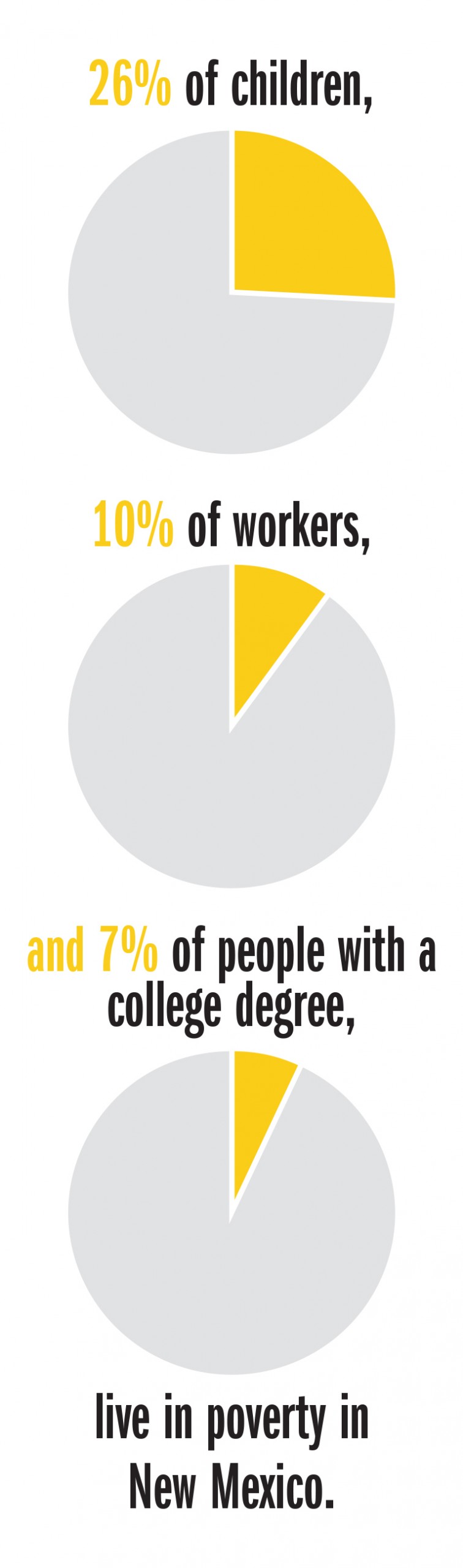

Many New Mexicans faced big economic challenges prior to the COVID-19 pandemic. We have some of the worst poverty rates in the nation among children (26 percent), workers (10 percent), and people with a college degree (7 percent).[22] The economic hurdles that come with earning low wages loom large for families and workers in our state on a regular basis, and they have grown larger with the onset of the pandemic. Now more than ever, the government has a role to play in ensuring that all New Mexicans can meet the needs of their families and continue to contribute to economic activity in the state.

In order to provide financial relief directly to families, the Coronavirus Aid, Relief, and Economic Security (CARES) Act includes rebate checks of $1,200 for individual tax filers ($2,400 for joint filers), and an additional $500 for every child under age 17, with rebates gradually reduced for single taxpayers with incomes over $75,000, heads of households making more than $112,500, and joint filers with incomes over $150,000.[23]

This is important and necessary relief, but it is inadequate to address the dire financial straits that many families are experiencing. What’s more, some immigrant families are left out of this relief because in order for a household to receive a rebate, each adult on a tax filer’s tax return must have an SSN, and the additional $500 for each child is only available if they have an SSN. Some immigrants in New Mexico do not have an SSN and instead file for and pay their income taxes using an IRS-issued ITIN. This provision means that some New Mexico workers and children will be deprived of rebate relief, including workers who pay taxes using ITINs, households where one spouse does not have an SSN, U.S. citizens who are spouses of people with an ITIN, and children – including U.S.-citizen children – who may have a parent who has an ITIN. Due to this provision, more than 30,000 New Mexico adults and more than 38,000 New Mexico children will be denied more than $55 million in recovery rebates, meaning that money will not be circulating in New Mexico’s economy.[24]

Unemployment Insurance

The COVID-19 pandemic has put our unemployment insurance (UI) system under incredible strain as more workers than ever before are in need of assistance. More than 97,000 New Mexicans filed for unemployment benefits between March 14 and April 9,[25] out of a workforce of 835,800, and UI claims in the state have increased by more than 3,000 percent.[26]

The state of New Mexico has taken some important steps to support impacted workers, including waiving the one week waiting period that normally applies to benefits, temporarily waiving work search requirements, extending hours of operation, and including gig workers and the self-employed in relief when possible. The federal government has also taken steps – through both the Families First Coronavirus Response Act (Families First) and the CARES Act – to strengthen and expand UI programs. Families First provides $1 billion in federal funding to help states with the increase in administrative costs. The CARES Act includes relief through three new UI programs: one extends benefits to some workers ineligible for state benefits (e.g., gig workers and the self-employed); one extends the timeline for benefits by 13 weeks; and one provides $600 per week for unemployed workers in addition to their state benefits.

However, some workers and their families are ineligible for this federal relief because immigrant workers who are not work-authorized or who lack documentation are not eligible for UI benefits. Immigrant workers who are eligible must have an SSN or valid work authorization when they apply for UI, while they are receiving UI benefits, and during the base period that states use to determine whether laid-off workers have earned enough wages to qualify for UI benefits. This can leave out some DACA and temporary protected status (TPS) recipients and applicants, as well as undocumented workers.

The negative impact of this aid exclusion is massive for New Mexico workers, families, and communities. There are more than 16,000 low-income workers in New Mexico who do not have an SSN and instead use an ITIN to file and pay their income taxes. Given that unemployment rates in New Mexico are predicted to rise to between 13 and 16 percent[27] this summer, more than 2,000 New Mexico immigrant workers could miss out on around $350 in state benefits[28] and $600 in additional federal benefits per worker, per week. This means more than $2 million per week in UI benefits are not flowing to taxpaying workers in the state.[29] The economic stakes may be much higher, as these estimates only take into account workers with ITINs, even though some immigrant workers (e.g., the self-employed and undocumented) who don’t have ITINs may also become unemployed due to the pandemic. Lastly, immigrants are overly represented in industries that have been disproportionately impacted by the global pandemic, namely the food services industry. Currently, more than one in five New Mexicans receiving UI benefits worked in food preparation[30] and immigrants represent about 22 percent of the food service workforce.[31]

Health Care

During a global pandemic, access to affordable, high-quality health care is a necessity. Medicaid is the largest source of health insurance in the state, covering more than 800,000 New Mexicans.[32] The majority of Medicaid funding comes from the federal government, and it provides critical financial stability for New Mexico’s entire health care system. Families First temporarily increased the federal government’s share of Medicaid costs for New Mexico by 6.2 percent.[33] In late April, the federal government established the COVID-19 Uninsured Program to reimburse health care providers and hospitals at Medicare rates for provision of COVID-19 treatment and testing for the uninsured, irrespective of immigration status.[34] However, the program obligates that providers request, but not require, an SSN and identification, which is cause for concern. Moreover, the program does not cover all services, and its funding is limited. Lastly, the U.S. Citizenship and Immigration Services has announced that testing, prevention, and treatment of COVID-19 will not count against immigrants under the Public Charge rule.[35]

Even with these temporary positive changes, undocumented immigrants are still largely uninsured as they are ineligible for Medicaid or the Affordable Care Act’s federal tax credits, which reduce the cost of private health insurance. Although federal policy hasn’t done much to expand access to health insurance for undocumented immigrants, state policy offers some solutions. In 1987, New Mexico created a high-risk medical insurance pool to provide coverage to residents who were denied insurance or deemed uninsurable.[36] To qualify for insurance under this pool, an applicant’s immigration status is not taken into account. Therefore, undocumented immigrants and mixed-status families in New Mexico qualify for health insurance through the state’s high-risk pool. However, even while premiums and copays are reduced for persons earning less than 400 percent of the federal poverty level, this option is unaffordable for many families.

Housing

Nearly 30 percent of New Mexico’s children live in households that have a high housing cost burden – meaning they spend 30 percent or more of their income on housing.[37] The rate is even higher among Hispanic children (32 percent).[38] Given that large numbers of workers are losing their jobs due to the pandemic, such housing cost burdens are untenable for many New Mexico families and can lead to homelessness. High housing cost burdens can also push families into substandard or crowded housing, potentially increasing contagion risks. Homelessness and the lack of affordable housing were already challenging in a state with high poverty and low incomes. In 2018, 10,683 New Mexico children experienced homelessness over the course of a school year.[39] Without intervention, the pandemic and resulting economic downturn are sure to exacerbate those issues.

Although undocumented immigrants aren’t eligible for public housing or rental assistance, the CARES Act granted homeowners and renters – including undocumented immigrants – a short-term reprieve from foreclosure and eviction that includes:

- A moratorium for 120 days on filings for evictions for renters in homes covered by a federally backed mortgage.

- A moratorium for 60 days on foreclosures for all federally backed mortgages.

A moratorium on evictions, on its own, is not enough. Moreover, the federal moratorium is limited and many tenants live in homes not covered by the new provisions. To mitigate some of these shortcomings, Congress must provide more in rental assistance to avoid creating a financial cliff that renters will fall off when eviction moratoria are lifted and back-rent is due. More than one-third of undocumented residents in the U.S. own their own homes, with that rate approaching 50 percent in New Mexico.[40] Homeownership has long been a key to building wealth and upward mobility in America, and at a time of economic uncertainty protecting this important family asset is even more imperative.

Food Security

Even before the public health and economic crises of COVID-19, New Mexico families, particularly families of color, faced significant challenges related to food security. New Mexico has the highest rate of child food insecurity in the nation with one in four children hungry or lacking regular access to nutritious food,[41] and more than 685,000 New Mexicans live in a food desert.[42] Prior to the crisis, Governor Michelle Lujan Grisham had made a concerted push to address food-system and hunger issues in the state, but the current crisis has overwhelmed already-struggling systems, and food banks and pantries are now seeing unprecedented demand at the same time that they are facing shortages of supplies and volunteers.[43]

Both the state and the federal government have taken important steps to address challenges related to COVID-19 for food-insecure families. New Mexico made changes to: automatically provide all families that receive SNAP the maximum SNAP benefit; temporarily suspend mandatory interviews with applicants before awarding benefits; and automatically extend recertification periods for SNAP recipients. The state has applied for other waivers from the federal government that would allow New Mexico to maximize benefits and give maximum flexibility to recipients. On the federal level, Families First gives states more flexibility for SNAP and temporarily suspended time limits on receiving SNAP for able-bodied adults without dependents. The CARES Act increased SNAP appropriations to help cover new enrollment and ensure existing beneficiaries can maintain benefits.[44]

Both the state and the federal government have taken important steps to address challenges related to COVID-19 for food-insecure families. New Mexico made changes to: automatically provide all families that receive SNAP the maximum SNAP benefit; temporarily suspend mandatory interviews with applicants before awarding benefits; and automatically extend recertification periods for SNAP recipients. The state has applied for other waivers from the federal government that would allow New Mexico to maximize benefits and give maximum flexibility to recipients. On the federal level, Families First gives states more flexibility for SNAP and temporarily suspended time limits on receiving SNAP for able-bodied adults without dependents. The CARES Act increased SNAP appropriations to help cover new enrollment and ensure existing beneficiaries can maintain benefits.[44]

However, some immigrant families in New Mexico will still continue to miss out on SNAP benefits because undocumented residents and some documented residents – including DACA recipients – are ineligible to receive most federal public benefits, including SNAP. This is a major issue not only because immigrant families are facing the same enormous challenges as all New Mexico families due to the pandemic, but also because immigrant families often face bigger hurdles when it comes to food security even in normal times. Nationally, 80 percent of children in immigrant families are U.S.-born citizens,[45] yet more than half of children younger than 6 who have immigrant parents earning low incomes live in families experiencing hunger or other food-related problems.[46] More should be done to assist families who are facing hunger and food insecurity, especially for those families who do not have access to other relief resources.

Impact on Local Economies in New Mexico

Denying undocumented immigrant workers UI benefits and excluding mixed-status families from stimulus rebates and other essential safety net services not only puts short- and long-term financial burdens on those families, it also has a disproportionate impact on the economies of the cities and counties with higher percentages of foreign-born residents.

One in ten New Mexicans is an immigrant, with two-thirds living in mixed-status families. Because of geographic proximity to the U.S./Mexico border and because certain regional industries (e.g., tourism, agriculture, oil and gas) have drawn immigrant workers for decades, some communities have significantly higher percentages of foreign-born residents than does the state as a whole.[47]

Communities with higher shares of immigrant residents than the state:

- Luna County (18.5 percent); Deming (19 percent)

- Doña Ana County (18 percent); Las Cruces (12 percent)

- Lea County (16.5 percent); Hobbs (17 percent)

- Chaves County (13 percent); Roswell (12 percent)

- Santa Fe County (13 percent); Santa Fe (15 percent)

Many of these communities have seen a precipitous decline in critical sources of revenue, such as gross receipts taxes, due to the stay-at-home orders. Yet, to date, none have received federal stimulus funds because their total populations are less than the threshold of 500,000 set in the CARES Act. Neither will these localities benefit from the relief dollars immigrant families would otherwise receive and spend, if not for their status. In the short term, these cities and counties will see the need for privately and locally funded safety net services increase at a greater rate for these residents. In the long term, as New Mexicans finally get back to work, these families will be forced to use future income to pay off debt incurred during the pandemic, instead of to jump-start economic recovery in their communities.

Policy Recommendations:

Immigrant families in New Mexico provide important economic and social contributions – they work, own businesses, and pay taxes. They are government employees, construction workers, lawyers, doctors, and educators, and their children attend New Mexico preschools, public schools, and colleges. Yet some immigrants in New Mexico are left out of relief in a way that not only puts the health and well-being of children and families at risk, but that also stands to harm workers, businesses, and economies in the state.

State Recommendations

The state and local governments should do what they can to address those left out of federal relief in order to ensure that all New Mexico workers, families, and communities can survive through and thrive after this crisis.

- Expand eligibility and funding for the General Assistance Program to include able-bodied, undocumented residents, and others who do not qualify for federal relief.

- Create a new emergency assistance fund for New Mexico residents who are ineligible for other forms of federal or state relief, similar to funds created in Minneapolis, California, and Oregon.

- Create a basic health plan or Medicaid buy-in plan that is available to all residents, regardless of immigration status.

- Increase the state SNAP supplement.

- Expand the SNAP supplement to provide a minimum benefit for families who do not qualify for federal SNAP, but are financially eligible.

- Expand the state-level Earned Income Tax Credit (EITC) – the Working Families Tax Credit (WFTC) – to include ITIN filers.

- Increase the Low-Income Comprehensive Tax Rebate (LICTR) that is available to low-income tax filers in New Mexico.

- Ensure timely language access for non-English speakers regarding how and when to apply for existing benefits – state relief programs, electronic UI forms, business support, etc.

- Provide information to immigrant communities about public charge and encourage families to enroll children who qualify for safety net benefits.

Federal Recommendations

The federal government should pass measures that are inclusive of all residents, regardless of immigration status, in order to strengthen the ability of workers, families, and children all across the country to thrive and to make our economy and future strong.

- Eliminate the requirement that all members of a household who are listed on a tax return must have an SSN for anyone in the household to qualify for individual recovery rebates, and allow ITIN filers to qualify as well.

- Ensure that eligibility for new UI relief is inclusive of all workers, regardless of immigration status.

- Halt implementation of the Public Charge rule changes that took effect in February 2020 relating to the use of crucial safety net programs like SNAP and TANF.

- Increase the SNAP eligibility limit and extend the reach of SNAP to low-income households that are ineligible under the current regulations due to immigration status.

- Expand Pandemic Electronic Benefit Transfers (P-EBT) through the summer. P-EBT gives families with school-aged children funding for school lunches on an EBT card, regardless of their documentation status.

- Allow maximum flexibility for state and local governments in spending federal relief aid.

Endnotes

[1] For more information on how federal relief will impact New Mexico, please see our fact sheets at https://www.nmvoices.org/covid-19-info-resources

[2] “Immigrants and the Economy in New Mexico,” New American Economy (NAE), 2018

[3] Becerra, D., Androff, D.K., Ayon, C., Castillo, J.T., “Fear vs. Facts: Examining the economic impact of undocumented immigrants in the U.S.,” Journal of Sociology and Social Welfare, 39(4), 111-135. 2012 ISSN 0915096

[4] Undocumented Immigrants State & Local Tax Contributions, Institute on Taxation & Economic Policy (ITEP), March 2017

[5] 2017-2018 Average Starting Teacher Salaries by State, National Education Association

[6] Police Officer Salary in New Mexico, salary.com

[7] Public Defender Salary in New Mexico, ZipRecruiter

[8] Undocumented Immigrants State & Local Tax Contributions, ITEP

[9] Ibid

[10] Tsdoodle, L.J., & Turner, T.M. “Property Taxes and Residential Rates,” Real Estate Economics, 36(1), 63-80. 2008

[11] Undocumented Immigrants State & Local Tax Contributions, ITEP

[12] “Immigrants and the Economy in New Mexico,” NAE

[13] McKissen, D., Immigrants are far more likely to start new businesses than native born Americans, Inc.com, February 2018

[14] Stangler, D., & Wiens, J., “The Economic Case for Welcoming Immigrant Entrepreneurs,” Ewin Marion Kauffman Foundation, March 2014

[15] Ibid

[16] “Immigrants and the Economy in New Mexico,” NAE

[17] “Immigrant Employment by State and Industry,” Pew Charitable Trusts, December 2015

[18] Ibid

[19] Population Projections, Geospatial and Population Studies, University of New Mexico, July 2000. GPS uses a standard cohort component method based on the demographic balancing equation: Popt = Popt –1 + Births – Deaths + Net Migration

[20] Ibid

[21] “A Basic Demographic Profile of Workers in Frontline Industries,” Center for Economic and Policy Research, 2020

[22] All poverty data come from the U.S. Census Bureau, American Community Survey (ACS), 2018

[23] “CARES Act Includes Essential Measures to Respond to Public Health, Economic Crises, But More Will Be Needed,” Center on Budget and Policy Priorities (CBPP), 2020

[24] NMVC analysis of data from the US Census, ACS, ITEP, and the Pew Research Center

[25] “New Mexico jobless numbers remain high despite drop in claims,” Santa Fe New Mexican, April 10, 2020

[26] “Every state in the country reported its highest initial unemployment claims ever either last week or the week before,” Economic Policy Institute (EPI), April 2020

[27] “Nearly 20 million workers will likely be laid off or furloughed by July,” EPI, April 2020

[28] Average unemployment benefits per week in New Mexico, Feb. 2020, NM Department of Workforce Solutions (DWS)

[29] Total: $2,030,150; $747,950 of this is the state portion of UI and $1,282,200 is the additional relief from the CARES Act

[30] “Why the increase in female, young adult unemployment claimants?” Labor Market Review, NM DWS, March 2020

[31] “Immigrants and the Economy in New Mexico,” NAE

[32] “January 2020 Medicaid & Chip Enrollment Data Highlights,” Medicaid.gov, January 2020

[33] “COVID-19: Expected Implications for Medicaid and State Budgets,” Henry J. Kaiser Family Foundation, April 2020

[34] “COVID-19 Claims Reimbursement to Health Care Providers and Facilities for Testing and Treatment of the Uninsured,” HRSA

[35] “Immigrant Eligibility for Public Programs During COVID-19,” Protecting Immigrant Families, April 2020

[36] “Benefits & Eligibility,” New Mexico Medical Insurance Pool. Retrieved April 24, 2020 from: https://nmmip.org/benefits-eligibility/

[37] Kids Count Data Center, Annie E Casey Foundation

[38] Ibid

[39] New Mexico Homelessness Statistics, U.S. Interagency Council on Homelessness, 2018

[40] “Inclusive Approach to Immigrants Who Are Undocumented Can Help Families and States Prosper,” CBPP, 2019

[41] “Profile of Infants and Toddlers in New Mexico,” Food Research Action Center, 2019

[42] “Food Access Research Atlas,” US Dept. of Agriculture, 2019

[43] “New Mexico food banks see surge in demand during pandemic,” KRQE TV, April 14, 2020

[44] “Coronavirus Aid, Relief, and Economic Security Act,” U.S. Congress, 2020

[45] Facts About Immigrants & the Food Stamp Program, National Immigration Law Center, March 2007

[46] “The Health and Well-being of Young Children of Immigrants,” Urban Institute, Feb. 2005

[47] “Quick Facts: New Mexico,” Census.gov. Retrieved April 2018 from https://www.census.gov/quickfacts/fact/map/NM/POP645218

Download this report (April 2020; 16 pages; pdf)